0 ratings0% found this document useful (0 votes) 215 views11 pagesLecture 03

Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content,

claim it here.

Available Formats

Download as PDF or read online on Scribd

COST ESTIMATION IN FOUNDRY SHOP

{) Know how cost costimation is done in respect of a casting.

(ii) List the various sections that will be normally found in a foundry shop.

(iii) List the various elements of cost involved in the total cost of manufacturing a casting.

(iv) Explain what are overhead expenses.

(v) Calculate the total cost of a cast component.

1. Pattern Making Section

2. Sand-mixing Section

3. Core-making Section

4. Mould Making Section

5. Melting Section

6. Fettling Section

7. Inspection Section�ESTIMATION OF COST OF CASTINGS

The total cost of manufacturing a component consists of following elements :

. Material cost,

. Labour cost.

L

2,

3. Direct other expenses.

4.

. Overhead expenses.

1. Material Cost

(a) Cost of material required for casting is calculated as follows :

(H From the component drawing, calculate the volume of material required for casting.

This volume multiplied by density of material gives the net weight of the casting.

(i) Add the weight of process scrap ie. weight of runners, gates and risers and other

material consumed as a part of process in getting the casting

(i) Add the allowance for metal loss in oxidation in furnace. in cutting the gates and

runners and over runs ete.

(iv) Multiply the total weight by cost per unit weight of the material used.

(v) Subtract the value of scarp return from the amount obtained in step (i). to get the

direct matetial cost.

(®) In addition to the direct material, various other materials are used in the process of

manufacture of a casting. Some of the materials are

(®) Materials required in melting the metal. ie., coal, limestone and other fluxes etc. The

cost of these materials is calculated by tabulating the value of material used on per

tonne basis and then apportioned on each item.�2. Labour Cost

Labour is involved at various stages in a foundry shop. Broadly it is divided into two categories =

(® The cost of labour involved in making the cores. baking of cores and moulds is based on

the time taken for making various moulds and cores,

(ii) The cost of labour involved in firing the furnace. melting and pouring of the metal

Cleaning of castings. fettling, painting of castings etc., is generally calculated on the basis

of per kg of cast weight.

3. Direct Other Expenses

Direct expenses include the expenditure incurred on pattems, core boxes, cost of using machines

and other items which can be directly identified with a particular product. The cost of patterns, core

boxes ete., is distributed on per item basis.

4, Overhead Expenses

The overheads consist of the salary and wages of supervisory staff, pattern shop staff and

inspection staff, administrative expenses, water and electricity charges ete. The overheads are

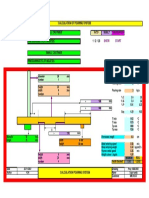

generally expressed as percentage of labour charges.�Example 1 : Calculate the total cost of CI (Cast Iron) cap shown in Fig. 5.1, from the following

data :

Cost of molten iron at cupola spout = Rs. 30 per kg

Process scrap = 17 percent of net wt. of casting

Process scrap retum value = Rs. Sperkg

Administrative overhead charges = _ Rs. 2 per kg of metal poured.

Density of material used = 7.2 gms/ec

The other expenditure details are :

Process Time per Labour charges Shop overheads

piece per hr per hr

Moulding and pouring 10 min Rs. 30 Rs. 30

Casting removal, gate cutting etc. 4 min Rs. 10 Rs. 30

Fettling and inspection 6 min Rs. 10 Rs. 30�60, 120 60,

Fig. 5.1. All dimensions are in mm.�Solution : To calculate material cost

Volume of the component = (2 x 6 x 2 = 6)+ + xp l(75y-©7] 6

= 335 cc

Net weight of the casting = 335 « 7.2

2.412 gms

2.4 kgs

Process scrap = 2.4= 0.17 = 0.4kg

Metal required per piece = 2.4+04 = 2.8 kgs

Material cost/piece = 2.8 x 30 = Rs. 84

Process return = 0.4% 5 = Rs. 2

Net material cost per piece = 84—2 = Rs. 82�ii) Calculate Labour Cost and Overheads

Process Time per Labour charges Shop overheads

piece per piece (Rs.) —_per piece (Rs.)

Moulding and pouring 10 min 10 ¢39=5 SUBIR,

60 60

Cc L 4 4 10=0.67 S04 =2

‘asting removal, gate cutting ete min 60 = co

Fettli id 6 & 10=1 50% 6 =3

‘ettling and inspection min 5 «10> 73

Total Rs. 6.67 Rs. 10

Labour charges = Rs. 6.67 per piece

Shop overheads = Rs. 10 per piece

Administrative overheads = 22.8 = Rs. 5.6

Total cost per piece = 82+ 6.67 + 10+5.6

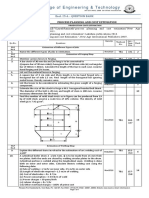

Rs. 104.27�Example 2 : A cast iron component is to be manufactured as per Fis

price per piece from the following data :

Density of material

Cost of molten metal at cupola spout

Process scrap

Scrap return value

Administrative overheads

Sales overheads

Profit

Other expenditures are :

Estimate the sellin;

7.2 ems/ec

Rs. 20 per kg

20 percent of net weight

Rs. 6 per kg

Rs. 30 per hour

0 percent of factory cost

20 percent of factory cost

Operation Time (min) Labour cosvhr ‘Shop overheads/hr

(Rs.) (Rs.)

Moulding and pouring 15 20 60

Shot blasting 5 10 40

Fettling 6 10 40

The component shown is obtained after machining the casting. The pattern which costs Rs. 5,000

can produce 1,000 pieces before being scrapped. The machining allowance is to be taken as 2 mm on

each side.�09

OF | oF

Component as cast,

Finished component

(All dimensions are in mm)�(@) Material cost :

T 2 2

Net volume of cast component = (10? «648? * 446 «4-2. = 14)

= Tle

Net weight of cast component = 711 7.2 = S117 gms

= S17 kg

Process scrap = 20 percent of 5.117 kg

= 02% 5.117 = 102 kg

Total metal required per component = 5.12 + 1.02 = 6.14 kg

Cost of metal poured = 6.14 20 = Rs. 122.8

Process return value = 1.02 x6 = Rs. 6.12

Material cost per component = 122.8 ~ 6.1 = Rs. 116.7�Gi) Labour cost and factory overheads :

Labour cost = Rs. 6.83

Shop overheads = Rs. 22.33

Process Time per piece Labour cost ‘Shop overheads

(Minutes) __ per piece (Rs.) per piece (Rs.)

Melting and pouring 15 5.00 15.00

Shot blast s 0.83 3.33

Fetlling 6 1.00 4.00

Total 26 min 6.83 22.33

Gi) Factory cost per component = 116.70 + 6.83 + 22.33 = Rs. 145.86

ae 30 «26

() Administrative overheads = > = Rs. 13

@) Sales overheads = 0.2 « 145.86 = Rs. 29.17

7) Profit = 0.2 « 145.86 = Rs. 29.17

Selling price per component = Factory cost + Administrative overheads

+ Sales overheads + profit

= 145.86 + 13 + 29.17 + 29.17

= Rs. 217.2