0% found this document useful (0 votes)

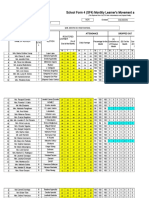

51 views11 pagesBatch Planning and Resource Allocation: 14x2 28C, 14x1 14S

The document discusses batch planning and resource allocation. It provides an overview of linear programming models and some examples, including:

1) The transportation problem and its dual, which involves allocating resources (steel) from multiple plants to multiple markets to minimize shipping costs while meeting supply and demand constraints.

2) The transportation problem is presented as a network model and numerical example to illustrate the duality theorem, which states that feasible linear programs have optimal solutions with equal objective values.

3) Economic interpretations are given for the dual variables in the transportation problem, which can be viewed as competitive market prices.

Uploaded by

Ana FloreaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

51 views11 pagesBatch Planning and Resource Allocation: 14x2 28C, 14x1 14S

The document discusses batch planning and resource allocation. It provides an overview of linear programming models and some examples, including:

1) The transportation problem and its dual, which involves allocating resources (steel) from multiple plants to multiple markets to minimize shipping costs while meeting supply and demand constraints.

2) The transportation problem is presented as a network model and numerical example to illustrate the duality theorem, which states that feasible linear programs have optimal solutions with equal objective values.

3) Economic interpretations are given for the dual variables in the transportation problem, which can be viewed as competitive market prices.

Uploaded by

Ana FloreaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 11