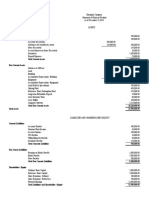

Pratt Company

Statement of Financial Position

December 31, Year 2 and Year 1

(dollars in thousands)

Year 2 Year 1

Current assets:

Cash and marketable securities $ 140 $ 140

Accounts receivable, net 190 180

Inventory 150 150

Prepaid expenses 70 70

Total current assets 550 540

Noncurrent assets:

Plant & equipment, net 1,490 1,420

Total assets $2,040 $1,960

Current liabilities:

Accounts payable $ 160 $ 160

Accrued liabilities 50 60

Notes payable, short term 230 250

Total current liabilities 440 470

Noncurrent liabilities:

Bonds payable 300 300

Total liabilities 740 770

Stockholders’ equity:

Preferred stock, $5 par, 10% 120 120

Common stock, $5 par 180 180

Additional paid-in capital–common stock 210 210

Retained earnings 790 680

Total stockholders’ equity 1,300 1,190

Total liabilities & stockholders’ equity $2,040 $1,960

Pratt Company

Income Statement

For the Year Ended December 31, Year 2

(dollars in thousands)

Sales (all on account) $2,000

Cost of goods sold 1,400

Gross margin 600

Selling and administrative expense 240

Net operating income 360

Interest expense 30

Net income before taxes 330

Income taxes (30%) 99

Net income $ 231

Dividends during Year 2 totaled $121 thousand, of which $12 thousand were preferred dividends. The

market price of a share of common stock on December 31, Year 2 was $80.