0% found this document useful (0 votes)

1K views5 pagesAnswer Key Chapter 3

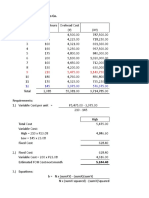

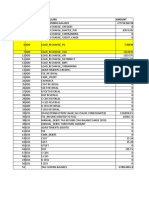

This document contains 5 problems related to accounting for costs. Problem 1 provides income statement information for Queen Manufacturing Corporation. Problem 2 shows a cost of goods sold statement for Marvin Manufacturing Company. Problem 3 displays a cost of goods sold statement for Donna Company. Problem 4 gives journal entries and financial statements for Ram Company. Problem 5 lists journal entries for Darvin Company. Overall, the document presents examples of accounting for costs and financial statements for multiple manufacturing companies.

Uploaded by

Donna Zandueta-TumalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views5 pagesAnswer Key Chapter 3

This document contains 5 problems related to accounting for costs. Problem 1 provides income statement information for Queen Manufacturing Corporation. Problem 2 shows a cost of goods sold statement for Marvin Manufacturing Company. Problem 3 displays a cost of goods sold statement for Donna Company. Problem 4 gives journal entries and financial statements for Ram Company. Problem 5 lists journal entries for Darvin Company. Overall, the document presents examples of accounting for costs and financial statements for multiple manufacturing companies.

Uploaded by

Donna Zandueta-TumalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 5