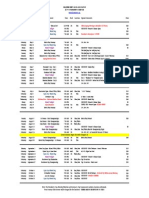

Contents

Preface Important Note on Auditing Standards Referred to in this Book Chapter 1: What is Auditing?

xi

AL

xv 1 2 3 4 8 9 11 18 19 20 21 23 24 24 50 54 55 57 59 61 62 63 65 74 89 93 98 98 99 100

Chapter 2: The Development of Auditing and Audit Objectives 2.1 Introduction 2.2 The development of auditing 2.3 Future developments 2.4 Summary Self-review questions References Additional reading

Chapter 3: A Framework of Auditing Concepts 3.1 3.2 Introduction Social purpose, postulates and framework for key concepts of auditing 3.3 Concepts relating to the credibility of auditors work 3.4 Concepts relating to the audit process 3.5 Concepts relating to auditors communication 3.6 Concepts relating to the standard of auditors performance 3.7 Summary Self-review questions References Additional reading

CO

PY

RI

GH

TE

1.1 Introduction 1.2 What is an audit? 1.3 Types of audit 1.4 Auditing vs accounting 1.5 Why are external nancial statement audits needed? 1.6 Benets derived from external nancial statement audits 1.7 Summary Self-review questions References Additional reading

MA

TE

RI

�vi

Principles of External Auditing

101 102 103 107 131 154 155 156 159 161 162 165 180 184 188 192 194 196 204 205 206 208

Chapter 4: Threats to, and Preservation of, Auditors Independence Introduction Factors that may compromise auditors independence Steps taken by Parliament, regulators and the profession to secure auditors independence from their audit clients 4.4 Other proposals for strengthening auditors independence 4.5 Summary Self-review questions References Additional reading Chapter 5: Legal and Professional Duties of Auditors 5.1 5.2 5.3 5.4 5.5 Introduction Audits and auditors duties under statute law Auditors duties under common law Auditors duties under auditing standards Auditors duties under regulatory requirements applying to companies of specic types or in specic industries 5.6 Auditorclient relationship 5.7 Auditors vis--vis directors responsibility for the nancial statements 5.8 The audit expectationperformance gap 5.9 Summary Self-review questions References Additional reading Chapter 6: Auditors Duties with Respect to Fraud and Non-compliance with Laws and Regulations 6.1 6.2 6.3 6.4 Introduction Auditors responsibility to detect and report fraud Aggressive earnings management Auditors responsibility to detect and report non-compliance with laws and regulations 6.5 Auditors duty of condentiality to clients 6.6 Summary Self-review questions References Additional reading Chapter 7: Overview of the Audit Process, Audit Evidence, Stafng and Documenting an Audit 7.1 7.2 Introduction Overview of the audit process 4.1 4.2 4.3

209 210 211 233 236 243 245 246 247 249

251 252 252

�Contents

7.3 Clarication of some jargon 7.4 Audit evidence 7.5 Stafng an audit 7.6 Documenting an audit 7.7 Summary Self-review questions References Additional reading Chapter 8: Commencing an Audit: Engagement Procedures, Understanding the Client and Identifying Risks 8.1 8.2 8.3 8.4 Introduction Pre-engagement investigation Audit engagement letters Understanding the client, its business and its industry and identifying and assessing risks 8.5 Analytical procedures 8.6 Summary Self-review questions References Additional reading Chapter 9: Planning the Audit: Materiality and Audit Risk 9.1 Introduction 9.2 Phases of planning an audit 9.3 Impact of materiality on planning an audit 9.4 Desired level of assurance (desired level of audit risk) 9.5 Impact of audit risk on planning the audit 9.6 Summary Self-review questions References Additional reading Chapter 10: Internal Control and the Auditor 10.1 10.2 10.3 10.4 Introduction The accounting system Conceptual aspects of internal control Reviewing the accounting system and evaluating its related controls 10.5 Developing the audit plan (audit programme) 10.6 Compliance testing 10.7 Reporting internal control deciencies to management 10.8 Summary Self-review questions

vii

255 257 267 275 293 294 295 296

297 298 298 307 313 322 325 326 327 328 329 330 330 334 345 350 359 360 361 362 363 364 364 367 385 394 398 403 403 404

�viii

References Additional reading

Principles of External Auditing

405 406 407 408 408 411 415 423 426 426 434 444 444 445 445

Chapter 11: Testing Financial Statement Assertions: Substantive Testing 11.1 11.2 11.3 11.4 11.5 Introduction Signicance of substantive testing in the audit process Objectives of, and approaches to, substantive testing Substantive audit procedures Requirements of auditors with respect to identied misstatements 11.6 Introduction to substantive testing of inventory and debtors 11.7 Signicant aspects of auditing inventory (stock) 11.8 Signicant aspects of auditing debtors 11.9 Summary Self-review questions References Additional reading Chapter 12: Audit Sampling and Computer-assisted Auditing Techniques (CAATs) 12.1 Introduction 12.2 Meaning and importance of sampling in auditing 12.3 Basic terminology relating to sampling 12.4 Judgmental sampling vs statistical sampling 12.5 Designing and selecting samples 12.6 Judgmental sampling 12.7 Introduction to statistical sampling 12.8 Following up sample results 12.9 Computer-assisted audit techniques 12.10 Summary Self-review questions References Additional reading Chapter 13: Completion and Review 13.1 Introduction 13.2 Review for contingent liabilities and commitments 13.3 Review for subsequent events 13.4 (Re)assessment of the going concern assumption 13.5 Written representations and representation letters 13.6 Final review of audit evidence, conclusion and conference 13.7 Summary Self-review questions References Additional reading

447 448 448 450 452 454 461 461 470 471 475 476 476 477 479 480 481 483 489 500 505 517 517 518 519

�Contents

Chapter 14: Auditors Reports to Users of Financial Statements and to Management 14.1 Introduction 14.2 Auditors reporting obligations under the Companies Act 2006 14.3 Format of audit reports 14.4 Types of audit report 14.5 Different forms of modied audit report 14.6 Emphasis of matter and other matter(s) paragraphs 14.7 The audit report the auditors chance to communicate 14.8 Auditors communication with those charged with governance 14.9 Summary Self-review questions References Additional reading Chapter 15: Legal Liability of Auditors 15.1 Introduction 15.2 Overview of auditors legal liability 15.3 Auditors contractual liability to their clients 15.4 Liability to third parties under Common Law 15.5 The effect of out-of-court settlements 15.6 Summary Self-review questions References Additional reading Appendix Chapter 16: Avoiding and Limiting Auditors Liability 16.1 Introduction 16.2 Maintaining high quality audits 16.3 Proposals for limiting auditors liability 16.4 Summary Self-review questions References Additional reading Chapter 17: Environmental Management Systems and Audits 17.1 17.2 17.3 17.4 17.5 17.6 17.7 Introduction Environmental reporting and auditing: clarifying the jargon Development of environmental auditing and environmental management systems Internal environmental audits Reasons for companies reporting their environmental performance Advantages and disadvantages of environmental audits Summary

ix

521 522 523 528 535 537 547 550 560 572 573 574 576 577 578 578 581 586 626 627 628 629 630 631 633 634 636 666 680 680 681 684 685 686 687 690 698 706 710 718

�x

Self-review questions References Additional reading

Principles of External Auditing

718 719 721 723 724 725 729 743 745 751 756 756 757 758 759 763 779

Chapter 18: Corporate Responsibility Assurance Engagements 18.1 18.2 Introduction Development of, and motivations for, corporate responsibility (or sustainability) reporting 18.3 Corporate responsibility assurance engagements 18.4 Professional requirements to provide assurance services 18.5 Advantages and disadvantages of corporate responsibility reporting and assurance 18.6 Relevance of environmental issues to external nancial statement audits 18.7 Summary Self-review questions References Additional reading Appendix Appendix: Summary of Steps in a Statutory Financial Statement Audit Index