0% found this document useful (0 votes)

76 views8 pagesInstant Noodle Company

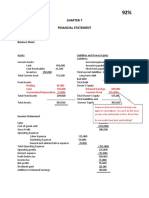

The document provides financial information for an instant noodle company over 4 years. It includes income statements, balance sheets, and cash flow statements. Key details are revenues grow significantly each year through higher sales volumes and prices. The company invests heavily in production facilities in years 0 and 3. While losses are incurred in early years, ratios show improving liquidity and efficiency over time.

Uploaded by

Isabella GimaoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

76 views8 pagesInstant Noodle Company

The document provides financial information for an instant noodle company over 4 years. It includes income statements, balance sheets, and cash flow statements. Key details are revenues grow significantly each year through higher sales volumes and prices. The company invests heavily in production facilities in years 0 and 3. While losses are incurred in early years, ratios show improving liquidity and efficiency over time.

Uploaded by

Isabella GimaoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 8