0% found this document useful (0 votes)

265 views7 pagesQUIZ REVIEW Homework Tutorial Chapter 3

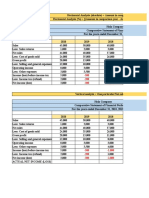

1. The cost per unit of Product A under the activity-based costing system for Matt Company is $6.60.

2. The predetermined overhead rate under the traditional costing system for Acton Company is $270.66.

3. The overhead cost per unit of Product B under the traditional costing system for Acton Company is $54.13.

Uploaded by

Cody TarantinoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

265 views7 pagesQUIZ REVIEW Homework Tutorial Chapter 3

1. The cost per unit of Product A under the activity-based costing system for Matt Company is $6.60.

2. The predetermined overhead rate under the traditional costing system for Acton Company is $270.66.

3. The overhead cost per unit of Product B under the traditional costing system for Acton Company is $54.13.

Uploaded by

Cody TarantinoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOC, PDF, TXT or read online on Scribd

/ 7