A Project Work on

“Inventory Control- Probabilistic Models”

Submitted To – Dr. Rupesh Kumar

In partial fulfillment of the requirement of

MASTER OF BUSNIESS ADMINISTARTION

LOGISTICS & SUPPLY CHAIN MANAGEMENT

UNIVERSITY OF PETROLEUM &

ENERGY STUDIES

SCHOOL OF BUSNIESS

DEHRADUN

Submitted by –

Nitin Rajput

SAP ID- 500066201

Enrollment No.- R600218036

Course – MBA (LSCM) 3rd Sem

1|Page

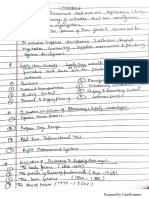

�Contents:

S.No. Particulars Page No.

1 Introduction 3

2 Inventory Models with Probabilistic Demand 3

3 Single Period Probabilistic Models 4

4 Multi- Period Probabilistic Models 9

5 Inventory Control System 9

6 Fixed Order Quantity System 10

7 Periodic Review System 15

8 Summary 16

9 Keywords 17

10 References 18

Objective of the Project:

Discuss about Various Probabilistic Models

Explain Various approaches to Probabilistic problems

Set various inventory levels under various Probabilistic conditions

Clarify the problems in terms of variability in lead time and demand

2|Page

� 1. Introduction:

In simple deterministic inventory model where each and every influencing factor is known

completely. But in actual business life complete certainty never occurs. Therefore, in this

project we will discuss the inventory models and problems by relaxing the condition of

certainty for some of the factors. The major influencing factors for the inventory problems

are price, demand and lead time. Other factors such as carrying cost, ordering and stock-out

costs are also affecting the inventory problems, but their nature is not so much disturbing.

This is because their estimation provides almost, on the average, as known values. Even price

can also be averaged out to reflect the condition of certainty. But sometimes, price

fluctuations are too much in the market and hence they influence the inventory decisions.

Similarly, variability in demand or consumption of an item as well as the variability in lead

time influences the overall inventory policy.

2. Inventory Models with Probabilistic Demand:

Probabilistic inventory models consisting of probabilistic supply and demand are most

suitable in most circumstances. Inventory models where only demand is probabilistic or

random will be discussed in this project. Demand pattern may be having discrete probability

distribution or continuous probability distribution as explained in Figure 2.

Demand

Continuous Discrete

Single Period Multi-period Single Period Multi- Period

Fig-2 Nature of Demand

3. Single Period Probabilistic Models:

These models deal with the inventory situation of the items-such as perishable

goods, spare parts and seasonal goods requiring one time purchase only. The

demand for such items may be discrete or continuous. Since purchases are made

only once, the lead time factor is least important in these models. In single period

models, the problem is studied using marginal (or incremental) analysis and the

decision procedure consists of a sequence of steps. In such cases, there are two types

of costs involved, namely (a) Over-stocking cost, and (b) Under-stocking cost. These

two costs represent opportunity losses incurred when the number of units stocked is

not exactly equal to the number of units actually demanded. The following symbolic

notations are to be used:

3|Page

� D = demand of an item in units (a random variable) Q

= the number of units stocked (or to be purchased)

C1 = Over-stocking cost (also known as over-ordering cost). This is an opportunity

loss associated with each unit left unsold.

= C + Ch - V

C2 = Under-stocking cost (also known as under-ordering cost). This is an

opportunity loss due to not meeting the demand.

= S-C-Ch/2+Cs

where C is the unit cost price; Ch, the unit carrying cost for the entire period; Cs, the

shortage cost; S, the unit selling price and, V, the salvage value.

3.1 Single Period Discrete Probabilistic Demand Model (Incremental Analysis

Method)

The cost equation for this type of problem may be developed as follows. For any

quantity in stock Q, only D units are consumed. Then for specified period of time,

the cost associated with Q units in stock is either:

a) (Q-D) C1, where D, the number of units used or demanded is less than or equal

to the number of units Q, in stock, i.e., D< Q

b) (D-Q) C2, where the number of units required is greater than the number of units

in stock, i.e. D>Q.

Since, the demand D is random variable, its probability distribution of demand is

known. p(D) denotes the probability that the demand is D units, such that total

probability is one, i.e.,

If Q* is the optimal quantity stocked, then the total expected cost f(Q*) will be minimum.

Thus, if we stock one unit more or less than the optimal quantity, the total expected cost

will be higher than the optimal. Thus

If Q* is the optimal quantity stocked, then the total expected cost

f(Q*) will be minimum. Thus, if we stock one unit more or less

than the optimal quantity, the total expected cost will be higher

than the optimal. Thus

4|Page

� Therefore, the optimal stock level Q* satisfies the relationship (6).

For practical application of (6), the three-step procedure is as

follows:

Step1. From the data prepare a table showing p(D), probability and the cumulative

probability P(D<Q) for each reasonable value of D.

Step2. Compute the ratio C2/C1+C2 which is known as service level.

Step3. Find the value of Q which satisfies the inequality.

Example 1

A trader stocks a particular seasonal product at the beginning of the season and cannot re-

order. The item costs him Rs. 25 each and he sells at Rs. 50 each. For any item that cannot be

met on

demand, the trader has estimated a goodwill cost of Rs.15. Any item unsold will have a

salvage value of Rs. 10. Holding cost during the period is estimated to be 10 per cent of the

price. The probability distribution of demand is as follows:

5|Page

�Determine the optimal number of items to be stocked.

Solution:

As per step 1, we put the data regarding demand distribution in the Table 1 below:

Table 1: Probability Distribution of Demand

Looking at Table 1, this ratio lies between cumulative probabilities of 0.60 and 0.80 which in

turn reflect `the values of Q as 3 and 4. That is,

P(D< 3)=0.60<0.69<0.80 = P(D < 4).

Therefore, the optimal number of units to stock is 4 units.

Inventory for Perishable Products

Many organizations handle merchandise which has negligible utility if it is not sold almost

immediately. Products in this category include newspapers, printed programs for special

events, fresh produce and other perishable commodities. Such items commonly have high

mark-up. The large difference between the wholesale cost and the retail price is due to the

risk vendor faces in stocking the item. He faces obsolescence costs on the one hand and

opportunity costs on the other. All such problems can be very easily solved with the help of

the model discussed above.

Example 2

A newspaper boy buys papers for Rs. 0.35 each and sells them for Rs. 0.60 each. He can not

return unsold newspapers. Daily demand has the following distribution:

6|Page

�If each day's demand is independent of the previous day's demand, how many papers should

he order each day?

Solution

Transferring the given data into the following table, we have

gives Q*=280. Thus, newspaper boy should buy 280 papers each day.

3.2 Single Period Continuous Probability Demand Model

This model is similar to that discussed through (1) to (6) with the difference that the

demand is not discrete. The demand, though probabilistic, is treated as continuous.

The probability distribution described by equation (1) is now written as

where f(D) is a continuous probability density function indicating the probability for small

interval of demand D. dD is known as the differential of the demand D. Equation (9) is read

as the integral of probability function f(d) dD over the interval from demand D=0 to D=

infinity is one. This is the total probability. The cumulative probability function is obtained as

follows:

7|Page

�representing that F(Q) is the probability that demand lies between 0 and Q.

For optimal results, we use the incremental analysis in the same way as has been used in (1)

to (6). The optimal quantity to stock Q* is the point where

Example 3

An item sells for Rs. 25 per unit and costs Rs. 10. Unsold items can be sold for Rs. 4 each. It

is assumed that there is no shortage penalty cost besides the lost revenue. The demand is

known to be any value between 600 and 1000 items. Determine the optimal number of units

of the item to be stocked.

Solution: It is assumed that the demand distribution is a uniform distribution between 600

and 1000 units. The uniform distribution is represented by the relation

F(D) = 1/b-a

Where b is the upper limit of the demand and a is the lower limit of the demand. Thus, for

our problem,

8|Page

�4. Multiperiod- Probabilistic Models:

In single period models, only demand is the major variable factor and lead time does not play

any role in the decision process. But, in multi-period models, both demand and lead time play

major role in the decision process. These factors may be changing according to certain laws

of probability. The variation in demand and/or in lead time imposes risks. We cushion the

effects of demand and lead time variation by absorbing risks in carrying larger inventories,

called buffer stocks or safety stocks. The larger we make these safety stocks, the greater our

risk, in terms of the funds tied up in inventories, the possibility of obsolescence and so on.

However, we minimize the risk of running out of stock. While minimizing the risk of out of

stock we can minimize the risk of inventories by reducing the buffer inventories which in

turn lead to increase in the risk of poor inventory service. Therefore, our objective is to find a

rational decision model for balancing these risks.

5. Inventory Control Systems:

When, either demand or lead time, or both vary randomly, the concept of operating doctrine

is introduced to take into account the possibility of stock-outs. These operating doctrines are

based on inventory control system adopted for the purpose of control of inventory. While

following an inventory control system, the various levels of operating the system are

established. There are various kinds of stock-levels, but the following are fundamentals to the

control systems:

- Minimum Level

- Ordering Level

- Hastening Level

-Maximum Level

Minimum Stock Level: This is also known as safety or buffer stock. This is the level below

which stock is not allowed to fall. When this level is reached, it triggers of urgent action to

bring forward delivery of the next order, it is sometimes called the danger level. In fixing

their level, the main factor to be taken into account is the effect which a run-out of stock

would have upon the flow of work or operations.

Ordering Stock Level: This is known as Re-order level. This is the level at which ordering

action is taken for the material to be delivered before stock falls below the minimum. Two

main factors are involved in deciding the re-order level, (i) the anticipated rate of

consumption, and (ii) the estimated time which will elapse between the raising of a provision

demand and the actual availability of goods in store after receipt and inspection, i.e. the lead

time.

9|Page

�The Hastening Stock Level: This is the level at which it is estimated that hastening action is

necessary to request suppliers to make early delivery. It is fixed between the minimum level

and the re-order level. This level is subjectively based on experience.

The Maximum Stock Level: This is the level of stock above which the stock should not be

allowed to rise. The purpose of this level is to curb excess investment. In fixing the

maximum, the main consideration is usually financial, and the figure is arranged so that the

value of stock will not become excessive at any time. Other points affecting this level are the

possibility of items becoming obsolete, and the danger of deterioration in perishable

commodities.

These levels are fixed for implementing various levels of inventory control systems.

6. Fixed Order Quantity System:

This is also known as Perpetual Inventory System; Re-order Inventory System or Q- system.

In this system, the count of the number of units in inventory is continuously maintained. With

lead time is less than the re-order cycle, an order for a fixed quantity (mostly, it is EOK)) is

placed when the inventory level drops to a pre- determined re-order R.

Fig.

Fixed order quantity system

Setting for various levels for Q system

For fixed order quantity system, the various levels can be fixed for the following conditions:

1) Variable demand and constant lead time

10 | P a g e

�2) Constant demand and variable lead time

3) Variable demand and variable lead time

1) Controls levels for Variable demand and constant lead time

In this case we want to find an operating doctrine that takes into account the possibility of a

stockout. We define the few additional variables:

U = random variable representing demand during lead time

= standard deviation of demand during lead time

U = Expected lead time demand

tL = lead time

d = average daily demand

σd = standard deviation of daily demand

D = expected annual demand

B = buffer stock or safety stock

Z = number of standard deviations needed for a specified confidence level

R = Re-order level

Thus, re-order level is given as:

Example 4

The daily demand of an item is normally distributed with a mean of 50 units and standard

deviation of 5 units. Lead time is 6 days. The cost of placing' an order is Rs. 8, and annual

11 | P a g e

�holding costs are 20% of the unit price of Rs. 1.20. A 95% service level is desired. Back-

orders are allowed but there is no stock-out cost. Find the various levels.

Solution:

Operating doctrine is to order 2700 units when inventory level reaches to the re-order point of

2662 units.

Maximum Level = 2700+862 = 3562 units

2) Control levels for constant demand and variable lead time:

For this model, the various levels are determined as follows:

Re-order level = R* = U + B

where U = dtL = (Daily demand x expected lead time) and Buffer stock, B = z sigma U

= Z (demand) (Standard deviation of lead time) Another, simple way of determining the

safety stock is:

B = (Maximum Lead Time - Normal Lead Time) (Demand during Lead Time) Furthermore,

the levels of safety stock depend upon what extent an organization is prepared to accept

stock-out risk (SOR). Since it is difficult to obtain an accurate

estimate for the shortage cost, the management must specify reasonable service level

(SL) so as to determine safety stock necessary to keep the stock-out risk within the prescribed

limits.

The service level is the probability of not running out of stock on any stock cycle, i.e. per

cent of order cycle in which all the demand can be supplied from the stock:

Service level (SL) = 100% - Stock-out Risk (SOR) ... (18)

Optimal stock out risk = C1/C2 … (19)

where (19) is obtained by marginal analysis of evaluating the cost of shortage for one unit i.e.

(1 unit short) (average stock-out per year) (Cost per unit short) = C1

or (SOR/yr) C2 = C1 ... (20)

Example 7

A company is ordering an item 4 times a year and has specified a service level of one stock-

out per 3 years. The history of re-order lead times is shown below. Daily demand of the item

is 40 units. Find the re-order level.

12 | P a g e

�13 | P a g e

�7. Periodic Review System:

14 | P a g e

�This system involves the reviewing of stock levels at a fixed interval of time known as review

period and placing replenishment orders at the end of each period. The replenishment

quantity is variable and corresponds to the amount of stock required to bring the stock

ordered and the stock on hand up to a target level. Thus, the key variable for system are T, the

review period (fixed time between reviews of inventory records) and TI, the target inventory

level on which rder are based. This system is also known as Fixed Period System or

Replenishment Inventory System or P-system.

15 | P a g e

�Figure summarizes the operation of a forced ordering periodic review system, as an order

must be placed at the end of each review period. Each review period is exactly T days long;

at the end of this period, an order is placed for a quantity sufficient to replenish inventory to

the target level T1. After the re-order lead time t L, the shipment arrives and goes into

inventory. The order quantities are different each period, being calculated as Q=Tl minus

inventory on hand minus previous orders not yet received. The formula for target inventory

for a fixed interval T is as follows:

Example 8. Consider Example 7 - a case of constant demand and variable lead time.

Solution. For this example, review period is fixed as

T = ¼ years = 90 days

Then, average demand during review period is = 90*40= 3600 units

Average lead time (tL) = 14.83 days

Therefore, average demand during average lead time = 40x 14.83 = 593.3 units Variance of lead time

= 34.97 (days)2

Safety stock for confidence level of 91.7 % confidence = 1.39

16 | P a g e

�Square root of 34.97 = 351.47 units.

Therefore, the target inventory level

TI = 3600+593.3+351.4 = 4544.7 or 4545 units.

8. Summary:

This project has highlighted the role of inventory control under the actual business conditions

of uncertainty desirable by any probability distribution. Various inventory models under the

conditions of probabilistic demand and/or probabilistic lead time have been illustrated with

the help of various examples. Two major Inventory Control systems have been described by

the various situations of probabilistic pattern of demand and lead time. Monte-Carlo

simulation method has been applied for illustrating the inventory model when both demand

and lead time vary.

17 | P a g e

�9. Keywords:

Buffer Stock: Extra-inventory held against the possibility of stock-out.

Continuous Probability Distribution: A probability distribution in which the

variable is allowed to take on any value within a given range.

Deterministic Model: A model where every influencing factor is known completely.

Discrete Probability Distribution: A probability distribution in which the variable is

allowed to take only limited number of values.

Expected Value: The average value or mean. This is obtained by summing the

multiplication of the variable values with their respective probabilities.

Expected Payoff: Expected value of the variable indicating payoffs.

Expected Opportunity Cost: Expected value of the variable indicating opportunity

costs.

Monte-Carlo Simulation: Quantitative procedure which conducts a series of

organized trial and error experiments on a model of a process to predict the behavior

of that process over time.

Multi Period Models: Models dealing with multiple ordering in a plan period.

Opportunity Cost: The cost of the opportunities that are sacrificed in order to take a

certain action.

Opportunity Cost Matrix: Matrix (or values put in a table form) of opportunity

costs.

Over-stocking cost: This is the cost of keeping more units that demanded.

Payoff The benefit which accrues from a given combination of decision alternative

and state of nature.

Payoff Matrix: Arrangement of payoffs in proper order or in table form.

Perishable Products: The goods that deteriorate with time.

Periodic Review System: An inventory which reviews the inventory status of every

item under system control at stipulated intervals review periods.

Probability Distribution: Values of a variable known as outcomes of an experiment

with the associated probabilities is known as probability distribution.

Probabilistic Inventory Models: Models dealing with inventory having demand or

lead time with probability distributions.

Random Numbers: The numbers that simulates the output that one would get from

sampling a uniform random variable.

Review Period: A time interval fixed for reviewing the inventory position.

Re-order Level: The stock level which is sufficient for the lead time consumption.

Salvage Value: Revenue received by selling the item at comparative lower selling

prices.

Single Period Models: Inventory models where only single order is initiated.

Standard Deviation A measure of the spread of the date around the mean.

Service Level: The probability of not being out of stock or the percentage of time that

the demand during the re-order period can be satisfied.

Under Stocking Cost: Cost relating to the out of stock situation under the

probabilistic situation.

Variance: This is the square of the standard deviation

18 | P a g e

� 10. References:

Buchan, J. and E. Koenigsberg (1963): Scientific Inven'tory Management;

Prentice Hall, Unc.

Buffa, Diwood S. (1990) : Modern Production/Operations Management, led.

Wiley Eastern Limited.

Dobler, D.W., Leel, Jr., and Burt, D.N. (1984): Purchasing and Materials

Management Text and Cases; Tata McGraw Hill.

Gupta, M.P. and J.K. Sharma (1987): Operations Research for Management;

National Publishing House.

Hadley, G and T.N. Whitin (1983): Analysis of Inventory Systems; Prentice Hall.

Levin, R.I. and C.A. Kirkpatrick (1978): Quantitative Approaches to

Management;.

McGraw Hill Kogkusha International Student.

IVIhstafi, C.K., (1988) : Operations Research : Methods and Practice; Wiley

Eastern Ltd.

McClain, J.O. and L.J. Thomas (1987) : Operations Management; Prentice Hall of

India.

Peterson, R and E.A. Silver (1979) : Decision Systems for Inventory Management

and Production Planning, Wiley, New York.

Shenoy, C.V., V.K. Shrivastava and S.C. Sharma, (1986) ; Operations Research

for Management; Wiley Eastern Limited.

Starr, M.K. and D.W. Miller (1977) : Inventory Control Theory and Practice,

Prentice Hall of India.

Taha, H.A. (1982): Operations Research: Introduction; MacMillan Publishing Co.

19 | P a g e