0% found this document useful (0 votes)

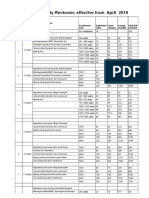

49 views1 pageInvestment Opportunities: 1. Utilities 2. Capital Goods & Chemicals

This document discusses investment opportunities related to water resources and defines four investment clusters: utilities, capital goods & chemicals, construction & materials, and quality & analytics. It also outlines three key principles for a successful investment strategy focusing on water: complying with sustainability, adhering to general investment principles, and looking at the entire water value chain to identify solution-providing companies.

Uploaded by

LymeParkCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

49 views1 pageInvestment Opportunities: 1. Utilities 2. Capital Goods & Chemicals

This document discusses investment opportunities related to water resources and defines four investment clusters: utilities, capital goods & chemicals, construction & materials, and quality & analytics. It also outlines three key principles for a successful investment strategy focusing on water: complying with sustainability, adhering to general investment principles, and looking at the entire water value chain to identify solution-providing companies.

Uploaded by

LymeParkCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1