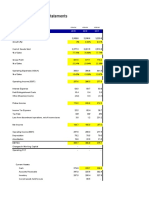

statement of financial position 2015 2016 sci

Cash 3,514 2,875 (639) Sales

Accounts Receivable 6,742 5,583 (1,159) Cost of Goods Sold

Inventory 2,573 3,220 647 Gross profit

Current Assets 12,829 11,678 Operating expenses

Non-Current Assets Profit before interest expense

Gross 22,478 24,360 1,882 interest expense

Accumulated Depreciation (12,147) -13313 (1,166) Profit before tax

Net 10,331 11,047 Tax

Total Assets 23,160 22,725 Profit

Accounts Payable 1,556.00 1,702.00 146

Accruals 268.00 408.00 140

Current Liabilities 1,824.00 2,110.00

Long-term Debt 7,112.00 6,002.00 (1,110)

Total Liabilities 8,936.00 8,112.00

Equity 14,224.00 14,613.00 389

Total Liabilities and Equity 23,160.00 22,725.00

Cash Flow Statement

2016

Net Income 3,116

Adjustement to reconcile net income to net cash

provided by operating activities

Depreciation expense 1,166

Decrease in accounts receivable 1,159

Increase in inventory (647)

Increase in accounts payable 146

Increase in accruals 140 1,964

Net Cash provided by Operating Activities 5,080

Net Cash from Investing Activities

Purchase of non-current assets (1,882)

Net Cash from Financing Activities

Payment of non-current liabilities (1,110)

Retirement of Stocks (1,000.00)

Payment of Dividends (1,727.00)

Net increase in cash during the year (639)

Cash, beginning 3,514

Cash, 12/31/16 2,875

-

�2016

36,227

19,925

16,302

10,868

5,434

713

4,721

1,605

3,116

� sfp 2015 2016 sci

Cash 2,745 1,071 (1,674) Sales

Receivable 19,842 24,691 4,849 Cost of Goods Sold

Inventory 10,045 15,621 5,576 Gross profit

Current Assets 32,632 41,383 - Operating expenses

Non-Current Assets Profit before interest expense

Gross 80,128 97,432 17,304 interest expense

Accumulated Depreciation (60,225) -68076 (7,851) Profit before tax

Net 19,903 29,356 Tax

Total Assets 52,535 70,739 Profit

Accounts Payable 3,114.00 6,307.00 3,193

Accruals 768.00 914.00 146

Current Liabilities 3,882.00 7,221.00

Long-term Debt 36,490.00 48,128.00 11,638

Total Liabilities 40,372.00 55,349.00

Equity 12,163.00 15,390.00 3,227

Total Liabilities and Equity 52,535.00 70,739.00 -

Statement of Cash flows

2016

Net Income 6,227

Adjustement to reconcile net income to net cash

provided by operating activities

Depreciation expense 7,851

Increase in accounts receivable (4,849)

Increase in inventory (5,576)

Increase in accounts payable 3,193

Increase in accruals 146 765

Net Cash provided by Operating Activities 6,992

Net Cash from Investing Activities

Purchase of non-current assets (17,304)

Net Cash from Financing Activities

Proceeds from non-current liabilities 11,638

Payment of Dividends (3,000)

Net increase in cash during the year (1,674)

Cash, beginning 2,745

Cash, 12/31/16 1,071

-

�2016

88,765

39,506

49,259

34,568

14,691

4,312

10,379

4,152

6,227

� sfp 2014 2015 2016 2015 2016

Cash 30 40 52 10 12

Accounts Receivable 175 351 590 176 239

Inventory 90 151 300 61 149

Current Assets 295 542 942

Non-Current Assets

Gross 1,565 2,373 2,718 808 345

Accumulated Depreciation (610) (860) (1,135) (250) (275)

Net 955 1,513 1,583

Total Assets 1,250 2,055 2,525

Accounts Payable 56 81 134 25 53

Accruals 15 20 30 5 10

Current Liabilities 71 101 164

Long-term Debt 630 1,260 1,600 630 340

Total Liabilities 701 1,361 1,764

Equity 549 694 771

Total Liabilities and Equity 1,250 2,055 2,535

(10)

2015 2016

Net Income 154 82

Adjustement to reconcile net income to net cash

provided by operating activities

Depreciation expense 250 275

Increase in accounts receivable (176) (239)

Increase in inventory (61) (149)

Increase in accounts payable 25 53

Increase in accruals 5 43 10 (50)

Net Cash provided by Operating Activities 197 32

Net Cash from Investing Activities

Purchase of non-current assets (808) (345)

Net Cash from Financing Activities

Proceeds from non-current liabilities 630 340

Difference in equity (9) (15)

Net increase in cash during the year 10 12

Cash, beginning 30 40

Cash, 12/31/16 40 52

- -

� sci 2014 2015 2016

Sales 1578 2106 3265

Cost of Goods Sold 631 906 1502

Gross profit 947 1,200 1,763

Expenses:

Marketing 316 495 882

Research and Development 158 211 327

Administration 126 179 294

Total Expenses 600 885 1,503

Profit before interest expense 347 315 260

interest expense 63 95 143

Profit before tax 284 220 117

Tax 86 66 35

Profit 198 154 82

Statement of Changes in Equity 2015 2016

beginning 549 694

net income 154 82

Should be balance 703 776

reflected in financial position 694 771

Difference 9 5

unbalance amount in financial position 10

Total Difference 9 15