PROJECT A -

ACCT 505

Student Name:

Jaykumar Patel

SALES BUDGET:

Budgeted unit sales

Selling price per unit

Total Sales

April

65,000

$10

$ 650,000

May

100,000

$10

$ 1,000,000

SCHEDULE OF EXPECTED CASH COLLECTIONS:

April

February sales (10%)

$ 26,000

March sales (70%) next (10%)

280,000 $

April sales

130,000

May sales

June sales

Total Cash Collections

$ 436,000 $

June

Quarter

215,000

$10

$ 2,150,000

65,000

700,000

100,000

865,000

Quarter

26,000

320,000

650,000

900,000

100,000

$ 1,996,000

May

100,000

June

50,000

Quarter

215,000

20,000

120,000

40,000

80,000

$320,000

12,000

62,000

20,000

42,000

$168,000

72,000

287,000

86,000

201,000

$804,000

BUDGETED CASH DISBURSEMENTS FOR MERCHANDISE PURCHASES:

April

May

June

Accounts payable

$ 100,000

April purchases

158,000 $ 158,000

May purchases

160,000 $ 160,000

June purchases

84,000

Total cash payments

$ 258,000 $ 318,000 $ 244,000

Quarter

$100,000

316,000

320,000

84,000

$ 820,000

MERCHANDISE PURCHASES BUDGET:

April

Budgeted unit sales

65,000

Add desired ending inventory

(40% of the next month's unit)

40,000

Total needs

105,000

Less beginning inventory

26,000

Required purchases

79,000

Cost of purchases @ $4 per unit

$316,000

May

June

50,000

$10

500,000

$

40,000

455,000

200,000

695,000

EARRINGS UNLIMITED

CASH BUDGET

FOR THE THREE MONTHS ENDING JUNE 30

April

May

June

$ 74,000 $

50,000 $

50,000

Cash balance

436,000

695,000

865,000

Add collections from customers

Total cash available

$ 510,000 $ 745,000 $ 915,000

Less Disbursements

Quarter

74,000

1,996,000

$ 2,070,000

$

�Merchandise purchases

Advertising

Rent

Salaries

Commissions

Utilities

Equipment purchases

Dividends paid

Total Disbursements

$ 258,000

200,000

18,000

106,000

26,000

7,000

15,000

$ 630,000

Excess (deficiency) of receipts

over disbursements

Financing:

Borrowings

Repayments

Interest

Total financing

318,000 $

200,000

18,000

106,000

40,000

7,000

16,000

0

705,000 $

$ (120,000) $

40,000

$ 170,000

10,000

Cash balance, ending

$ 170,000

10,000

50,000

50,000

244,000 $ 820,000

200,000

600,000

18,000

54,000

106,000

318,000

20,000

86,000

7,000

21,000

40,000

56,000

0

15,000

635,000 $ 1,970,000

280,000

0 $

(180,000)

(5,300)

(185,300) $

94,700

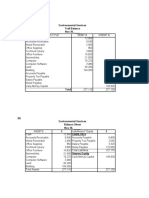

EARRINGS UNLIMITED

BUDGETED INCOME STATEMENT

FOR THE THREE MONTHS ENDED JUNE 30

$ 2,150,000

Sales

Variable expenses:

Cost of goods sold

Commissions

Contribution Margin

Fixed expenses:

Advertising

Rent

Salaries

Utilities

Insurance

Depreciation

Net operating income

Interest expense

Net income

$

$

860,000

86,000

$

$

$

$

$

$

600,000

54,000

318,000

21,000

9,000

42,000

$ 946,000

$ 1,204,000

$ 1,044,000

$ 160,000

$

(5,300)

$ 154,700

EARRINGS UNLIMITED

BUDGETED BALANCE SHEET

JUNE 30

Assets:

Cash

Accounts receivable (see below)

Inventory

Prepaid insurance

$

$

$

$

94,700

500,000

48,000

12,000

100,000

180,000

(180,000)

(5,300)

(5,300)

94,700

�Property and equipment, net

Total assets

$ 964,000

$ 1,618,700

Liabilities and Stockholders' Equity

Accounts payable, purchases

Dividends payable

Capital stock

Retained earnings (see below)

Total liabilities and stockholders' equity

$

84,000

$

15,000

$ 800,000

$ 719,700

$ 1,618,700

Accounts receivable at June 30:

May sales x 10%

June sales x 80%

Total

$

$

$

100,000

400,000

500,000

Retained earnings at June 30:

Balance, March 31

Add net income

Total

Less dividends declared

Balance, June 30

$

$

$

$

$

580,000

154,700

734,700

15,000

719,700

�PROJECT A

Student Name:

Jaykumar Patel

SALES BUDGET:

Budgeted unit sales

Selling price per unit

Total Sales

April

65000

10

=C7*C8

SCHEDULE OF EXPECTED CASH COLLECTIONS:

April

February sales (10%)

=(26000*0.1)*10

March sales (70%) next (10%)

=(40000*0.7)*10

April sales

=(65000*0.2)*10

May sales

June sales

Total Cash Collections

=SUM(C14:C18)

May

100000

10

=D7*D8

May

=(40000*0.1)*10

=(65000*0.7)*10

=(100000*0.2)*10

=SUM(D14:D18)

MERCHANDISE PURCHASES BUDGET:

April

Budgeted unit sales

Add desired ending inventory

(40% of the next month's unit)

Total needs

Less beginning inventory

Required purchases

Cost of purchases @ $4 per unit

May

65000

100000

=(100000*0.4)

=SUM(C24:C26)

=(65000*0.4)

=C27-C28

=C29*4

=(50000*0.4)

=SUM(D24:D26)

=(100000*0.4)

=D27-D28

=D29*4

BUDGETED CASH DISBURSEMENTS FOR MERCHANDISE PURCHASES:

April

May

Accounts payable

100000

April purchases

=316000*0.5

=316000*0.5

May purchases

=320000*0.5

June purchases

Total cash payments

=SUM(C35:C38) =SUM(D35:D38)

Cash balance

Add collections from customers

Total cash available

EARRINGS UNLIMITED

CASH BUDGET

FOR THE THREE MONTHS ENDING JUNE 30

April

May

74000

50000

436000

695000

=SUM(C46:C47) =SUM(D46:D47)

Less Disbursements

Merchandise purchases

258000

318000

�Advertising

Rent

Salaries

Commissions

Utilities

Equipment purchases

Dividends paid

Total Disbursements

Excess (deficiency) of receipts

over disbursements

Financing:

Borrowings

Repayments

Interest

Total financing

Cash balance, ending

200000

18000

106000

26000

7000

200000

18000

106000

40000

7000

16000

15000

0

=SUM(C51:C58) =SUM(D51:D58)

=C48-C59

=D48-D59

=120000+50000 10000

=SUM(C64:C66) =SUM(D64:D66)

=C48-C59+C67

=D48-D59+D67

EARRINGS UNLIMITED

BUDGETED INCOME STATEMENT

FOR THE THREE MONTHS ENDED JUNE 30

Sales

Variable expenses:

Cost of goods sold

Commissions

Contribution Margin

Fixed expenses:

Advertising

Rent

Salaries

Utilities

Insurance

Depreciation

Net operating income

Interest expense

Net income

=215000*4

=(215000*0.04*10)

=200000*3

=18000*3

=106000*3

=7000*3

=3000*3

=14000*3

EARRINGS UNLIMITED

BUDGETED BALANCE SHEET

JUNE 30

Assets:

Cash

Accounts receivable (see below)

Inventory

Prepaid insurance

Property and equipment, net

�Total assets

Liabilities and Stockholders' Equity

Accounts payable, purchases

Dividends payable

Capital stock

Retained earnings (see below)

Total liabilities and stockholders' equity

Accounts receivable at June 30:

May sales x 10%

June sales x 80%

Total

Retained earnings at June 30:

Balance, March 31

Add net income

Total

Less dividends declared

Balance, June 30

�June

Quarter

=SUM(C7:E7)

10

=F7*F8

June

Quarter

=SUM(C14:E14)

=SUM(C15:E15)

=SUM(C16:E16)

=SUM(C17:E17)

=SUM(C18:E18)

=SUM(F14:F18)

50000

10

=E7*E8

=(65000*0.1)*10

=(100000*0.7)*10

=(50000*0.2)*10

=SUM(E14:E18)

50000

June

Quarter

=SUM(C24:E24)

=(30000*0.4)

=SUM(E24:E26)

=(50000*0.4)

=E27-E28

=E29*4

=SUM(C26:E26)

=SUM(C27:E27)

=SUM(C28:E28)

=SUM(C29:E29)

=SUM(C30:E30)

June

Quarter

=SUM(C35:E35)

=SUM(C36:E36)

=SUM(C37:E37)

=SUM(C38:E38)

=SUM(C39:E39)

June

50000

865000

=SUM(E46:E47)

Quarter

74000

=SUM(C47:E47)

=SUM(F46:F47)

244000

=SUM(C51:E51)

=320000*0.5

=168000*0.5

=SUM(E35:E38)

�200000

18000

106000

20000

7000

40000

0

=SUM(E51:E58)

=SUM(C52:E52)

=SUM(C53:E53)

=SUM(C54:E54)

=SUM(C55:E55)

=SUM(C56:E56)

=SUM(C57:E57)

=SUM(C58:E58)

=SUM(F51:F58)

=E48-E59

=F48-F59

0

-180000

=-((170000*0.01*3)+(10000*0.01*2))

=SUM(E64:E66)

=SUM(C64:E64)

-180000

-5300

=SUM(F64:F66)

=E48-E59+E67

=F48-F59+F67

2150000

=D78+D79

=E76-E79

=SUM(D82:D87)

=E80-E87

-5300

=SUM(E88:E89)

94700

500000

=12000*4

=21000-9000

= 950000+56000-42000

�=SUM(E99:E103)

=168000*0.5

15000

800000

719700

=SUM(E109:E112)

=1000000*0.1

=500000*0.8

=SUM(E117:E118)

580000

154700

=SUM(E123:E124)

15000

=E125-E126