Tomas Del Rosario College

Capitol Drive, San Jose, Balanga City, Bataan

Telefax No.: (047)791-6152; Tel. Nos.: (047) 237-3511, 237-0841

BACHELOR OF SCIENCE IN ACCOUNTANCY

(Course Syllabus)

Course: Actg. 3

Course Title: Financial Accounting & Reporting, Part I

Course Credit: Six (6) units

Prerequisite: Fundamentals of Accounting, Part II

Course Description

This course introduces the nature, functions, scope, and limitations of the broad field of accounting

theory. It deals with the study of the theoretical accounting framework objectives of financial

statements, accounting conventions, and generally accepted accounting principles, standard setting

process for accounting practice, national as well as international principles relating to the preparation

and presentation of financial statements, the conditions under which they may be appropriately applied,

their impact or effect on the financial statements; and the criticisms commonly leveled against them. The

course covers the detailed discussion, appreciation, and application of accounting principles covering the

assets, financial and nonfinancial. Emphasis is given on the interpretation and application of theories of

accounting in relation to cash, temporary investments, receivables, inventories, prepayments, long-term

investments, property, plant and equipment, intangibles, and other assets, including financial statement

presentation and disclosure requirements. The related internal control, ethical issues, and management of

assets are also covered. Exposure to computerized system in receivables, inventory, and lapsing

schedules is a requirement in this course.

Course Outline:

1. Concepts and principles relating to the preparation and presentation of financial statements

2. Financial Reporting Standards Council and Conceptual Framework for the Preparation and

Presentation of Financial statements

2.1 Financial Reporting Standards Council (Creation, objectives and functions;

Membership/composition; Standard setting process)

2.2 The IASB, history, current structure and processes, globalization of capital markets, calls

for the harmonization of accounting standards, formation and achievements of the IASC

2.3 Conceptual Framework for the Preparation and Presentation of Financial Statements

2.3.1 Users and their information needs

2.3.2 Objective of financial statements

2.3.3 Underlying assumptions in the preparation of financial statements

2.3.4 Qualitative characteristics of financial statements (Understandability,

Relevance, Reliability, Comparability)

2.3.5 Principles of Recognition and Measurement (Measurement base)

2.3.6 Elements of financial statements and their definition (Assets, Liabilities,

Equity, Income, Expenses)

� 2.3.7 Recognition and measurement of the elements of financial statements

2.3.8 Concepts of capital and capital maintenance (Financial concept, Physical

concept)

3. Introduction to Financial Instruments

3.1 Definition of financial instruments [Financial assets: nature and examples, Financial

liabilities: nature and examples, Equity instruments: nature and examples (Distinction

between equity and financial liabilities), Compound financial instruments]

3.2 Categories of financial assets/financial liabilities

3.3 Financial assets covered by PAS 32 & 39

3.4 Other financial assets excluded from the scope of PAS 39 and addressed under other

PFRS

3.5 Approach in accounting for financial instruments

3.6 Nonfinancial assets/nonfinancial liabilities: nature and examples

4. Accounting for Cash

4.1 Definition, nature and composition of cash and cash equivalents

4.2 Recognition and measurement of cash

4.3 Management and control of cash (Accounting of petty cash fund, Bank reconciliation at a

single date)

4.4 Financial statement valuation, presentation and disclosure

5. Accounting for Receivables

5.1 Definition, nature and classification of receivables

5.2 Accounting for receivables [Recognition, Initial and subsequent measurement,

Impairment and uncollectibility of receivables (Assessment and recording of impairment

loss, Reversal or recovery of impairment loss), Derecognition, Generating cash from

receivables]

5.3 Accounting for notes/loans receivable (Definition and types of promissory notes,

Recognition, Initial measurement and valuation at present value)

5.4 Receivable financing arrangements {Accounts receivable [Pledging (general assignment

of receivables), Factoring, Assignment of specific receivable]; Notes receivable

(Discounting)}

5.5 Notes/loans receivable impairment and uncollectibility

5.6 Financial statement presentation and disclosure

5.7 Internal control measures for receivable

6. Accounting for Investments in Equity and Debt Instruments including basic concepts on

Derivatives (covered by PAS 32 and 39)

6.1 Investment in equity instruments covered by PAS 32 and 39 [Investment in marketable

equity securities (Designated at fair value through profit or loss, Trading, Available-for-

sale), Investment in unquoted equity securities]

6.2 Investment in debt instruments [Held-to-maturity investments, Not held-to-maturity

(Trading, Available-for-sale)]

7. Accounting for Inventories

7.1 Definition, nature and classes of inventories

7.2 Recognition

7.3 Initial measurement at cost

� 7.4 Inventory recording systems (Periodic inventory system, Perpetual inventory system)

7.5 Inventory costing methods (Items not ordinarily interchangeable: Specific identification;

For items that are interchangeable: First in, First out, method, Weighted average cost

method)

7.6 Inventory estimation methods [Gross profit method, Retail inventory method (excluding

peso value and retail info)]

7.7 Valuation at lower of cost and net realizable value (Write-down to net realizable value,

Reversal of write-down)

7.8 Other Inventory Issues (Purchase commitment, Inventory valued at selling price, Use of

more than one cost method, Borrowing costs, Lump-sum acquisition, Inventory errors)

7.9 Financial statement presentation and disclosures

7.10 Internal control and management of inventory

8. Accounting for agricultural activities and biological assets

8.1 Definition, nature and classes

8.2 Recognition

8.3 Initial measurement at cost

8.4 Valuation at lower of cost and net realizable value (Write-down to net realizable value,

Reversal of write-down)

8.5 Financial statement presentation and disclosures

9. Accounting for Property, Plant and Equipment

9.1 Definition, nature and classes

9.2 Recognition

9.3 Initial measurement (Cash purchase, Purchase on a deferred payment contract, Issuance

of securities, Donation or discovery, Self-construction, Exchanges of non-monetary and

monetary assets)

9.4 Expenditures subsequent to acquisition

9.5 Valuation or measurement subsequent to initial recognition (Benchmark method – cost

less accumulated depreciation and accumulated impairement losses; Allowed alternative

method – revaluation at fair value less) accumulated depreciation and accumulated

impairment losses

9.6 Depreciation of assets (Definition, nature and causes; Factors affecting depreciation;

Methods of depreciation (Straight-line method, Declining balance method, Sum-of-the-

years’ digits method, Group and composite depreciation)

9.7 Depletion of wasting assets

9.8 Accounting changes affecting depreciation

9.9 Revaluation of property, plant and equipment (Recording on date of revaluation,

Frequency of revaluation, Revaluation increase, Revaluation decrease, Realized

Revaluation)

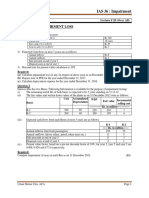

9.10 Impairment of assets (Definition, When to recognize and how to measure impairment

loss, Measurement of recoverable amount, Impairment loss for an individual asset,

Impairment loss for cash-generating unit, Reversal of previously recognized impairment

loss)

9.11 Retirement and disposals

9.12 Financial statement presentation and disclosures

9.13 Internal control and management of property, plant and equipment

�10. Accounting for Intangible Assets

10.1 Definition, nature, and classes

10.2 Recognition criteria

10.3 Initial measurement and accounting for intangibles (Patents, Copyright, Trademarks and

trade names, Franchise rights, Leaserights, Computer software, Goodwill, Research and

development costs, Other intangible assets)

10.4 Subsequently incurred costs

10.5 Measurement subsequent to initial recognition (Cost method, Revaluation method)

10.6 Amortization

10.7 Impairment of value of intangible assets

10.8 Reversal of impairment loss

10.9 Retirements and disposition

10.10 Financial statement presentation and disclosures

10.11 Internal control measures for intangibles

11. Accounting for Other Types of Investments

11.1 Investment in cash surrender value of life insurance

11.2 Investment in funds/Bonds

11.3 Investment property

11.4 Investment in associates*

12. Accounting for Noncurrent Assets Held for Sale

Detailed discussion covered in Advanced Accounting subjects

Suggested References

Alfredson, Keith, L. Ken, R. Picker, P. Pacter, and J. Radford. (2005). Applying International

Accounting Standards. Australia: John Wiley and Sons, Ltd.

Cabrera, E. B. Financial Accounting and Reporting, Theory and Practice Volume 1, 2007

Edition, GIC Enterprises, C. M. Recto, Manila

Robles, N., and P. M. Empleo. (2005). Intermediate Accounting Volume 1 (2005).

Mandaluyong: Millenium Books, Inc.

Valix, C. T. and J. Peralta. (2007). Financial Accounting Volume 1 (Based on PAS, PFRS, IAS,

IFRS). Manila: GIC Enterprises.

Valencia, E. and G. Roxas (2004). Financial Accounting. Mandaluyong Millennium Books, Inc.

Baysa, Gloria T., MC. Y. Lupisan, and E. F. Ledesma. (2006). Financial Accounting Theory.

Mandaluyong Millennium Books, Inc.

Padilla, N. (2005). Financial Accounting – Theory of Accounts. Manila: GIC Enterprises.

Weygandt, Kieso, and Warfield, Intermediate Accounting (2004) 11th Ed., Millennium Books,

Inc., Shaw Blvd., Mandaluyong City.

Compilation of Philippine Accounting Standards (PAS), Philippine Financial Reporting

Standards (PFRS)