UNIT 3 Accounting Adjustments

Recommended Prior Knowledge Students need some understanding of commercial transactions and an understanding of double entry principles.

Context The Unit covers aspects of accounting which are required because business is continuous but accounting covers discrete periods of time. The

adjustments largely derive from the application of accounting concepts and look at the accounting bases and methods used to apply those concepts. This

could be studied in conjunction with the latter part of Unit 10.

Outline The unit concentrates on adjustments which feature in virtually every examination, either as part of final accounts and/or in separate questions.

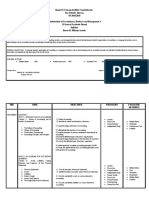

Syllabus Learning Outcomes Suggested Teaching Activities Online Resources Other resources

Ref.

2.1 Candidates should be able to: Explain the matching concept. Income and

• show understanding of the revenue expenditure should be matched to

differing accounting treatment of the year they were incurred.

capital and revenue expenditure

Capital and revenue expenditure is an http://www.bized.ac.uk/stafsu

and income

important distinction because an error in p/options/accounting/work03. BKA 18

categorisation affects the profit and htm IGSCE 8

• calculate and comment on the

balance sheet.

effect on profit and asset

http://teachers.cie.org.uk/tea

valuation of incorrect treatment

Students should be able to provide cher_support/pdf/7110_w03_

definitions, identify and state examples and qp_1.pdf CIE Nov 2003 Paper 1 Q11

calculate the effects of incorrect

categorisation. Students may find making

notes in a matrix form will help revision, for

example:

Definition Example

Capital expenditure

Capital income

Revenue expenditure

Revenue income

1

�Syllabus Learning Outcomes Suggested Teaching Activities Online Resources Other resources

Ref.

2.2 Candidates should be able to: A fixed asset arises from capital

BKA 25, 26

• define depreciation expenditure. Depreciation of the fixed asset

http://www.staffs.ac.uk/schoo IGSCE 10

is revenue expenditure.

ls/business/bsadmin/staff/s5/ BM 38, 39, 40, 41

• explain the reasons for

accsys/wfour.htm#l1

accounting for depreciation Students should be able to define

depreciation clearly and show brief

• name and describe the straight calculations as an example. Comparing

line, diminishing (reducing) different methods of depreciation for one

http://www.accaglobal.com/p

balance and revaluation methods asset over a period of two to three years

ublications/studentaccountan

of depreciation should clearly show the differences to

t/12013?session=fffffffeffffffff

students. Students should, at this stage, be

c28288ca40a137f0d9a9c4f8

• explain the circumstances in aware that depreciation is an example of

c6ad2017d5a4837ffa10d34f

which each method is used an ‘accounting base’ and is applied by

various ‘methods’ such as straight-line.

A useful exercise to help students is to

prepare ledger accounts for specific assets

http://teachers.cie.org.uk/tea CIE Nov 2003 Paper 1 Q14

and their respective provisions for

cher_support/pdf/7110_w03_

depreciation accounts at this stage and

qp_1.pdf

then bring these accounts into a later profit

and loss account and balance sheet when

studying final accounts. This will help them

see the connections

http://teachers.cie.org.uk/tea BM 61, 62

• prepare ledger accounts and Students often experience difficulties with

cher_support/pdf/7110_w03_

journal entries for the provision of preparing disposal accounts. Clear

qp_1.pdf CIE Nov 2003 Paper 1 Q13

depreciation and the disposal of diagrams of the various accounts and how

fixed assets they interrelate and practice in preparing

disposal accounts is recommended.

2

�Syllabus Learning Outcomes Suggested Teaching Activities Online Resources Other resources

Ref.

2.3 Candidates should be able to: Explain that accounting adjustments are BKA 28

• make entries in the journal and required because accounts are produced IGSCE 9

ledger accounts to record for a period of time (often a year) but BM 29

accrued and prepaid expenses business is continuous. So amounts are

http://www.staffs.ac.uk/schoo

and outstanding and prepaid outstanding at the end of the period (e.g.

ls/business/bsadmin/staff/s5/

incomes wages are owed to employees – an

accsys/wthree.htm#t

accrual).

A progressive approach is the best way to

illustrate accruals and prepayments, for

example:

http://www.bized.ac.uk/stafsu

p/options/accounting/work05.

1) illustrate an accrual followed by practice

htm

2) illustrate a prepayment, then practice

3) take the illustrations on another period

where an account starts a year with an

accrual and ends with a prepayment and

vice versa.

http://teachers.cie.org.uk/tea

CIE Nov 2003 Paper 1 Q22

cher_support/pdf/7110_w03_

Candidates often find this subject

qp_1.pdf

confusing so time and practice are

essential to reinforce understanding.

http://www.accaglobal.com/p BKA 27, 28

• make entries in the journal and Ensure students are clear on the difference

ublications/studentaccountan IGSCE 11

ledger accounts to write off bad between actual bad debts and a provision.

t/11983?session=fffffffeffffffff BM 42, 43

debts and to make provision for By considering them separately rather than

c28288ca40a137f0d9a9c4f8

doubtful debts as instructed, and together, they are less likely to confuse the

c6ad2017d5a4837ffa10d34f

discounts two. Practice journal and ledger account

entries together as further reinforcement of

http://teachers.cie.org.uk/tea

double entry principles.

cher_support/pdf/7110_s02_ CIE Jun 2002 Paper 2 Q3

qp_2.pdf