0% found this document useful (0 votes)

186 views3 pagesRisk Matrix

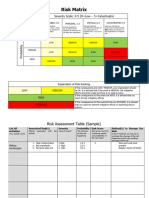

A risk matrix is used in risk assessment to determine the severity of risks from potential events. It analyzes both the probability and consequences of hazards to calculate overall risk. Probability is ranked on a scale from certain to rare, while consequences range from negligible injuries to multiple deaths. The matrix crosses these factors to provide qualitative risk levels from low to extreme. However, risk matrices have limitations as they oversimplify risks and can misrank some hazards compared to quantitative analysis. They should be used carefully alongside explanations of subjective judgments.

Uploaded by

Sagar KulkarniCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

186 views3 pagesRisk Matrix

A risk matrix is used in risk assessment to determine the severity of risks from potential events. It analyzes both the probability and consequences of hazards to calculate overall risk. Probability is ranked on a scale from certain to rare, while consequences range from negligible injuries to multiple deaths. The matrix crosses these factors to provide qualitative risk levels from low to extreme. However, risk matrices have limitations as they oversimplify risks and can misrank some hazards compared to quantitative analysis. They should be used carefully alongside explanations of subjective judgments.

Uploaded by

Sagar KulkarniCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 3