0% found this document useful (0 votes)

300 views3 pagesCash Flow Statement

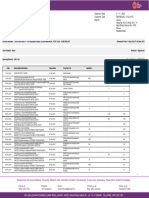

1) Cash flow refers to the actual movement of cash into and out of a business. It is essential for businesses to prepare a cash flow statement to ensure they have adequate cash flows to meet current liabilities.

2) A cash flow statement depicts the movement of a firm's cash position between periods on a cash basis. It is a useful tool that helps management with financial decision making and evaluating changes in the cash position.

3) The cash flow statement presents operational, financial, and investment activities to help management understand how cash moved and what caused changes in cash flows.

Uploaded by

vianfulloflifeCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

300 views3 pagesCash Flow Statement

1) Cash flow refers to the actual movement of cash into and out of a business. It is essential for businesses to prepare a cash flow statement to ensure they have adequate cash flows to meet current liabilities.

2) A cash flow statement depicts the movement of a firm's cash position between periods on a cash basis. It is a useful tool that helps management with financial decision making and evaluating changes in the cash position.

3) The cash flow statement presents operational, financial, and investment activities to help management understand how cash moved and what caused changes in cash flows.

Uploaded by

vianfulloflifeCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

/ 3