0% found this document useful (0 votes)

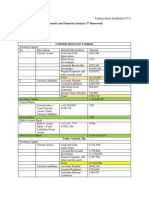

181 views8 pagesI. Concept Notes Five Contents of Financial Statements

This document is a learning packet for a financial management course that provides an overview of financial statement analysis. It includes:

1) An introduction stating the intended learning outcomes around analyzing financial statements using various techniques and interpreting the analyses.

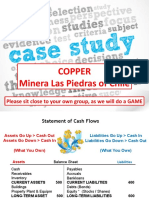

2) A section on the contents of financial statements including the income statement, balance sheet, statement of owners' equity, statement of cash flows, and notes.

3) An explanation of ratio analysis and its uses in performance evaluation, comparison, and control. It defines categories of ratios including liquidity, asset efficiency, leverage, and profitability.

Uploaded by

Danica Christele AlfaroCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

181 views8 pagesI. Concept Notes Five Contents of Financial Statements

This document is a learning packet for a financial management course that provides an overview of financial statement analysis. It includes:

1) An introduction stating the intended learning outcomes around analyzing financial statements using various techniques and interpreting the analyses.

2) A section on the contents of financial statements including the income statement, balance sheet, statement of owners' equity, statement of cash flows, and notes.

3) An explanation of ratio analysis and its uses in performance evaluation, comparison, and control. It defines categories of ratios including liquidity, asset efficiency, leverage, and profitability.

Uploaded by

Danica Christele AlfaroCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 8