Asset Allocation

What is Asset Allocation?

Asset allocation is the process of determining what mix of

assets to hold in your investment portfolio. Some of the

asset classes where you can invest are Equity, Debt, Real

Estate, Gold, and Cash. The objective of an asset

allocation plan is to help you achieve your financial goals

with a degree of risk that you are comfortable with.

Different Asset Classes

Within each of the asset classes, there are several subclasses that you can invest in to build a truly diversified

portfolio that will help you achieve your financial goals.

EQUITY

Large Cap

With market cap greater that 30,000 cr.;

these stocks tend to be less volatile

because large companies are more

mature

Mid Cap

With market cap between 15,000 cr.

and 30,000 cr.; these stocks tend to be

more volatile

Small Cap

With market cap less than 15,000 cr.;

these stocks are very risky but could

give a higher return

Sector Specific

Stocks belonging to different sectors

like FMCG, Pharma, Infrastructure,

Banking

Value Stocks

Typically these are well-established

stocks, but have temporarily fallen out

of favor with the market

Growth Stocks

Typically these stocks exhibit higher

growth in income and revenue

compared to the overall market

DEBT

Government Securities

These could be short-term or longterm. They have lower risk because

they are backed by central or state

government.

Corporate Bonds/NCDs

These are issued by public or private

corporations. These securities could be

secured or unsecured.

Fixed Deposits

Is a sum of money given to a bank or

corporation, wherein the investor is

paid a fixed interest rate over a fixed

period of time

OTHER

Cash

Current and Savings Accounts

Real Estate

Could be commercial or residential

Commodities

Gold, silver, oil, and other commodities

�Why is Asset Allocation important?

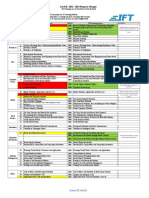

1. Magic of Portfolio Diversification. The performance of different asset classes varies over time, as

shown in the chart, Winners Change. By investing in several asset classes, you may improve your

chances of benefiting from market gains, and lower the impact of poor performing asset categories on

your overall portfolio returns. Allocating your investments among different asset classes reduces

portfolio risk and improves your chances to earn a more consistent return.

Best

Winners Change - Annual % Return of Different Asset Classes (2006-2014)

2014

2012

2011

2010

7.9%

Crisil Liquid

33.5%

Fund Index

BSE Healthcare

5.9%

Crisil Composite

27.8%

Bond Fund Index

BSE FMCG

2009

2007

7.6%

Crisil Liquid

Fund Index

2.9%

Crisil Composite

Bond Fund Index

117.3%

BSE Capital

Goods

2006

92.9%

BSE Midcap

46.7%

SENSEX

56.4%

BSE Capital

Goods

-21.2%

BSE FMCG

74.2%

BSE Smallcap

39.8%

BSE IT

55.%

BSE IT

48.6%

BSE Midcap

20.9%

BSE Healthcare

45.6%

BSE FMCG

48.7%

BSE Healthcare

10.4%

BSE FMCG

37.2%

BSE Healthcare

2.4%

BSE FMCG

26.2%

BSE IT

115.2%

BSE Smallcap

104.3%

BSE Capital

Goods

47.2%

BSE Midcap

8.8%

SENSEX

8.8%

Crisil Liquid

Fund Index

4.4%

Crisil Composite

Bond Fund Index

36.5%

BSE Smallcap

34.7%

BSE Capital

Goods

-14.2%

BSE Healthcare

17.4%

SENSEX

100.4%

BSE Midcap

-35.3%

BSE Healthcare

47.1%

SENSEX

33.8%

BSE Midcap

-17.6%

BSE IT

16.7%

BSE Smallcap

81.%

SENSEX

-52.4%

SENSEX

25.1%

BSE FMCG

28.2%

BSE Smallcap

-24.6%

SENSEX

-.2%

BSE Midcap

-5.8%

BSE Capital

Goods

25.7%

SENSEX

9.9%

Crisil Composite

Bond Fund Index

8.6%

Crisil Liquid

Fund Index

-10.1%

BSE Smallcap

.8%

BSE IT

19.2%

BSE FMCG

17.8%

BSE IT

11.6%

Crisil Composite

Bond Fund Index

9.3%

Crisil Liquid

Fund Index

-32.8%

BSE Midcap

-36.4%

BSE Smallcap

-47.7%

BSE Capital

Goods

133.6%

BSE IT

2008

63.8%

BSE Smallcap

50.8%

BSE Capital

Goods

30.1%

SENSEX

Worst

2013

16.3%

75.9%

BSE Midcap

BSE Healthcare

9.2%

BSE Capital

46.6%

Goods

BSE FMCG

5.4%

9.6%

Crisil Composite Crisil Composite

Bond Fund Index Bond Fund Index

4.3%

6.3%

Crisil Liquid

Crisil Liquid

Fund Index

Fund Index

-52.8%

BSE IT

-60.4%

BSE Midcap

-65.%

BSE Capital

Goods

-68.8%

BSE Smallcap

17.3%

19.3%

BSE Healthcare BSE Healthcare

7.5%

Crisil Liquid

12.8%

Fund Index

BSE FMCG

6.3%

5.7%

Crisil Composite Crisil Liquid

Bond Fund Index

Fund Index

3.5%

-10.4%

Crisil Composite

BSE IT

Bond Fund Index

Source: BSE, CRISIL; Data as of Oct 2015

2. Stay Focused on Your Goals. A well-allocated portfolio prevents the need to constantly adjust

investment positions to chase market trends. It can help reduce the urge to buy or sell in response to

the markets short-term ups and downs.

�Does Asset Allocation really work?

Yes. As the chart below shows, a consistent asset allocation over time improves your chance to earn a more

consistent return with lesser volatility. For each asset class, the green number represents the Best Year Return

between 2006 & 2014. The blue number represents the Annual Return from 2006 to 2014. The red number

represents the Worst Year Return between 2006 & 2014. The Asset Allocation portfolio (with all the 5 asset

classes in equal proportion) earns a consistent return with lesser risk or volatility.

Average Annual Return from 2006 2014

Worst Year Return from 2006 2014

Best Year Return from 2006 2014

(1) Crisil Composite Bond Fund Index

(2) Crisil Liquid Fund Index

(3) Portfolio with all 5 asset classes in equal proportion

The example below shows that being patient and following a consistent asset allocation strategy will pay-off in

the long term.

Asset Allocation - 70% Equity; 30% Bond **

Choosing Last Years Winner - Investing in

last years best performing asset class

Total Investment

Value in 9 Years*

9-Year CAGR*

Rs. 1,00,000

Rs. 2,86,179

12.40%

Rs. 1,00,000

Rs. 1,56,762

5.10%

* Using NIFTY and CRISIL Composite Bond Fund Returns over 9 years from 2006 - 2014

** Equity is represented by NIFTY and Bond is represented by the Crisil Composite Bond Fund Index; assumes annual rebalancing of the portfolio

�How do you determine your Asset Allocation?

The typical rule is to subtract your age from 110 and invest that amount in equity. The equity asset class has

historically given the highest return, but also has the maximum volatility over time*. For example, at age 25,

you should have 85% of your assets in equity. But, this is just a rule of thumb. Each individual has different

needs and goals. Therefore, each individual portfolio will need a different asset allocation based on the

following

1. Financial Goals Your liquidity needs at different points in life. For example, marriage, house,

childrens education, retirement, etc.

2. Time Horizon What is your time horizon for each of the financial goals

3. Risk Tolerance How much risk are you willing to take at different stages of your life

*Past performance does not guarantee future returns.

Which Asset Allocation is right for me?

Conservative Asset Allocation

Equity - 20%; Debt - 70%; Cash - 10%

(Equity - NIFTY; Debt - Crisil Composite Bond

Fund Index; Cash = 0% return)

Annual Return (2006-2014)

Best Year Return

Worst Year Return

Cash

10%

Equity

20%

7.6%

30.3%

Debt

70%

-15.5%

A portfolio with a conservative asset allocation

is for those investors that would like to

conserve their wealth, but keep ahead of

inflation.

Moderately Aggressive Asset Allocation

Equity - 50%; Debt - 40%; Cash - 10%

(Equity - NIFTY; Debt - Crisil Composite Bond

Fund Index; Cash = 0% return)

Annual Return (2006-2014)

Best Year Return

Worst Year Return

Cash

10%

9.5%

Debt

40%

62.2%

Equity

50%

-33.8%

A portfolio with a moderately aggressive

asset allocation gives a balance of income and

growth. This is meant for investors with a

medium term horizon and a moderate level

of risk tolerance.

Aggressive Asset Allocation

Equity - 80%; Debt - 10%; Cash - 10%

(Equity - NIFTY; Debt - Crisil Composite Bond

Fund Index; Cash = 0% return)

Annual Return (2006-2014)

11.3%

Best Year Return

94.1%

Worst Year Return

-46.0%

Cash

10%

Debt

10%

Equity

80%

A portfolio with an aggressive asset allocation

provides aggressive capital growth over a

longer time horizon. This portfolio has a

higher risk and therefore, more volatility over

the short-term.