0% found this document useful (0 votes)

188 views2 pagesSample Problem

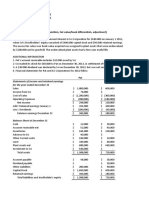

On January 1, 2020, Lettuce Co. acquired Spinach Corp. for P1,380,000. Lettuce recorded the acquisition by debiting assets and crediting cash. Spinach's books were closed by debiting cash and crediting assets, with the difference credited to gain on sale. Lettuce's balance sheet showed increased assets and no change in equity from the acquisition.

Uploaded by

Zaldy Magante MalasagaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

188 views2 pagesSample Problem

On January 1, 2020, Lettuce Co. acquired Spinach Corp. for P1,380,000. Lettuce recorded the acquisition by debiting assets and crediting cash. Spinach's books were closed by debiting cash and crediting assets, with the difference credited to gain on sale. Lettuce's balance sheet showed increased assets and no change in equity from the acquisition.

Uploaded by

Zaldy Magante MalasagaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2