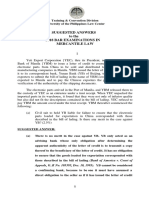

Table 3.

1 summarizes the key features of the sole proprietorship, the partnership, the C corporation, the S

corporation, and the limited liability company.

TABLE 3.1 Characteristics of the Major Forms of Ownership

Sole

Characteristic Proprietorship

Definition

General

Partnership

Limited

Partnership

Limited

Liability

C

S

Corporation Corporation Company

A for-profit

business owned

A for-profit business jointly

One general

partner and one

An artificial

legal entity

and operated by

owned and oper-

or more partners

one person

ated by two or

with limited

more people

liability and no

separate

from

its owners

and

formed

under

state and

federal

laws

rights of

management

An artificial

legal entity

that

is structured

like

aC

corporation

but taxed by

the

federal

government like a

A business entity

that provides

limited liability like

a

corporation but

is

taxed like a part-

partnership

members

Ease of

Easiest form of

Easy to set up

File a certificate

formation

business to set

and operate. A

up. If necessary,

written partner-

acquire licenses

ship agreement

and permits,

is highly recom-

register fictitious

mended. Must

name, and

acquire an

obtain taxpayer

Employer ID

identification

number. If neces-

File articles

Must meet

of

all

of limited partincorporation criteria to

file as

nership with the

and other

an S

corporation.

secretary of state. required

Must file

reports

timely

Name must show with the

election with

secrethe

that business is a

tary of state. IRS (within

212

limited partnerprepare

months of

bylaws

first

ship. Must have

and follow

taxable

year).

written agreement, corporate

sary, register

and must keep

fictitious name.

certain records.

formalities

nership. Owners

are referred to as

File articles of

organization

with

the secretary of

state. Adopt

operating agreement, and file

necessary reports

with the

secretary

of state. The

name

must show it is a

limited liability

company.

Owner's personal liability

Unlimited

Unlimited for

general partners,

Limited

Limited

Limited

Limited

limited for

limited partners

(continue

d)

�Sole

Proprietorshi

p

General

Partnershi

p

Limited

Partnershi

p

Limited

Liability

C

S

Corporation Corporation Company

Number

of owners

One

Two or more

At least one

gen- eral partner

and any number

of limited

partners

Any number

Tax liability

Single tax: per-

Single tax: part-

Same as general

Double tax:

sonal tax rate

ners pay on

their

proportional

shares at their

individual rate

partnership

corporatio

n pays tax

and shareholders

pay tax on

dividends

distributed

Current

maxi- mum

tax rate

35%

35%

35%

Transferability

Fully transfer-

May require

Same as general

39%

corporat

e plus

35%

individual

Fully

of ownership

able through

sale or transfer

of company

assets

Ends on death or

insanity of

proprietor or

upon

termination by

proprietor

consent of

all partners

partnership

Dissolves upon

death, insanity,

or retirement of

a general partner

(business may

continue)

Same as

general

partnership

Cost of

formatio

n

Liquidity of

the owner's

invest- ment in

the business

Low

Moderate

Poor to average

Ability to

raise capital

Characteristic

Maximum

of 100 with

restrictions as to

who they

are

Single tax:

owners

pay on

their

proportional

shares at

individua

l rate

35%

One (A few

states require

two or more)

Single tax:

members pay on

their

proportional

shares at

individ- ual

rate

35%

Transferable

(but

transferable

transfer

may

affect S

status)

Perpetual life Perpetual life

Usually

requires

consent

of all

members

Moderate

High

High

High

Poor to average

Poor to average

High

High

High

Low

Moderate

Moderate

to high

Very high

High

High

Formation

No special steps

No written part-

Must comply

Must follow

Procedure

required other

nership agree-

with state laws

Must meet

formal

requirements

than buying nec-

ment required

regarding limited

essary licenses

(but

highly

advisable)

partnership

Must meet

formal

requirements

specified by

state

law

Continuity

of the

business

Chapter Review

same

procedures

as C

corporation,

then elect S

status with

IRS

Perpetual Life

specified by

state

law

�1.

2.

Discuss the issues that entrepreneurs should consider when evaluating different forms of

ownership.

The key to choosing the right form of ownership is to understand the characteristics

of each and know how they affect an entrepreneur's personal and business

circumstances.

Factors to consider include tax implications, liability expense, start-up and future capital

requirements, control, managerial ability, business goals, management succes- sion

plans, and cost of formation.

Describe the advantages and disadvantages of the sole proprietorship.

A sole proprietorship is a business owned and managed by one individual and is the

most popular form of ownership.

Sole proprietorships offer these advantages:

Simple to create

Least costly to form

Owner has total decision-making authority

No special reporting requirements or legal restrictions

Easy to discontinue

Sole proprietorships suffer from these disadvantages:

o Unlimited personal liability of owner

o Limited managerial skills and capabilities

o Limited access to capital

o Lack of continuity

3. Describe the advantages and disadvantages of the partnership.

A partnership is an association of two or more people who co-own a business for the purpose of making a

profit.

Partnerships offer these advantages:

o Easy to establish

o Complementary skills of partners

o Division of profits

o Large pool of capital available

o Ability to attract limited partners

o Little government regulation

o Flexibility

o Tax advantages

Partnerships suffer from these disadvantages:

o Unlimited liability of at least one partner

o Difficulty in disposing of partnership interest

o Lack of continuity

o Potential for personal and authority conflicts

o Partners are bound by the law of agency

4. Describe the advantages and disadvantages of the corporation.

A limited partnership operates like any other partnership except that it allows limited partnersprimarily

investors who cannot take an active role in managing the business to become owners without subjecting

themselves to unlimited personal liability of the company's debts.

A corporation is a separate legal entity and the most complex of the three basic forms of ownership.

To form a corporation, an entrepreneur must file the articles of incorporation with the state in which the

company will incorporate.

Corporations offer these advantages:

o Limited liability of stockholder

o Ability to attract capital

�Ability to continue indefinitely

Transferable ownership

Corporations suffer from these disadvantages:

Cost and time in incorporation

Double taxation

Potential for diminished managerial incentives

Legal requirement and regulatory red tape

Potential loss of control by the founders

Describe the features of the alternative forms of ownership, such as the S corporation, the

limited liability company, and the joint venture.

An S corporation offers its owners limited liability protection but avoids the double taxation of C

corporations.

A limited liability company, like the S corporation, is a cross between a partnership and a corporation and

offers the advantages of each. However, it operates without the restrictions imposed on an S corporation.

To create a limited liability company, an entrepreneur must file the articles of organization and the

operating agreement with the secretary of state.

A joint venture is like a partnership, except that is it formed for a specific purpose.

o

o

o

o

o

o

o

5.