0% found this document useful (0 votes)

763 views1 pageEmployee Pay Stub Summary

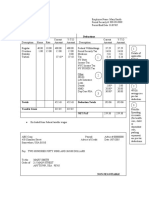

Mary Smith received a paycheck from ABC Corp. for the period ending January 7, 2005. Her pay included $400 for regular wages, $15 for overtime, and a $37.43 tuition reimbursement. Federal, state, and local taxes as well as Social Security and Medicare deductions were taken from her wages. She contributed $27.15 to her 401(k) savings plan and paid $2 each for life insurance, dental insurance, and an HMO plan. Her net pay was $259.38.

Uploaded by

chairgraveyardCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

763 views1 pageEmployee Pay Stub Summary

Mary Smith received a paycheck from ABC Corp. for the period ending January 7, 2005. Her pay included $400 for regular wages, $15 for overtime, and a $37.43 tuition reimbursement. Federal, state, and local taxes as well as Social Security and Medicare deductions were taken from her wages. She contributed $27.15 to her 401(k) savings plan and paid $2 each for life insurance, dental insurance, and an HMO plan. Her net pay was $259.38.

Uploaded by

chairgraveyardCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1