100% found this document useful (1 vote)

838 views1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019

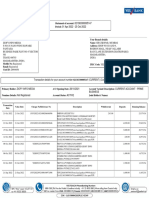

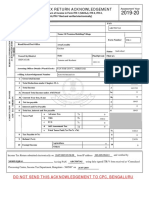

This pay slip summarizes Amaresh Chandra Nayak's earnings and deductions for March 2019. He earned a basic salary of Rs. 22,625 along with HRA of Rs. 10,181 and other allowances totaling Rs. 41,312 in gross pay. Provident fund and life insurance contributions were deducted totaling Rs. 1,805. His net pay for the month was Rs. 39,507. An annual income tax worksheet shows total earnings of Rs. 511,942 for the fiscal year with deductions reducing his taxable income to Rs. 341,742, resulting in a total tax due of Rs. 2,170.

Uploaded by

Amaresh NayakCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

838 views1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019

This pay slip summarizes Amaresh Chandra Nayak's earnings and deductions for March 2019. He earned a basic salary of Rs. 22,625 along with HRA of Rs. 10,181 and other allowances totaling Rs. 41,312 in gross pay. Provident fund and life insurance contributions were deducted totaling Rs. 1,805. His net pay for the month was Rs. 39,507. An annual income tax worksheet shows total earnings of Rs. 511,942 for the fiscal year with deductions reducing his taxable income to Rs. 341,742, resulting in a total tax due of Rs. 2,170.

Uploaded by

Amaresh NayakCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1