Professor Jay Bhattacharya

Spring 2001

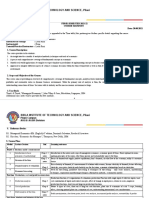

Firm Objectives

Profit

Cost minimization: Given a fixed output

level (without any story about how this

output is determined) firms choose the

minimum cost combination of inputs.

Profit maximization: Firms choose that

level of output that yields the highest level

of profits.

Spring 2001

Econ 11--Lecture 13

Profit = Revenue Cost

Last class, we analyzed costs in detail.

The cost minimization problem produces a

function C(Q), which represents minimum

costs given output Q.

Revenue is output multiplied by the price at

which that output sellsR(Q) = PQ.

1

Spring 2001

Profit MaximizationChoosing Output

If a firm produces at all, it will produce an

amount such that MR = MC.

If the extra revenue generated from producing 1

extra unit of output (MR) exceeds the

additional cost of producing that unit, then the

firm can increase its profit by expanding output

by 1 unit.

d dR dC

dR dC

=

=0

=

dQ dQ dQ

dQ dQ

Interpretation: To maximize profits, set

marginal revenue (dR/dQ) equal to marginal

cost (dC/dQ).

Econ 11--Lecture 13

Spring 2001

Second Order Condition

C,R

The SOC is important because of S shaped cost

curves.

Also, if price falls below AVC, the firm (if it

produced positive amounts of output) would earn

a loss. Instead, it should go out of business

Econ 11--Lecture 13

Econ 11--Lecture 13

Econ 11--Lecture 13

Graphical Presentation

d 2 d 2 R d 2C

=

<0

dQ 2 dQ 2 dQ 2

Spring 2001

Supply: How much will firms produce?

max = R(Q) C(Q)

First order condition:

Spring 2001

Econ 11--Lecture 13

slope = P

R=PQ

C(Q)

Q**

5

Spring 2001

R(Q)-C(Q)

Q* Q

Econ 11--Lecture 13

Q**

Q*

Q

6

�Professor Jay Bhattacharya

Spring 2001

Nicholson Example Problem

Lump-Sum Tax

Would a lump-sum profits tax affect the

profit maximizing quantity of output? How

about a proportional tax on profits? How

about a tax assessed on each unit of output?

Profit maximization under a lump-sum

profits tax: (T is the lump-sum tax)

= PQ C ( Q ) T

First order condition is exactly the same:

d dR dC

=

=0

dQ dQ dQ

Spring 2001

Econ 11--Lecture 13

Lump-Sum Tax (continued)

Spring 2001

Under a proportional tax on profits (say, t)

the firms problem is:

= ( PQ C ( Q ) ) (1 t )

R=PQ

The first order condition is:

R=PQ-T

C(Q)

Econ 11--Lecture 13

d dR dC

dR dC

=

=

(1 t ) = 0

dQ dQ dQ

dQ dQ

Q* Q

Spring 2001

Proportional Tax (continued)

Spring 2001

Econ 11--Lecture 13

= PQ (1 t ) C ( Q )

R=PQ(1-t)

Econ 11--Lecture 13

10

Under a tax (say, t) on output the firms

problem is:

R=PQ

C(Q)

Econ 11--Lecture 13

Tax on Output

The firm makes less profits, but the

marginal and limit conditions are the same:

C,R

If the firm

produces positive

Q without the tax,

it produces positive

Q with the tax.

Proportional Tax on Profits

However, it may be optimal for firms to go

out of business if the lump sum tax is high

enough: C,R

Spring 2001

Econ 11--Lecture 13

(1-t)C(Q)

Q* Q

The first order condition is:

d dR

dC

dR

dC

=

(1 t ) = 0 (1 t ) =

dQ dQ

dQ

dQ

dQ

11

Spring 2001

Econ 11--Lecture 13

12

�Professor Jay Bhattacharya

Spring 2001

Tax on Output (continued)

Prices and Industry Structure

The price that firms can charge will depend upon

the structure of the industry.

This tax distorts the firms FOCthe

optimal Q differs from Q*:

In a competitive industry, firms cannot affect prices by

cutting back on (or increasing) output.

In a monopolistic or oligopolistic industry, changes in

output affect market price.

C,R

The firm is more

likely to go out of

business with this

risky tax scheme.

R=PQ

In general, output prices that firm faces will be a

function of the firms output:

C(Q)

P = P(Q)

This is exactly the (inverse) market demand function.

Qnew Q*

Spring 2001

Econ 11--Lecture 13

13

Spring 2001

Econ 11--Lecture 13

14

Supply Curve

Competitive Supply

P

In a competitive industry, firms take prices as

fixed.

If firms charge prices higher than marginal costs, they

lose all their business.

If firms charge prices lower than marginal costs, they

make negative profits.

C(Q )

For price taking firms, dR/dQ = P

The first order condition is P = MC = dC/dQ

The firm will choose output at a point where price is

equal to marginal cost.

Q

Spring 2001

Econ 11--Lecture 13

15

Spring 2001

How Does Supply Vary with

Input Prices

P

For example, an

increase in wages

shifts supply back

since it increases

marginal costs.

Econ 11--Lecture 13

Econ 11--Lecture 13

16

Monopoly Supply

An increase in marginal cost = a shift in the

supply curve

Spring 2001

Econ 11--Lecture 13

17

Monopolists do not sit back and take prices.

They manipulate prices by curtailing output below

competitive levels.

For monopolists, prices are a function of quantity

produced (the inverse market demand curve).

However, like firms in a competitive industry,

monopolists still maximize profits. The FOC is:

dC

dR dP (Q )

Q + P (Q ) =

=

dQ

dQ

dQ

Spring 2001

Econ 11--Lecture 13

18

�Professor Jay Bhattacharya

Spring 2001

Monopoly Supply (Graphical)

Nicholson Example Problem #2

P

dR/dQMarginal

Revenue curve

C(Q )

P(Q) Demand curve

Area in box =

Total revenue

Q(monopoly) Q(competitive)

Spring 2001

Econ 11--Lecture 13

19

Example #2 Solved

Econ 11--Lecture 13

Spring 2001

Inverting two demand functions yields:

1

p1 = q1 + 50

2

21

Spring 2001

max = q 1 q + 50 + q 1 q + 25 (q + q )2

2

1

1

2

1

2

q1 , q2

2

Econ 11--Lecture 13

1

p2 = q2 + 25

4

Econ 11--Lecture 13

22

Example #2 Solution (IV)

Plugging the inverse demand functions back

into the profit function gives the firms

maximization problem in terms of q1 and q2:

Econ 11--Lecture 13

20

The firm chooses q1 and q2 to maximize

profits:

max = q p + q p (q + q )2

1 1

2 2

1

2

q1 , q2

Example #2 Solution (III)

Spring 2001

Econ 11--Lecture 13

Example #2 Solution (continued)

Let q1 be the amount sold in Australia at

price p1.

Let q2 be the amount sold in Lapland at

price p2.

The firms total revenues from the two

locations equal p1q1 + p2q2.

The firms total costs of producing q1 + q2

are 0.25(q1 + q2)2.

Spring 2001

Universal Widget produces high-quality widgets

at its plant in Gulch, Nevada, for sale throughout

the world. The cost function for total widget

production (q) is given by TC = 0.25q2. Widgets

are demanded only in Australia (where demand is

q = 100 2p), and Lapland (where demand is q =

100 4p). If Universal Widget can control q in

each market, how many should it sell in each

location in order to maximize profits? What price

will be charged in each location?

23

The first order conditions for the firms

problem and their solution are:

3

1

q1 q2 + 50 = 0

2

2

1

q1 q2 + 25 = 0

2

Spring 2001

q1 = 30 p1 = 35

q 2 = 10 p2 = 22.5

Econ 11--Lecture 13

24

�Professor Jay Bhattacharya

Spring 2001

Producer Surplus

3 Ways to Measure PS

Producer surplus = Revenue - Variable Cost

Profit = Revenue - Total Cost

Producer surplus = Profit if no fixed costs

or if in the long-run

AKA operating profit

PS = Revenue - Variable Cost

PS = Area where Price > MC

PS = Area to the left of the supply curve

Spring 2001

Spring 2001

Econ 11--Lecture 13

25

Producer Surplus

P

P = C (Q )

The industry supply curve is the horizontal

sum of the existing firms supply curves

Econ 11--Lecture 13

Q1

Q

Econ 11--Lecture 13

26

Industry Supply

Market

price line

Spring 2001

Econ 11--Lecture 13

27

Spring 2001

Q2

Econ 11--Lecture 13

Q1+Q2

Q

28