UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 1

1.

2. Accounting equation

Assets = Capital + Liabilities

AL=C

-

depicts the relationship between assets, liabilities and owners equity.

shows the financial position of a business entity at a particular date.

can be presented in the form of balance sheet.

the total of one part is always equal to the total of the other part.

Statement of Financial Position as at XXX

Assets

Liabilities

Capital

3.

4.Fatimah

�UKAF 1033 Business Accounting 1

Jan 2011

5. Johari

6.Kok Heng

Tutorial 2

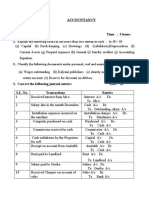

Q.1

Debited

Credited

Debited

Credited

(a) Lorry

(c) Loan from

(e) Machinery

(g) Bank

(i) Cash

Cash

Cash

Amal

Siva

Bala

(b) Siti

(d) Cash

(f) Cash

(h) Bank

(j) Lam

Bank

Van

Ho

Capital

Cash

�UKAF 1033 Business Accounting 1

Q.2

Date

Mar 1

Mar 2

Mar 3

Mar 5

Mar 8

Mar 15

Mar 17

Mar 24

Mar 31

Q.3

Jan 2011

Particulars

Dr Cash

Dr Bank

Cr Capital

Dr

750

9,000

Dr Bank

Cr Dala (Loan creditor)

2,000

Dr Equipment (Computer)

Cr Cash

600

Dr Equipment (display equipment)

Cr Chin Enterprise

420

Dr Cash

Cr Bank

200

Dr Dala

Cr Bank

500

Dr Chin Enterprise

Cr Bank

420

Dr Dala

Cr Cash

250

Dr Equipment (Printer)

Cr Lim

200

Cr

9,750

2,000

600

420

200

500

420

250

200

Fendy

1

24

28

Capital

Wong

Biz rates

28

bank

28

bank

10

28

returns out

bank

11000

250

45

830

6100

195

415

Bank

5 Stationery

16 biz rates

19 rent

28 ben

28 mardi

28 betty

62

970

75

830

415

6100

Ben

2 Purchases

830

betty

20 motor vehi

6100

mardi

2 purchases

610

capital

1600

Cash

3 purchases

4 rent

7 wages

11 rent

18 insurance

21 motor exp

23 wages

370

75

160

75

280

24

170

Sales

6 tam

6 husin

6 wong

15 lee

15 sharee

15 rashid

370

290

410

205

280

426

�UKAF 1033 Business Accounting 1

lam

2 purchases

Jan 2011

13

husin

590

Returns outwards

10 mardi

tam

6

Sales

Returns Inwards

35

195

370

rent

sales

290

husin

13 returns in

4

11

19

cash

cash

cash

Sales

410

wong

24 bank

16

Bank

biz rates

970 28 bank

sharee

7

23

cash

cash

wages

160

170

rashid

Bank

stationery

62

18

cash

insurance

280

21

cash

motor exp

24

20

betty

35

250

75

75

75

45

lee

15

15

15

sales

Sales

sales

205

280

426

Capital

1 Bank

1 cash

2

2

2

3

ben

mardi

lam

cash

purchases

830

610

590

370

11000

1600

motor vehicle

6100

Tutorial 3

1. Joe Trading

�UKAF 1033 Business Accounting 1

Jan 2011

2. Kim

3. Gary

�UKAF 1033 Business Accounting 1

Jan 2011

4.

5. (a) Purpose of day books

- segregation of duties different bookeepers

- provides a means of internal control to prevent fraud

- facilitates the location of errors and ensuring accuracy of ledgers

(b) Sales day book: Invoice

Purchases day book: Suppliers Invoice

Sales return day book: Credit note

Purchases return day book: Debit note

Contents:- Date on which each transaction took place

- Name and contact information of the addressee

- Details or description relating to the sales/purchases/returns

transaction (e.g: name of the goods, no. of items).

- Folio column entry for cross referencing back to the original source

documents

- Monetary amounts of the goods

Tutorial 4

1.

�UKAF 1033 Business Accounting 1

Jan 2011

2. Kedai Runcit Shaari

3. Purpose of trial balance

(a) to ascertain whether the total of the accounts with debit balances equals the

total of the accounts with credit balances (matching credit entry for every debit

entry).

(b) to prove arithmetic accuracy of the ledger accounts.

(c) to assist in the preparation of financial statements.

�UKAF 1033 Business Accounting 1

Jan 2011

4.

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 5

1.

Trial Balance as at 31 Dec 2007

RM

Capital

Drawings

Loan- Public Bank

Leasehold premises

Motor vehicles

Investment

Trade debtors

Trade creditors

Cash

Bank overdraft

Sales

Purchases

Returns outwards

Returns inwards

Carriage

Wages and salaries

Rent and rates

Light and heat

Telephone and postage

Printing and stationery

Bank interest

Interest received

RM

39,980

14,760

20,000

52,500

13,650

4,980

2,630

1,910

460

3,620

81,640

49,870

960

840

390

5,610

1,420

710

540

230

140

148,730

620

148,730

�UKAF 1033 Business Accounting 1

Jan 2011

2

.

10

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 6

1.

Balance b/d

Beh

2,740

201

Cash Book

Bank charges

Gina

Balance c/d

2,941

Bank Reconciliation statement as on 31 March 2008

Balance as per cash book

Add: Unpresented cheque

Less: Lodgements not yet credited

Balance as per bank statement

32

93

2816

2,941

2816

131

2947

410

2537

2.Hogan

11

�UKAF 1033 Business Accounting 1

Jan 2011

3. Thomas Lee

4. King

12

�UKAF 1033 Business Accounting 1

5. Han Chung Trading

(a)

Balance b/f

Receipts (15,073-47-18)

(b)

Jan 2011

Cash Book

RM

1,470 Payments (15,520+47)

15,008 Bank charges

Balance c/f

16,478

RM

15,567

35

876

16,478

Bank Reconciliation Statement as on 31 Oct 2007

RM

Balance as per cash book

Add

Unpresented cheques (214+370+30)

614

Less

Uncredited lodgements

Bank error in debiting account

Balance as per bank statement

1,542

72

RM

876

614

1,490

1,614

(124)

6. Factors causing the differences:(a) Timing differences

Uncredited lodgements and unpresented cheques

(b) Omissions and errors

Omissions of transactions such as bank charges, standing order, direct debit,

credit transfer, dishonoured cheque of third parties; and errors in cash book.

13

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 7

1.

2.

14

�UKAF 1033 Business Accounting 1

Jan 2011

3.

15

�UKAF 1033 Business Accounting 1

Jan 2011

4.

16

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 8

1.

2.

17

�UKAF 1033 Business Accounting 1

Jan 2011

3.Didi

4.

(a)

Journal

Bank

Thong

(Being receipt of RM500 towards debt previously written off)

Thong

Bad debts recovered account

(Being reversal of debt previously written off)

Debit Credit

RM

RM

500

500

500

500

18

�UKAF 1033 Business Accounting 1

(b)

(c)

Provision for doubtful debts

RM

Balance c/d

1,045

Balance b/d

(22,000-800-300)*5%

P+L

1,045

Jan 2011

RM

900

145

1,045

Balance Sheet as at 30 Nov 2007

RM

Current Asset

Trade Debtors (22,000-1,100)

Less: Provision for doubtful debts

20,900

1,045

19,855

5.

19

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 9

1. Hikmat Trading

20

�UKAF 1033 Business Accounting 1

Jan 2011

2. Bakti Enterprise

3. Ori Sdn Bhd

2006

1-Jun

1-Jul

30-Sep

1-Oct

2007

1-Jan

1-Apr

1-Jun

Prepaid rent b/d

Bank- Q3

Bank- Rates

Bank- Q4

Bank- Q1

Bank- Q2

Accrual rates c/d

Prepaid b/d

Rent and Rates

RM

2006

200

1-Jun

600

2,040

600

750

750

380

5,320

250

Accrual rates b/d

31-May

31-May

31-May

P+L (Rates)

P+L (Rent)

Prepaid rent c/d

1-Jun

Accrual rates b/d

RM

340

2,080

2,650

250

5,320

380

Workings: P+L (Rent) = 7*200 (Jun-Dec'06) +

5*250 (Jan-May'07)

= 2,650

P+L (Rates) = 10*170 (Jun'06-Mar'07) +

2*190 (Apr'07-May'07)

= 2,080

b) Matching principles refers to the assumption that in the measurement of profit,

costs should be set against the revenue which they generate at the point in time

when this arises.

In this case, the rent and rates expenses are matched according to the

accounting period. Expenses give rise to certain effects which take the form of

revenue. Matching is thus the determination of profit by attributing specific

causes to particular effects at the point in time at which the effects occur.

21

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 10

1. Soon

Statement of Comprehensive Income for the year ended 31 Dec 2008

RM

Sales (1000+250+8+3-200)

Less: Cost of sales

Opening stock

Purchases (700+160-180)

200

680

880

230

less: Closing stock

Gross profit

Less: Expenditure

Rent (8+30-10)

Insurance (12+20+6)

Electricity (25+7-9)

Telephone (10-2-1)

Wages

Discounts allowed

Bad debts written off

Depreciation

28

38

23

7

100

8

3

50

Statement of Financial Position as at 31 Dec 2008

RM

RM

Fixed assets (350-50)

Current Assets

Trade debtors

Stock

Bank (20+1000-700-185-50)

Prepayments (10+2)

Less: Current Liabilities

Accruals (7+6)

Trade creditors

Net current assets

Capital

Balance as at 1 Jan 2008

Add: Net profit

Less: Drawings

RM

1,061

650

411

257

154

RM

300

250

230

85

12

577

13

160

173

404

704

600

154

754

50

704

22

�UKAF 1033 Business Accounting 1

Jan 2011

2.

23

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 11

1.

2.

3.

24

�UKAF 1033 Business Accounting 1

Jan 2011

4. Types of error that do not affect the trial balance agreement

(a) Error of omission

A transaction is completely omitted from the books.

(b) Error of principle

An entry is made in the wrong class of account.

(c) Error of commission

An entry is posted to the wrong persons account.

(d) Error of original entry

The double entry principle is correct but error occurs in the original documents

where the figure is incorrect.

(e) Complete reversal of entry

An account that should be credited is debited and vice versa.

(f) Compensating error

Errors occur and cancel each other out.

Tutorial 12

1. Regent Sdn Bhd

a)

i) Bank Charges

Cash

RM

56

56

ii) Creditors control

Purchases

400

iii) Debtors control

Sales

100

400

100

iv) Creditors control/ Amin Trading

Purchases

90

v) Bad debts

Debtors control/ Shanie

88

vi) Motor expenses

Motor Vehicle

vii) Accumulated Depreciation

Depreciation

RM

90

88

550

550

55

55

25

�UKAF 1033 Business Accounting 1

b)

Jan 2011

Statement of Corrected Net Profit for the year ended 31 May 2008

RM

Net profit as per draft final account

305,660

Add: Purchases overcast

400

Sales undercast

100

Error in purchases journal

90

Wrongly accounted depreciation

55

645

Less: Bank charges

Bad debts

Repair and maintenance

56

88

550

694

305,611

2.

3. Gail Dawson

26

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 13

1.

2.

27

�UKAF 1033 Business Accounting 1

Jan 2011

3.

4.

Balance b/d

Sales

Cash

Interest on overdue account

Balance c/d

Balance b/d

Debtors' Ledger Control

RM

7,182 Cash

69,104 Discounts allowed

66 Returns inwards

10 Bills receivable

42 Bad debts

Creditors ledger control

Balance c/d

76,404

RM

59,129

1,846

983

3,243

593

303

10,307

76,404

10,307

5. Purpose of Control Accounts

- to provide a check on the accuracy of the ledger

- to facilitate the location of erros higlighted in the trial balance by pinpointing

the personal ledger

- deter fraud and ensure proper segregation of duties

- facilitate the extraction of balances on creditors and debtors, whereby

information is obtained immediately from control accounts

28

�UKAF 1033 Business Accounting 1

Jan 2011

Tutorial 14

1. Balan

2. Othman

29

�UKAF 1033 Business Accounting 1

Jan 2011

3. Amal

Sales

Statement of Comprehensive Income for the year ended 31 May 2008

RM

RM

405,000

Less: Cost of sales

Opening stock

Purchases (259,600-1,040)

less: Closing stock

Gross profit

Add: Discounts received

Reduction in provision of doubtful debts ([0.5%*46,200]-280)

Less: Expenditure

Discounts allowed

Wages and salaries (52,360+140)

Bad debts

Loan interest

Carriage outwards

Other operating expenses (38,800-500+200)

Depreciation on property (90,000*1%)

Depreciation on equipment (57,500*15%)

27,400

258,560

285,960

25,900

260,060

144,940

4,420

49

149,409

3,370

52,500

1,720

1,560

5,310

38,500

900

8,625

112,485

36,924

Net profit

Statement of Financial Position as at 31 May 2008

RM

RM

Cost

Acc. Depn

Fixed Assets

Property

Equipment

90,000

57,500

Current Assets

Stock

Trade debtors

Less: Provision of bad debts

Cash on hand

Prepayment

46,200

231

Less: Current Liabilities

Bank overdraft

Accruals (140+200)

Trade creditors

Net current assets

14,500

340

33,600

13,400

41,125

RM

NBV

76,600

16,375

92,975

25,900

45,969

151

500

72,520

48,440

24,080

117,055

30

�UKAF 1033 Business Accounting 1

Jan 2011

Less: Long term liability

13% loan

Net assets

12,000

105,055

Capital

Balance at 1 June 2007

Add: Net profit

98,101

36,924

135,025

29,970

105,055

Less: Drawings (28,930+1,040)

4. Tim

Sales

Statement of Comprehensive Income for the year ended 30 Sep 2007

RM

RM

203,845

Less: Cost of sales

Opening stock

Purchases (167,760-112)

less: Closing stock

Gross profit

Add: Discounts received

Less: Expenditure

Rent (1,350+450)

Light and heat (475+136)

Insurance

Salaries

Stationery and printing

Telephone and postage

General Expenses (2,044+252)

Travellers commission and expenses (9,925+806)

Discounts allowed

Bad debts written off

Provision for doubtful debts

Depreciation on office furniture and equipment (1,440*10%)

Net profit

14,972

167,648

182,620

12,972

169,648

34,197

955

35,152

1,800

611

304

6,352

737

517

2,296

10,731

517

331

430

144

24,770

10,382

31

�UKAF 1033 Business Accounting 1

Jan 2011

Statement of Financial Position as at 30 Sep 2007

RM

RM

Fixed Assets

Office furniture and equipment (1,440-144)

Current Assets

Stock

Debtors

Less: Provision of bad debts

Bank

Petty cash in hand

Less: Current Liabilities

Accruals (450+136+806+252)

Trade creditors

Net current assets

RM

1,296

12,972

19,100

573

1,644

8,162

18,527

6,603

29

38,131

9,806

28,325

29,621

Capital

Balance at 1 June 2007

Add: Net profit

24,239

10,382

34,621

5,000

29,621

Less: Drawings (4,888+112)

5.

Statement of Comprehensive Income for the year ended 31 Jan 2006

RM

RM

Sales (50,240-300)

Less: Return inwards

Less: Cost of sales

Opening stock

Purchases

less: Return outwards

13,630

42,400

348

less: Closing stock (15,450+240)

Gross profit

Add: Gain on sales of motor vehicle

Less: Expenditure

Salaries and wages

Rent, rates and insurance (860+36-60-10)

Sundry expenses (750+90)

Provision for doubtful debts (340-280)

Bad debts

Depreciation on fixtures and fittings (1400*10%+240*4/12*10%)

Depreciation on motor vehicles ([920-80]*25%)

Net profit

RM

49,940

136

49,804

42,052

55,682

15,690

39,992

9,812

40

9,852

4,100

826

840

60

134

148

210

6,318

3,534

32

�UKAF 1033 Business Accounting 1

Jan 2011

Statement of Financial Position as at 31 Jan 2006

RM

Fixed Assets

Fixture and fittings

Motor Vehicle

1,640

840

Current Assets

Stock

Sundry debtors (4,610-300)

Less: Provision of bad debts

Prepayments (60+10)

Cash at bank and in hand

4,310

340

Less: Current Liabilities

Accruals (36+90)

Sundry creditors

Net current assets

126

3,852

Capital

Balance at 1 June 2007

Add: Net profit

Less: Drawings

RM

148

210

RM

1,492

630

2,122

15,690

3,970

70

3,820

23,550

3,978

19,572

21,694

20,760

3,534

24,294

2,600

21,694

Workings: Profit of 20% on sales price

x

100

=

240

80

x

=

RM300

33