Survey Master LLC

GSM5301: ACCOUNTING FOR DECISION MAKING

PUTRA BUSINESS SCHOOL

GROUP ASSIGNMENT

Survey Masters LLC

Group 4

Abdul Hakim Bin Sahaq

PBS15311279

Amar Hamka

PBS15111011

Arunachalam Balaji

PBS15211174

Badrul Hisham Ismail

PBS15311272

Low Jun Xian

PBS15311277

Neeshanthinee Nagoor

PBS15311266

�Survey Master LLC

Case Introduction

Survey Masters is a marketing research company which offers survey & research services to

companies with no specialized research resources. It focuses on various industries such as

manufacturing, retailing, and consulting industries. The company is operated by two main

partners Natalie Patel and Carlos Lopez.

The major line of business which Survey Master focuses is doing market research and conduct

industry specific surveys for their clients. This includes researching on the existing consumers as

well as research on new products and services offered by manufacturers, distributors, and

consultants. Survey Masters implemented a three-phase methodology in conducting survey for

clients. These three-phases includes survey proposal and design, data collection and analysis and

report preparation.

After two years of successful operating, the company now employs 10 professionals, and earned

$3 million revenues with $600,000 income in 2006. The partners Carlos and Natalie has

concerns around selection of their clients in order for the betterment of the company. They are

planning to be more selective in the types and size of the projects that the company should

engage with. The following case study analyses this issue further into detail.

�Survey Master LLC

Question 1: Comment on the analyses prepared by Linda Evans in Exhibit 2. Why do

smaller projects appear to be more or at least equally profitable as larger projects?

The cost driver for overhead is Salary, which is $400,000 for both largest and smallest projects.

As a result, the profit margin for smallest 100 projects is calculated $400,000 which is $200,000

more than largest projects $200,000. Similarly when dividing projects into largest 60 projects

and smallest 60 projects based on revenue, the former profit margin is $300,000 each which

equals to the latter profit margin.

However the cost driver chosen for cost allocation is not reasonable. Larger projects required

more analysts in number and more senior analysts with more experience. Thus the salaries for

largest projects are greater or equal to the ones for smallest project.

Overhead on the other hand, is more related with activities rather than with salaries. The factor

that truly affect overhead expenses are costs related to travelling, phone calls, time and

stationeries. Therefore the best method to allocate overhead costs is Activity Based Costing.

According to both calculations done by Linda, it unable to show the relationship between project

size and project profitability clearly as it is not calculated according the three activities provided

by Master Survey LLC. In summary, Activity Base Costing (ABC) method should be applied.

The ABC process attempts to provide a better model of the costs of producing products or

providing services and delivering them to customers. It promises to depict costs more accurately

through a deeper understanding both of the activities involved and the resources consumed by

each of those activities.

Question 2: Use the information in Exhibit 3 on overhead spending and activities to

prepare analyses of the profitability of larger (20 projects) and smaller (100 projects)

2

�Survey Master LLC

projects undertaken by Survey Master in 2006. What are your conclusions about the

relationship between project size and project profitability?

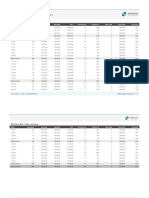

Table 1: Overhead Allocation Basis

Overhead

Survey Proposed and

Design (Trips)

Data Collection &

Tabulation (Days)

Analysis and Report

Preparation (Pages)

Largest 20 Projects

50

Smallest 100 Projects

110

600

3600

250

1050

Table 2: Overhead Allocation Table

Overhead

Largest 20 Projects

Smallest 100 Projects

Survey Proposed and

Design (Trips)

Data Collection &

Tabulation (Days)

Analysis and Report

Preparation (Pages)

Total Overhead

200000+52587+75000=327,587 440000+317143+315000=1,072,143

Costs

�Survey Master LLC

Table 3: Profit Calculation Table

Revenue

Salaries

Total Overhead Costs

Profit

Largest 20 Projects

1,300,000

(400,000)

(327,587)

372,143

Smallest 100 Projects

1,500,000

(400,000)

(1,072,143)

27,857

We want to allocated the overhead costs according to the new basis, hence we calculated the

overhead allocation based on the given figures which are shown in Table 2 and we found out that

the total overhead costs for the Largest 20 Projects are $327,587 while the total overhead costs for

Smallest 20 Projects are $1,072,143. From here, we can see that smaller projects has absorbed a

big portion of the overhead costs which is tallied with Lindas comment of smaller projects require

many trips, more data collection and more data and analysis. Furthermore, we have calculated the

new profit level for both of the segregated projects. As per results in Table 3, we discovered that

the Largest Projects has a much higher profit than the Smallest 100 Projects.

Question 3: Should Survey Master continue to take all projects offered to the company?

Why or why not? On which size of project should they focus their sales efforts? Should

they refuse to take on larger or smaller projects in the future? What should be their

strategy in selecting future projects to undertake with client?

�Survey Master LLC

Survey proposed and design

Large project

50 trips

Small project

110 trips

Total

160 trips

Data Collection and tabulation

600 days

3600 days

4200 days

Analysis and report

preparation

250 pages

1050 pages

1300 pages

Large project

Small project

Total

Fixed cost apportionment in $

2

Survey proposed and design

00,000

4

40,000

640,000

3

Data Collection and tabulation

52,857

17,143

370,000

Analysis and report

preparation

75,000

315,000

390,000

1,0

27,857

72,143

Large project

Small project

Revenue (per project)

Variable cost (Salary per

project)

65,000

15,000

20,000

4,000

Contribution

45,000

11,000

20

100

Number of project

9

5

1,

400,000

1,1

�Survey Master LLC

00,000

00,000

3

Apportioned fixed cost

27,857

1,0

72,143

5

Profit

72,143

27,857

Based on the calculation above, the large project recorded higher profit of $572,143 as compared

to small project of $27,857. Since the overhead are apportioned and charged according to the

activities, Survey Master will not incur additional fixed costs should they choose not to take up

small projects. Therefore, it is recommended that Survey Master:

i.

To continue with all current projects di regard of the size, if the Company still be able

to manage through the all projects and do not possess any constraint on resources.

This is to ensure that the Company maintain its presence in the market;

ii.

If the resources are scarce, then sales effort be focused on securing big projects and

be selective on accepting small projects;

iii.

The strategy is to assess the potential revenue on client basis and does not use the

magnitude of the projects as a criterion to accept or reject projects as some clients

may offered both small and big projects, and by rejecting small projects from this

clients may have a potential negative effect on securing bigger projects from the same

clients.

�Survey Master LLC

Question 4: Suppose that Survey Masters decides to only take on larger client projects, but

not enlarge its professional staff (i.e. maintain the level of project salaries at $800000).

Prepare a projection of income for 2007 for the strategy that you proposed in question 3

above.

Answer:

Supposing that the Survey Master decides to only take on larger client projects so the current

salaries of the Largest 20 projects will be duplicated and also the overhead costs and the Total

Revenue.

Description

Income statement

for 2006

Projection of income statement

for 2007

No. of large projects

completed

20 projects

40 projects

Revenue

$ 1,300,000

$ 2,600,000

Salaries

$ 400,000

$ 800,000

Overhead allocated

(based on project

salaries)

$ 327,858

$ 655,716

Net income

$ 572,142

$ 1,144,284