The payment behavior and credit worthiness of the business partner/customer have immediate impact on

the business result of an organization. Efficient credit management reduces the risk of business losses,

optimizes the credit risk and improves relationship with the business partner.

The traditional credit management has been stayed for a longtime. Most of the companies using FI-AR

and SD have implemented the traditional credit management to avoid the losses because of credit risk.

The FIN-FSCM-CR takes the credit management to a different level. The FSCM credit management (FINFSCM-CR) provides enhanced functionality to monitor credit and exposure risk of a company. It is an

extension over the traditional credit management (FI/SD-CM), which enables the user to have better

control and more transparent view on receivables. Based on my experience, I have summarized the basic

differences between the two ways of managing the credit in SAP.

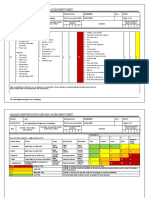

Area

Architecture

Traditional

Management

Credit

Distributed as well as

centralized structure

FSCM

Management

Credit

Distributed Architecture

Remarks

The

distributed

architecture of FINFSCM-CR makes it

necessary

to

have

interfacing.

Organizatio

n element

Credit Control Area

Credit Segment Many

segments can be linked

to a main segment

The credit segment is

associated with a credit

control

area.

Each

credit control area can

be assigned to one

credit segment only.

Master data

Uses AR master data

Requires

creation

of

Business partner master

data

Based

on

the

customizing setting the

business partner master

data is synched up with

the customer master

data.

Types

of

credit check

available

Automatic Check and

Static Credit Check

Only Automatic credit

control will be available

The

basic

credit

management

setting

remain same in both

FI/SD-CR and FINFSCM-CR.

Storing

credit rating

of external

rating

companies

Not Available.

Can store credit rating of

many

companies

in

business partner.

An interface can be setup to get the data from

credit rating company.

�Interfacing

with credit

rating

company

Not Available.

Possible

interface

through

XML

Not

Applicable

for

traditional credit rating

company as there is no

possibility to store the

credit rating of various

rating companies.

Defining

blocking

reason

Not Available.

Credit

Exposure

data

Available

at

credit

control area level.

Available

at

credit

segment level with the

breakup

under

each

category.

Credit

data

Needs to collect from

external company and

uploaded

manually

based

on

manual

calculation

Can be derived based on

both internal and external

data.

FIN-FSCM-CR,

credit

limit data can be

requested within SAP

and based on external

and internal rating the

limit can be calculated

within SAP system.

Reviewing

limit

Intermittent

manual

review is set-up to

derive and reclassify the

credit limit.

Improved

and

automated process in

FSCM

credit

management.

Additional

Set-up

requires

Not Required

Can

be

done

automatically within SAP

by utilizing the live/

internal data along with

the external rating.

Maintaining

interface

through XI/PI or point to

point interface.

Available.

limit

FIN-FSCM-AR provides

blocking of business

partner data providing a

reason code.

WS-RM can be used

from ECC6.0 EHP5.

The interface is used for

real-time exposure and

transaction data flow

between AR and FSCM

credit

management.

This

is

required

because of distributed

architecture of FSCM.

As we have seen here, the FSCM-Credit management has same underlying functionality as that of the

traditional credit management. FIN-FSCM_AR doesnt replace the traditional credit management but is

simply is an extension over the existing credit management. With the implementation of the FIN-FSCMCR, the companies are able to reduce the manual work, streamline adhoc work, and make better decision

for credit management based on the internal as well external data.