0% found this document useful (1 vote)

3K views1 pageGatt Declaration For Import

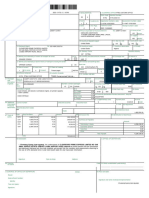

This document is a declaration form that importers must fill out for goods being imported into the country. It requests information about the importer, supplier, description of goods, country of origin, shipment details, invoice, payment terms, valuation method, costs not included in the invoice price, and a declaration that the information provided is complete and accurate. The customs official may not accept the declared value and will provide reasons for any alternative value assessed, along with reference to previous rulings. Importers must submit this form in duplicate with the original bill of entry.

Uploaded by

rajaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (1 vote)

3K views1 pageGatt Declaration For Import

This document is a declaration form that importers must fill out for goods being imported into the country. It requests information about the importer, supplier, description of goods, country of origin, shipment details, invoice, payment terms, valuation method, costs not included in the invoice price, and a declaration that the information provided is complete and accurate. The customs official may not accept the declared value and will provide reasons for any alternative value assessed, along with reference to previous rulings. Importers must submit this form in duplicate with the original bill of entry.

Uploaded by

rajaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1