0% found this document useful (0 votes)

176 views2 pagesUsing Costs in Decision Making

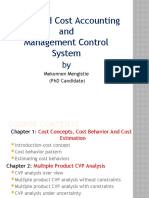

This document discusses the importance of cost information in decision making and strategy development. It outlines different types of costs including variable costs, which increase with activity levels, and fixed costs, which remain constant in the short run. The document also discusses cost-volume-profit analysis, which uses variable and fixed costs to determine profit at different activity levels. Other cost types discussed include mixed costs, step variable costs, incremental costs, sunk costs, relevant costs, opportunity costs, and avoidable costs, which are important to consider for make-versus-buy, product drop, pricing, and product mix decisions.

Uploaded by

Achmad Faizal AzmiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

176 views2 pagesUsing Costs in Decision Making

This document discusses the importance of cost information in decision making and strategy development. It outlines different types of costs including variable costs, which increase with activity levels, and fixed costs, which remain constant in the short run. The document also discusses cost-volume-profit analysis, which uses variable and fixed costs to determine profit at different activity levels. Other cost types discussed include mixed costs, step variable costs, incremental costs, sunk costs, relevant costs, opportunity costs, and avoidable costs, which are important to consider for make-versus-buy, product drop, pricing, and product mix decisions.

Uploaded by

Achmad Faizal AzmiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2