0% found this document useful (0 votes)

101 views7 pagesChapter Solutions

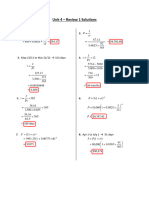

1) To summarize the key points:

- The document provides examples of calculating future values and present values of ordinary annuities using formulas, with adjustments made for compounding periods.

- It also sets up an amortization schedule for a $25,000 loan repaid over 5 years at 10% interest to show the yearly payments, interest, principal, and remaining balance.

- Additional questions are provided as examples, such as calculating interest rates, future/present values, and lengths of loans.

Uploaded by

Fakhir ZaidiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

101 views7 pagesChapter Solutions

1) To summarize the key points:

- The document provides examples of calculating future values and present values of ordinary annuities using formulas, with adjustments made for compounding periods.

- It also sets up an amortization schedule for a $25,000 loan repaid over 5 years at 10% interest to show the yearly payments, interest, principal, and remaining balance.

- Additional questions are provided as examples, such as calculating interest rates, future/present values, and lengths of loans.

Uploaded by

Fakhir ZaidiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 7