2016

FRM EXAM REVIEW

COVERS

ALL TOPICS

IN PART I

FRMPART I

FORMULA SHEETS

��Cover image: Loewy Design

Cover design: Loewy Design

Copyright 2016 by John Wiley & Sons, Inc. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any

form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise,

except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without

either the prior written permission of the Publisher, or authorization through payment of the

appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers,

MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests

to the Publisher for permission should be addressed to the Permissions Department, John Wiley &

Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online

at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best

efforts in preparing this book, they make no representations or warranties with respect to the

accuracy or completeness of the contents of this book and specifically disclaim any implied

warranties of merchantability or fitness for a particular purpose. No warranty may be created or

extended by sales representatives or written sales materials. The advice and strategies contained

herein may not be suitable for your situation. You should consult with a professional where

appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other

commercial damages, including but not limited to special, incidental, consequential, or other

damages.

For general information on our other products and services or for technical support, please contact

our Customer Care Department within the United States at (800) 762-2974, outside the United

States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some

material included with standard print versions of this book may not be included in e-books or in

print-on-demand. If this book refers to media such as a CD or DVD that is not included in the

version you purchased, you may download this material at http://booksupport.wiley.com. For

more information about Wiley products, visit www.wiley.com.

ISBN 978-1-119-34823-8 (ebk)

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

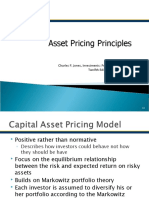

�Foundations of Risk Management (FRM)

�Elton, Chapter 13

Elton, Chapter 13

E ( Rm ) R f

E(R f ) = R f + X

m

E ( Ri ) = RF + i ( E ( RM ) RF )

Where:

E ( R p ) = expected return of asset (of portfolio) i

RF = risk-freee rate of return

E ( RM ) = expected rate of return of the market portfolio

Cov( Ri , RM )

1 =

Var( RM )

Equation of CML:

E (Rm ) R f

E (R p ) = R f + p

m

Cov( Ri , Rm ) i , m i , m i , m i

i = = =

2m 2m m

2 2016 Wiley

� Amenc, Chapter 4

Amenc, Chapter 4

Rp Rf

Sharpe ratio =

p

Rp Rf

Treynor ratio =

p

p = R p [ R f + p (R m R f )]

TrackingError = (ActiveReturn BenchmarkReturn)

RP RB

IR =

s(RP RB )

R T

S=

DR

2016 Wiley 3

�Bodie, Chapter 10

Bodie, Chapter 10

E ( R p ) = RF + 1 p,1 + ... k p,K

Required return = Risk-free rate + (Risk premium)1 + (Risk premium)2 + . . .

+ (Risk premium)k

Risk premiumi = Factor sensitivityi Factor risk premiumi

4 2016 Wiley

�Quantitative Analysis (QA)

�Miller, Chapter 2

Miller, Chapter 2

P(A or B) = P(A) + P(B) P(AB)

P(A and B) = P(A) P(B)

6 2016 Wiley

� Miller, Chapter 3

Miller, Chapter 3

N

Xi

= i =1

N

N

( X i )2

i =1

=

N

Cov(XY) = E{[X E(X)][Y E(Y)]}

Cov(R A ,R B ) = P(R A,i , R B,J )(R A,i ER A )(R B,j ER B )

i j

Cov(R A , R B )

Corr(R A , R B ) = (R A , R B ) =

(A )(B )

N

E(R p ) = w i E(R i ) = w1E(R1 ) + w2 E(R 2 ) + ... + w N E(R N )

i =1

N N

Var(R p ) = w i w jCov(R i , R j )

i =1 j=1

Var(R p ) = w2A 2 (R A ) + w2B2 (R B ) + 2w A w BCov(R A , R B )

2016 Wiley 7

�Miller, Chapter 4

Miller, Chapter 4

n!

P(r ) = pr q n r

r !(n r )!

L = e

(+0.52 ) 2L = e

(2+2 ) e2 1

8 2016 Wiley

� Miller, Chapter 6

Miller, Chapter 6

P(Information|Event) P(Event)

P(Event |Information) =

P(Information)

2016 Wiley 9

�Miller, Chapter 7

Miller, Chapter 7

s2 =

(X X ) 2

n 1

Formula of Standard Error

s

90% confidence interval: X 1.645

n

s

95% confidence interval: X 1.960

n

s

99% confidence interval: X 2.575

n

Sample statistic Hypothesized value

Test statistic =

Standard error of sample statistic

10 2016 Wiley

� Hull, Chapter 11

Hull, Chapter 11

COVn = COVn 1 + (1 ) X n 1Yn 1

COVn = + xn 1 + Yn 1 + cov n 1

1 = Z1

2 = Z1 + Z 2 1 2

2016 Wiley 11

�Stock, Chapter 4

Stock, Chapter 4

Regression model equation = Yi = b0 + b1 Xi + i, i = 1,...., n

Regression line equation = Yi = b0 + b1 Xi , i = 1, ..., n

n

( )

2

ESS = Yi Y

i =1

1/ 2 1/ 2

n

( ) n

2

Yi b0 b1 Xi ( i )

2

1/ 2

SSE

SEE = i =1

= i =1 =

n2 n2 n2

Explained variation Total variation Unexplaiined variation

R2 = =

Total variation Total variation

Unexplained variation

=1

Total variation

12 2016 Wiley

� Stock, Chapter 5

Stock, Chapter 5

b j (tc sb )

j

estimated regression coefficient (critical t -valu

ue)(coefficient standard error)

2016 Wiley 13

�Stock, Chapter 6

Stock, Chapter 6

2

Var (Slope) =

( x x )2

MSR RSS/k

F -stat = =

MSE SSE/[n (k + 1)]

14 2016 Wiley

� Stock, Chapter 7

Stock, Chapter 7

n 1

Adjusted R 2 = R 2 = 1 (1 R )

2

n k 1

2016 Wiley 15

�Diebold, Chapter 5

Diebold, Chapter 5

e 2

t

s2 = t =1

,

T k

2k

e 2

t

AIC = e T t =1

T

k

e 2

t

SIC = T T t =1

.

T

16 2016 Wiley

� Hull, Chapter 23

Hull, Chapter 23

2n = VL + U n21 + 2n 1

2n = + U n21 + 2n 1

b0

xt =

1 b1

2016 Wiley 17

�Financial Markets and Products (FMP)

� Hull, Chapter 1

Hull, Chapter 1

VT(0, T) = ST F(0, T)

F(0, T) = S0 (1+ r )T

Vt (0, T) = St [ F(0, T) / (1+r )T t ]

2016 Wiley 19

�Hull, Chapter 3

Hull, Chapter 3

s

MinimumVarianceHedgeRatio =

r

MDTarget MDPortfolio MVPortfolio

# of Futures = Yield

MDFutures MVFuturres Contract

Target Portfolio MVPortfolio

# of Futures =

Futures MVFutures Contract

20 2016 Wiley

� Hull, Chapter 4

Hull, Chapter 4

PMT PMT PMT + FV

PV = 1

+ 2

+ ... +

(1 + Z1 ) (1 + Z 2 ) (1 + Z N )N

relationship between multiperiod spot rates and forward rates:

(1 + 1s0 ) (1 + 1f1 ) = (1 + 2s0 )

2

(1 + 2s0 ) (1 + 1f2 ) = (1 + 3s0 )

2 3

B 1

= Dy + C (y)2

B 2

Convexity adjustment = Convexity estimate (r )2 100

2016 Wiley 21

�Hull, Chapter 5

Hull, Chapter 5

FFC/DC = SFC/DC

(1 + i FC )

(1 + i DC )

FFC/BC = SFC/BC

(1 + i FC )

(1 + i BC )

( i i ) Actual

FFC/DC SFC/DC = SFC/DC 360

FC DC

DC (

1 + i Actual

360 )

( i i ) Actual

FFC/BC SFC/BC = SFC/BC 360

FC BC

BC (

1 + i Actual

360

)

F0 = S0 e rT

r = Continuously compounded risk-free rate

F0 = S0 e( r+U ) T

F0 = S0 e( r+U Y ) T

22 2016 Wiley

� Hull, Chapter 6

Hull, Chapter 6

AI = the boxed

formula

(days between dates/days in period ) * interest earned during the period

BC0 ( T + Y ) 1 + r0 ( T ) FV ( CI, 0, T )

T

f0 ( T ) =

CF ( T )

CF ( T ) = Conversion factor on CTD bond

1

Forward Rate = Futures Rate 2T1T2

2

2016 Wiley 23

�Hull, Chapter 7

Hull, Chapter 7

1 B0 ( N )

Swap fixed rate = 100

B (1) + B ( 2 ) + B (3) + ... + B ( N )

0 0 0 0

24 2016 Wiley

� Hull, Chapter 11

Hull, Chapter 11

cS

CS

pK

pK

c max (0, S0 Ke rT )

C = max(0, ST K )

p max( Ke rT S0 , 0)

C + X/ (1+r )t = S0 + P

C0 c 0

P0 p0

2016 Wiley 25

�Hull, Chapter 12

Hull, Chapter 12

Bear spread valueT = MAX(0, StrikeH AssetT) MAX(0, StrikeL AssetT)

PayoffBear spread = Bear spread valueT PutStrikeH + PutStrikeL

Bull spread valueT = MAX(0, Asset T Strike L ) MAX(0, Asset T Strike H )

PayoffBullspread = Bull spread valueT CallStrikeL + CallStrikeH

Butterfly spread valueT = MAX(0, AssetT StrikeL) 2MAX(0, AssetT

StrikeM) + MAX(0, AssetT StrikeH)

PayoffButterfly spread = Butterfly spread valueT CallStrikeL + 2CallStrikeM

CallStrikeH

Box strategy valueT = StrikeH StrikeL

PayoffBox strategy = StrikeH StrikeL CallStrikeH PutStrikeH + PutStrikeL

Breakeven Straddle Asset T = Strike (Call 0 + Put 0 )

PayoffStraddle = Straddle valueT Call 0 Put 0

26 2016 Wiley

� McDonald, Chapter 6

McDonald, Chapter 6

Fo,T = S0 e( r )T

F0 = S0 e( r +U )T

2016 Wiley 27

�Saunders, Chapter 13

Saunders, Chapter 13

(Forward rate Spot rate) ( IRDomestic IRForeign )

=

Spot rate (1 + IRForeign )

and

Forward (1 + IRDomestic )

=

Spot (1 + IRForeign )

Real exchange rate DC/FC = SDC/FC ( PFC / PDC )

28 2016 Wiley

� Tuckman, Chapter 20

Tuckman, Chapter 20

Prepayment in month t

SMM t =

Beginning mortgage balance for month t Scheduled principal payment in month t

2016 Wiley 29

�Valuation and Risk Models (VRM)

� Allen, Chapter 3

Allen, Chapter 3

PortfolioVaR = VaR underlying

2016 Wiley 31

�Dowd, Chapter 2

Dowd, Chapter 2

1

ES =

1

(greatest loss) * pr (loss)

32 2016 Wiley

� Hull, Chapter 13

Hull, Chapter 13

c+ c

n=

S+ S

c + + (1 )c

c=

(1 + r )

(1 + r d )

=

(u d)

2016 Wiley 33

�Hull, Chapter 15

Hull, Chapter 15

Pi Pi 1

Ri = , i = 1 to N

Pi 1

Ric = ln(1 + Ri ), i = 1 to N

(R c

i Ric )2

=

2 i =1

N 1

= 2

c = S0N(d1) KerT N(d2)

and

p = KerT N(d2) S0N(d1)

where

ln(S0 / K ) + (r + 2 / 2)T

d1 =

T

ln(S0 / K ) + (r 2 / 2)T

d2 = = d1 T

T

34 2016 Wiley

� Hull, Chapter 19

Hull, Chapter 19

Change in option price

Delta =

Change in underlying price

2016 Wiley 35

�Tuckman, Chapter 1

Tuckman, Chapter 1

Days

PV = FV 1 DR

Year

Year FV PV

DR =

Days FV

PVFull = PVFull + AI

AI = t/T PMT

36 2016 Wiley

� Tuckman, Chapter 2

Tuckman, Chapter 2

1

d (t ) =

r (t ) 2 t

(1 + )

2

2016 Wiley 37

�Tuckman, Chapter 3

Tuckman, Chapter 3

Pt +1 + c Pt

R=

Pt

2T

C 1

P(T ) = 1

i y

1+

2

38 2016 Wiley

� Tuckman, Chapter 4

Tuckman, Chapter 4

P P+

Effective duration =

2 P0 (y)

Price = y Duration Price

Face A DV 01A

FaceB =

DV 01B

PV y PV+ y

2( PV0 )y

2016 Wiley 39

�Tuckman, Chapter 5

Tuckman, Chapter 5

1 P

DV 01k =

10, 000 y k

1 P

Dk =

P y k

40 2016 Wiley

� Schroeck, Chapter 5

Schroeck, Chapter 5

UL = EA PD 2LR + LR 2 2PD

n n

ULP = UL UL

i =1 j =1

i j ij i j

2016 Wiley 41

� WILEY END USER LICENSE

AGREEMENT

Go to www.wiley.com/go/eula to access Wileys ebook

EULA.