0% found this document useful (0 votes)

3K views14 pagesGann - Angle - Reversal Date Method

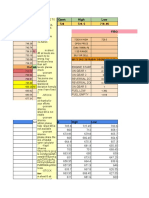

The document provides details on the Gann Angle Method for analyzing trends and identifying support and resistance levels in financial markets. It includes tables showing different Gann angles or degrees, their corresponding factors, and calculated resistance and support levels. The method can also incorporate volatility and be used on other timeframes like monthly charts.

Uploaded by

udhaya kumarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

3K views14 pagesGann - Angle - Reversal Date Method

The document provides details on the Gann Angle Method for analyzing trends and identifying support and resistance levels in financial markets. It includes tables showing different Gann angles or degrees, their corresponding factors, and calculated resistance and support levels. The method can also incorporate volatility and be used on other timeframes like monthly charts.

Uploaded by

udhaya kumarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLS, PDF, TXT or read online on Scribd

/ 14