NAME: Muhammad Safwan

REGISTRATION NO. 10296

DATED: 29-DEC-2010

SUBMITTED TO: SIR. MUHAMMAD FAISAL

1

�FINANCIAL STATEMENT ANALYSIS OF ENGRO

FERTILIZERS LIMITED

2

�TABLE OF CONTENTS

Introduction………………………………4

Engro Fertilizers…………………………6

Ratio Analysis……………………………7

Financial Analysis……………………….11

Financial Statements:

Income Statement………………….12

Balance Sheet………………………14

Reference………………………………..18

3

�INTRODUCTION OF COMPANY

ENGRO is a public ltd co. having eighth position from income point of view in Pakistan. Moved

from one high level of achievement to other establishing records year after year and is now ranked as a

top tier player in the fertilizer industry with highest production capacity and market participation.

ENGRO now owns two mega plants worth over 2 billion dollars in of replacement value.

In the interest of better managing and overseeing businesses of subsidiaries and affiliates that are

currently part of Engro’s capital investments, Engro Chemical Pakistan Limited converted into a holding

company structure. As part of this process, two major changes occurred with effect from January 1, 2010;

Engro Chemical was renamed as Engro Corporation Limited and it demerged and transferred its fertilizer

business into a separate wholly owned subsidiary, Engro Fertilizers Limited.

Currently Engro Corporation’s portfolio consists of seven businesses which include chemical fertilizers,

PVC resin, a bulk liquid chemical terminal, industrial automation, foods, power generation and

commodity trade.

Besides providing the long term vision for the company and overseeing performance of the subsidiaries

and affiliates, Engro Corporation Limited is also responsible for allocation of capital, management of

talent, leadership development, HR guiding policies, leadership role in public relations and CSR

activities, control structures, legal and IT support.

From its inception as Esso Pakistan Fertilizer Limited in 1965 to Engro Corporation Limited in 2010,

Engro has come a long way and will continue working towards its vision of becoming a premier Pakistani

company with a global reach.

HISTORY

In 1957, the search for oil by Pak Stanvac, an Esso/Mobil joint venture led to the discovery of the Mari

Gas field near Daharki – a small, remote area in Upper Sindh province at the time. Esso proposed the

establishment of a urea plant in that area which led to a fertilizer plant agreement signed in 1964. In the

subsequent year, Esso Pakistan Fertilizer Company Limited was incorporated, with 75% of the shares

owned by Esso and 25% by the general public.

The construction of a urea plant commenced at Daharki in 1966 and production began in 1968. At US $43

million with an annual production capacity of 173,000 tons, it was the single largest foreign investment

by a multinational corporation in Pakistan at the time.

A full-fledged marketing organization was established which undertook agronomic programs to educate

the farmers of Pakistan. As the nation’s first fertilizer brand, Engro (then Esso) helped modernize

traditional farming practices to boost farm yields, directly impacting the quality of life not only for

farmers and their families, but for the nation at large. As a result of these efforts, consumption of

fertilizers increased in Pakistan, paving the way for the Company’s branded urea called “Engro”, an

acronym for “Energy for Growth”.

4

�As part of an international name change program, Esso became Exxon in 1978 and the Company was

renamed Exxon Chemical Pakistan Limited. The Company continued to prosper as it relentlessly pursued

productivity gains and strived to attain professional excellence.

In 1991, Exxon decided to divest its fertilizer business on a global basis. The employees of Exxon

Chemical Pakistan Limited, in partnership with leading international and local financial institutions,

bought out Exxon’s 75% equity. This was at the time and perhaps still is the most successful employee

buy-out in the corporate history of Pakistan. Renamed as Engro Chemical Pakistan Limited, the Company

has gone from strength to strength, reflected in its consistent financial performance, growth of the core

fertilizer business, and diversification into other businesses.

Along the way, a major milestone in plant capacity upgrade coincided with the employee led buy-out;

innovatively optimizing our resources, Engro relocated fertilizer manufacturing plants from the UK and

US to its Daharki plant site – an international first.

Engro Chemical Pakistan Limited then started a journey of venturing into other sectors including foods,

energy, industrial control and automation, PVC resin manufacturing and marketing, and chemical

terminal and storage.

In 2009 plans were announced of demerging the fertilizer business into an independent operating

company. The expansion and growth in the company necessitated a change in the way the company

operated and conducted business. Keeping in view the operations of multi category businesses, expansion

strategy and growth vision, the management decided that the various businesses would be better served if

the Company was converted to a holding company. As a result it was decided to demerge the fertilizer

business and establish a holding company structure to manage the affairs of various businesses.

Engro Fertilizers Limited was incorporated in June 2009 to manage the fertilizer business post demerger.

The demerger required the approval of the High Court of Sindh, which was granted on December 9, 2009

after obtaining the requisite approvals from the creditors and shareholders of the Company. The demerger

became effective from January 1, 2010. Consequently, all fertilizer business assets and liabilities have

been transferred to Engro Fertilizers Limited against the issue of shares to the Company.

To reflect the change in the scope of mandate and scale of operations, Engro Chemical Pakistan Limited

has been renamed as ‘Engro Corporation Limited’ with effect from January 1, 2010. Engro Corp, as the

holding company is responsible for the long term vision of the company, overseeing the performance of

the subsidiaries and affiliates, allocation of capital, management of talent, leadership development, HR

guiding policies, leadership role in public relations and CSR activities, control structures, legal and IT

support.

5

� ENGRO FERTILIZERS

Engro Fertilizers Limited, a wholly owned Engro subsidiary, is a premier fertilizer manufacturing and

marketing company with products that focus on balanced crop nutrition and increased yield. The

company markets primary and secondary fertilizers like Engro Urea, Engro DAP, Engro Zorawar, Engro

Zarkhez and Zingro.

Engro Fertilizers has successfully developed a loyal customer base all across Pakistan, not only by

providing farmers with quality fertilizers, but also through extensive market development activities. A

premier brand and nationwide presence of the company ensures sellout production. Additionally, the

company sells phosphate fertilizers for balanced fertility and improved farm yields. Engro’s share of

Pakistan’s phosphates market mirrors or exceeds its urea market share.

The Company’s expansion plans include the world’s largest single train urea complex, which is being set

up with an estimated cost of US$ 1.05 billion, and is on track for completion by mid 2010.

6

�RATIO ANALYSIS:

A tool used by individuals to conduct a quantitative analysis of information in a company's financial

statements. Ratios are calculated from current year numbers and are then compared to previous years,

other companies, the industry, or even the economy to judge the performance of the company. Ratio

analysis is predominately used by proponents of fundamental analysis.

There are many ratios that can be calculated from the financial statements pertaining to a company's

performance, activity, financing and liquidity. Some common ratios include the price-earnings ratio, debt-

equity ratio, earnings per share, asset turnover and working capital.

DEBT MANAGEMENT RATIO:

A measure of the extent to which a firm uses borrowed funds to finance its operations. Owners and

creditors are interested in debt management ratios because the ratios indicate the riskiness of the firm's

position. See also debt ratio, debt-to-equity ratio, fixed-charge coverage.

DEBT RATIO:

The Debt Ratio indicates how much of the assets are provided through debt.

Given the total debt and total assets from a company’s balance sheet:

Debt Ratio = (Total Debt) / (Total Assets)

Generally, the higher the ratio, the greater the liquidity (ability to meet current obligations using liquid

assets).

DEBT TO EQUITY RATIO:

The Debt to Equity Ratio indicates how much financing is provided through debt as compared to equity.

Given the total debt and total assets from a company’s balance sheet, use the Debt Ratio:

Debt Ratio = (Total Debt) / (Total Assets)

Debt to Equity Ratio = (Debt Ratio) / (1 – Debt Ratio)

Generally, the higher the ratio, the more financial leverage is employed by the firm, and the higher the

financial risk.

TIE RATIO:

The Times Interest Earned Ratio shows the ability to service interest payments from earnings. This ratio

focuses more narrowly than the EBITDA Coverage Ratio which considers other obligations than interest

which must also be paid from earnings.

Given the Earnings Before Interest and Taxes (EBIT) and Interest from the Income Statement:

The Times Interest Earned Ratio = EBIT / Interest

Generally, the higher the ratio, the more easily interest obligations can be met out of earnings. A ratio of

less than 1.0 means earnings are insufficient to meet the interest payments.

7

�Long-term debt-to-equity ratio:

A capitalization ratio comparing long-term debt to shareholders' equity.

Ratio = Long-term debt / (Preferred stock + Common stock)

The greater a company's leverage, the higher the ratio. Generally, companies with higher ratios are

thought to be more risky because they have more liabilities and less equity.

PROFITABILITY RATIOS:

The profitability ratios are the basic bank financial ratios. Profitability ratios are the financial statement

ratios which focus on how well a business is performing in terms of profit.

Profit Margin -- The profit margin shows the relationship between net income (profit) and sales.

Net Profit Ratio = Net Profit / Sales

Gross Profit Ratio -- The gross profit ratio indicates how much of each sales dollar is available to meet expenses and

profits after merely paying for the goods that were sold.

Gross Profit Ratio = Gross Profit / Sales

Return on Assets -- Return on assets (ROA) is a percentage of the after-tax income as compared to the total assets of

the company.

Return on Assets = Net Income / Average Total Assets

Where Total Assets =

(Beginning Total Assets + Ending Total Assets) / 2

Return on Equity -- Return on equity (ROE) measures profitability related to ownership.

Return on Equity (ROE) = Net Income / Average Stockholders´ Equity

Where Average Stockholders´ Equity = (Beginning Stockholders´ Equity + Ending Stockholders´ Equity) / 2

LIQUIDITY RATIO :

A class of financial metrics that is used to determine a company's ability to pay off its short-terms debts

obligations. Generally, the higher the value of the ratio, the larger the margin of safety that the company

possesses to cover short-term debts.

Current Ratio:

The current ratio is a popular financial ratio used to test a company's liquidity (also referred to as its current

or working capital position) by deriving the proportion of current assets available to cover current liabilities.

8

�Quick Ratio:

The quick ratio – or the quick assets ratio or the acid-test ratio - is a liquidity indicator that further refines

the current ratio by measuring the amount of the most liquid current assets there are to cover current

liabilities. The quick ratio is more conservative than the current ratio because it excludes inventory and

other current assets, which are more difficult to turn into cash. Therefore, a higher ratio means a more

liquid current position.

ACTIVITY RATIO :

Accounting ratios that measure a firm's ability to convert different accounts within their balance sheets

into cash or sales.

Companies will typically try to turn their production into cash or sales as fast as possible because this will

generally lead to higher revenues.

Such ratios are frequently used when performing fundamental analysis on different companies. The asset

turnover ratio and inventory turnover ratio are good examples of activity ratios.

INVENTORY TURNOVER:

A ratio showing how many times a company's inventory is sold and replaced over a period.

The days in the period can then be divided by the inventory turnover formula to calculate the days it takes

to sell the inventory on hand or "inventory turnover days".

This ratio should be compared against industry averages. A low turnover implies poor sales and,

therefore, excess inventory. A high ratio implies either strong sales or ineffective buying.

9

�RECEIVABLE TURNOVER:

An accounting measure used to quantify a firm's effectiveness in extending credit as well as collecting

debts. The receivables turnover ratio is an activity ratio, measuring how efficiently a firm uses its assets.

A low ratio implies the company should re-assess its credit policies in order to ensure the timely

collection of imparted credit that is not earning interest for the firm.

TOTAL ASSET TURNOVER:

The total asset turnover ratio measures the ability of a company to use its assets to generate sales. The

total asset turnover ratio considers all assets including fixed assets, like plant and equipment, as well

as inventory and accounts receivable.

Total Asset Turnover = Net Sales

Average Total Asset

The lower the total asset turnover ratio, as compared to historical data for the firm and industry data, the

more sluggish the firm's sales.

PRICE EARNING RATIO:

A valuation ratio of a company's current share price compared to its per-share earnings.

Calculated as:

EPS is usually from the last four quarters (trailing P/E), but sometimes it can be taken from the estimates

of earnings expected in the next four quarters (projected or forward P/E). A third variation uses the sum

of the last two actual quarters and the estimates of the next two quarters.

EARNING PER SHARE:

The portion of a company's profit allocated to each outstanding share of common stock. Earnings per

share serves as an indicator of a company's profitability.

Calculated As:

Earnings per share is generally considered to be the single most important variable in determining a

share's price. It is also a major component used to calculate the price-to-earnings valuation ratio.

10

� FINANCIAL ANALYSIS

INTRODUCTION:

The year 2009 closed one chapter of Engro's history. At the end of year 2009, Engro Chemical Pakistan

Limited demerged and transferred its core business into a new subsidiary, Engro Fertilizers Limited.

This demerger is part of Engro Chemical Pakistan Limited's conversion into a holding company structure,

namely Engro Corporation Limited. Engro Corp will be one of Pakistan's largest conglomerates, with a

diversified portfolio, including fertilizers, foods, energy & power, PVC resin, chemical handling and storage,

industrial automation and trading.

Industry snapshot:

The fertiliser industry in Pakistan is of an oligopolistic nature, with the four major players being Engro, FFC,

FFBL and Dawood Hercules. FFC has the highest share of urea production (38%), followed by Engro (14%),

FFBL (10%) and Dawood Hercules (8%).

During the year under review, the Urea off take of industry grew 17% to 6.4 million tons. This was mainly due

to record wheat support prices of Rs 950/ mound for Rabi 08/09 and 09/10 resulting in highest ever returns

for the farmers, increase in acreages under BT cotton requiring more urea and, rising cotton prices

encouraging increased fertiliser use. Domestic urea production during 2009 on national basis was 5.05 million

tons as compared to 4.98 million tons in 2008. To fill the demand supply gap, GoP imported 1.6 million tons

of urea which was distributed through National Fertiliser Marketing Limited.

2010:

The consolidated net sales of the Engro Corp showed an increase of 48% and stood at Rs 50.59 billion for

the first half of 2010, as compared to the Rs 34.15 billion in the same period last year, while gross profit

increased from Rs 7.30 billion in 1H 2009 to Rs 13.88 billion this half. Net Profit rose 183% to Rs 8.21 bn

in 1H 2010 as compared to the same period last year. Meanwhile, PAT increased to Rs 4.59 bn, rising

221% since the corresponding period last year.

In the fertiliser business, urea sales were 492,000 tons up by 17% from 419,000 tons for the same period

last year primarily due to higher availability of product on account of higher production. Engro Fertilizers

recorded the best ever first half production with 504,000 tons during the six months ended June 30,

2010, a 16% increase over the 436,000 tons produced during the same period last year. The market

share also increased to 16% from 14% last year.

The market demand for urea, during the first half ended June 30, 2010 was 3.1 million tons showing a

marginal increase of 3% over the same period last year. The sale of company manufactured blended

fertilizers (Zarkhez and Engro NP) was 44,800 tons vs 43,500 tons during same period last year. Zarkez

sales increased to 28,900 tons from 23,000 tons in the corresponding period previous year as a result of

11

� a 55% growth in the potash industry which was witnessed during the first half of 2010 on account of

subsidy announced by the Government and subsequent imports by other potash players. NP sales

declined to 15,900 tons this year from 20,500 tons in the comparable period last year due to a decline in

the phosphate industry due to higher phosphate prices, poor farmer economics and water shortage.

The net profit for the six months ended June 30, 2010 was Rs 2.01 billion which was better than

expected due to better plant production and efficiency. The urea expansion project at Daharki site, at

40th month of execution is mechanically 98% complete. Mechanical completion as well as

commissioning activities are expected to take place in 3Q 2010.

FINANCIAL STATEMENT ANALYSIS

During FY09, the company produced 952,000 tons of urea, which is 4% lower than 995,000 tons of 2008

production; this was mainly due to the planned maintenance shutdown in the second quarter. The

company sold 933,000 tons of urea and consumed 20,000 tons in the Zarkhez operations. Also there has

been a decline in Engro's share because of production remaining constant having reached the maximum

capacity and while there was a growth in urea demand, the distribution of imported urea was handled

directly by NFML.

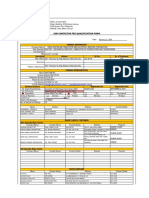

ENGR0 FERTILIZERS LIMITED

INCOME STATEMENT

(Rs in '000)

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

Net Sales 12,797,662 18,276,277 17,601,783 23,183,222 23,317,198 30,171,520

(9,528,215

Cost of Sales ) (14,364,288) (13,364,524) (18,262,793) (17,120,635) (23,240,176)

Gross Profit 3,269,447 3,911,989 4,237,259 4,920,429 6,196,563 6,931,344

(1,036,509

Selling & Dist expenses ) (1,270,703) (1,481,730) (1,641,724) (1,657,815) (1,945,176)

Other income 558,154 1,144,987 1,338,854 1,831,260 2,754,330 1,973,467

Financial and Other Chgs. (285,711) (280,070) (362,551) (535,023) (1,508,948) (1,320,579)

Taxation (704,478) (900,469) (897,330) (1,080,929) (964,144) (1,257,696)

Profit after tax 1,610,575 2,319,082 2,547,326 3,154,583 4,240,430 3,957,250

During the year under review, the company sold 357,000 tons of phosphates as compared to 128,000

tons in 2008, achieving a market share of 21% against 16% in 2008. The growth was based on the focus

on anticipating demand and market trends. As a result of the higher international potash prices in 2009,

the potash nutrient industry registered a 33% decline during the year. Being the largest player in the

12

�potash market, Zarkhez sales dropped to 55,000 tons, a decline from 69,000 tons levels of 2008.

However, the market share of potash increased from 51% in 2008 to 65% in 2009.

The net sales of the company have shown an increasing trend over the last 5 years. The stood at Rs

18,276 million in FY05, whereas in FY09 they have increased to Rs 30,172 million. The gross profits have

also shown an increase, increasing from levels of Rs 3,912 million in FY05 to Rs 6,931 million in FY09.

The profits after tax have been showing a fluctuating trend over the last 5 years. They stood at Rs 4,240

million in FY08, and declined to Rs 3,957 million in FY09. This fluctuating profitability trend has lead to

fluctuations in the profitability ratios of the company. The net profit margins in FY09 stood at 13% in

FY09 as compared to 18% in FY08 and 14% in FY07. Also, the gross profit margins stood at 23% in FY09

as compared to 27% in FY08 and 21% in FY07.

PROFITABILITY

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

Net Profit Margin 13% 13% 14% 14% 18% 13%

Gross Profit

Margin 26% 21% 27% 21% 27% 23%

Return on Assets 12% 16% 11% 8% 7% 4%

Return on Equity 24% 31% 22% 20% 18% 15%

90%

80%

70%

60%

50% Return on Equity

Return on Assets

40% Gross Profit Margin

Net Profit Margin

30%

20%

10%

0%

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

The return on assets and return on equity have been declining over the last 5 years. The RoA declined

from 15% in FY05 to 4% in FY09. The RoA stood at 7% in FY08. There has been a massive increase in the

total assets of the company. They increased from Rs 57,164 million in FY08 to Rs 93,709 million in FY09.

13

�The property, plant and equipment have increased from Rs 33,553 million in FY08 to Rs 69517 million in

FY09.

The property, plant and equipment have increased mainly on account of the urea expansion project. The

property, plant and equipment included in capital work in progress due to urea expansion project

increased to Rs 47,081,203 thousands in FY09 as compared to Rs 23,064,182 thousands in FY08. The RoE

has declined from 18% in FY08 to 15% in FY09. This has been due to the increase in the equity. The

equity increased from Rs 21,054 million in FY08 as compared to Rs 26,888 million in FY09.

BALANCE SHEET

RS(000) FY ‘04 FY ‘ 05 FY ‘ 06 FY ‘ 07 FY ‘ 08 FY ‘ 09

Share Capital 1,529,400 1,529,400 1,682,340 1,934,692 2,126,161 2,128,161

Reserves-revenue 4,429,240 4,429,240 4,429,240 4,429,240 4,429,240 4,429,240

Total Equity 6,585,884 7,375,566 7,555,453 15,740,651 23,084,068 26,888,238

Non Current Liabilities 3,614,324 3,935,970 2,968,304 17410,060 31,205,105 60,425,731

Current Liabilities 2,985,149 2,800,094 3,642,415 5,264,674 5,999,353 6,395,469

Total Liabilities 6,599,473 6,736,064 6,610,719 22,674,734 37,204,453 66,821,200

Fixed Assets 7,106,268 6,861,676 6,575,665 13,818,674 33,395,762 69,517,512

Long Term Investments 1,424,557 2,172,757 3,657,596 7,764,482 11,091,857 12,998,657

Current Assets 4,602,604 5,011,555 5,684,446 15,685,335 15,323,158 10,748,871

Total Assets 13,185,357 14,111,430 15,980,816 38,415,385 60,288,526 93,709,438

The total liabilities of the company have been increasing over the last 5 years. They have increased from

Rs 36,111 million in FY08 to Rs 66,821 million in FY09. Tremendous increase has been seen in the long

term liabilities. They have increased from Rs 30,112 million in FY08 to Rs 60,426 million in FY09. The

borrowings of the company have increased from Rs 27,757 million in FY08 to Rs 58,565 million in FY09.

The increase in the borrowings has been for the urea expansion project. Included in these are the loans

from consortium of Development Finance Institutions comprising of DEG, FMO and OFID for an amount

of US $85,000. Also the company has contracted a loan with International Finance Corporation for US

$50,000.

Another major increase on the liabilities front has been in the employee housing subsidy. In 2008, the

company announced a medium term Employee Housing Subsidy Scheme for its employees who were

not entitled to Employee Share Options. The company has completed disbursements of Rs 395,606

thousands in FY09 as compared to Rs 152,223 thousands in FY08. With the increase in the liabilities the

14

�Total debt to equity ratio of the company has reached a level of 2.49 as compared to 1.61 in FY08. Even

the debt to total assets has increased to 0.71 as compared to 0.62 in FY08.

DEBT MANAGEMENT

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

Total Debt to Total Assets 0.50 0.48 0.47 0.59 0.62 0.71

Total Debt to Total Equity 1.00 0.91 0.90 1.44 1.61 2.49

Time5 -Interest-Earned

(TI ) 6.64 9.28 8.03 6.9 3.81 4.00

Long term Debt to Equity 0.55 0.53 0.43 1.11 1.35 2.25

12.00

10.00

Long term Debt to

8.00 Equity

Time5 -Interest-Earned

6.00 (TI )

Total Debt to Total

Equity

4.00

Total Debt to Total

Assets

2.00

0.00

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

The current ratio of the company has been declining over the years. During FY09 it declined to 1.7 as

compared to 2.6 in FY08 and 3 in FY07.

LIQUIDITY

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

Current

Ratio 1.5 1.8 3.0 1.6 2.6 1.7

During FY09 the current liabilities of the company increased from FY08 levels of Rs 5,999 million to Rs

6,395 million. Increase was seen in derivative financial instruments, which have increased from Rs 155

15

�million to Rs 740 million. The company has entered into forward exchange contracts to hedge its foreign

exchange exposure. The company has forward contracts to purchase Euro 9,543 in FY09 as compared to

Euro 130,505 in FY08. Also, the company has entered into foreign exchange option contracts to hedge

its currency exchange against US dollars relating to the expansion project. The country had foreign

exchange options amounting to Euro 12,628 in FY09. The company has entered into an interest rate

swap agreement to hedge its interest rate exposure on floating rate committed borrowing from a

consortium of Development Finance Institutions for notional amount of US $85,000. During FY09 the

current assets of the company declined to Rs 10,749 million in FY09 from Rs 12,042 million in FY08.

Market

Value

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

Price Earning Ratio 12.28 10.85 11.73 15.48 5.74 13.02

Earning Per Share 10.53 14.37 14.53 17.17 16.81 14.08

35.00

30.00

25.00

20.00

Earning Per Share

15.00 Price Earning Ratio

10.00

5.00

0.00

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

With the increasing net profits after tax for the last 6 years, the earnings per share have also increased.

The net income stood at Rs 1,611 million in FY04 as compared to Rs 3,957 million in FY09. Also, the EPS

has increased to Rs 14 in FY09 as compared to Rs 8.3 in FY04. The dividend per share has been

fluctuating over the last 5 years. In FY05 the dividend was Rs 11 which has declined to Rs 6 in FY09

showing a payout ratio of 43%, as compared to a payout of 100% in FY05.

16

�ASSET MANAGEMENT

FY'04 FY'05 FY'06 FY'07 FY'08 FY'09

484,7 1,922,9 623,3 1,408,8 261,5 2,514,4

Trade Debts 48 82 49 85 08 25

13,185,3 14,111,6 15,980,8 38,156,6 57,164,7 93,709,4

Total Assets 57 30 16 51 39 38

1,203,8 1,515,5 2,219,9 2,350,7 3,607,9

Average Trade Debts 65 39 82 36 48

13,648,4 21,638,9 40,717,2 69,299,5 116,154,3

Average Total Assets 93 01 27 96 15

1,207,0 1,421,7 1,808,1 3,721,8 2,553,8

Average Inventory 83 58 97 77 65

FY'05 FY'06 FY'07 FY'08 FY'09

Inventory Turnover 11.9 9.4 10.1 4.6 9.1

Days Inventory On

hand(DAYS) 31 39 36 79 40

Receivables TurnOver 15.1 11.6 10.4 9.9 8.3

Days Sales Outstanding(DAYS) 24 31 35 37 44

Total Asset Turnover 1.3 0.8 0.5 0.3 0.25

140

120

100

Total Asset Turnover

80 Days Sales

Outstanding(DAYS)

Receivables TurnOver

60

Days Inventory On

hand(DAYS)

40 Inventory Turnover

20

0

FY'05 FY'06 FY'07 FY'08 FY'09

17

�Asset Management of Engro showed a decline during fy’09 . Days Inventory on hand has declined from

79 to 40 days But Days sales outstanding rose sharply from 37 days to 44 days this actually reflects the

inability of the company to quickly convert its credit sales into cash. Whereas trade debts has been

increased. Which becomes the main reason in an increase in days sales outstanding. During Fy ‘ 09 Total

Asset Turnover Ratio also declined from 0.30 to 0.25 this decline is due to the fact that total asset rose

more than the total sales. The rise in sale is low as compared to the total assets.

REFERENCES:

The above figures have been taken from the Annual Reports of Engro.

18