0% found this document useful (0 votes)

136 views2 pagesWhat Is SIP ?

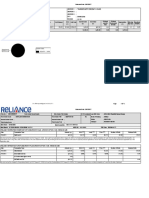

SIP, or Systematic Investment Plan, allows investors to regularly invest small amounts in mutual funds by setting up monthly or quarterly investments, similarly to a recurring bank deposit, which helps reduce risks compared to one-time lump sum investments by buying more units when prices are low. SIP provides discipline by automatically investing small amounts each period and benefits from rupee cost averaging to generate higher returns than lump sum investing over time, as demonstrated by the examples of various fund performances over 3 years with annual returns ranging from 34-43% through consistent SIP investments.

Uploaded by

bins_hiCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

136 views2 pagesWhat Is SIP ?

SIP, or Systematic Investment Plan, allows investors to regularly invest small amounts in mutual funds by setting up monthly or quarterly investments, similarly to a recurring bank deposit, which helps reduce risks compared to one-time lump sum investments by buying more units when prices are low. SIP provides discipline by automatically investing small amounts each period and benefits from rupee cost averaging to generate higher returns than lump sum investing over time, as demonstrated by the examples of various fund performances over 3 years with annual returns ranging from 34-43% through consistent SIP investments.

Uploaded by

bins_hiCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

/ 2