0% found this document useful (0 votes)

431 views6 pagesSample IRSTax Return Transcript

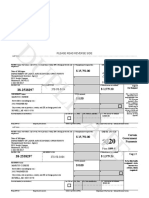

This document is a sample IRS tax return transcript for taxpayer John Doe for the 2014 tax year. It lists income such as wages, interest, dividends, adjustments, deductions, and credits. There is no income or deductions reported on the transcript, as it is a sample only. The transcript provides key personal information and tax data directly from the filed tax return.

Uploaded by

nowayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

431 views6 pagesSample IRSTax Return Transcript

This document is a sample IRS tax return transcript for taxpayer John Doe for the 2014 tax year. It lists income such as wages, interest, dividends, adjustments, deductions, and credits. There is no income or deductions reported on the transcript, as it is a sample only. The transcript provides key personal information and tax data directly from the filed tax return.

Uploaded by

nowayCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 6