0% found this document useful (0 votes)

117 views8 pagesHomework Chapter 11

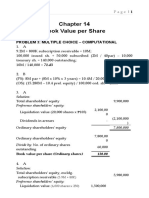

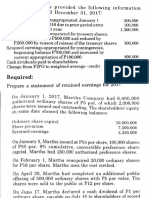

The document contains homework problems involving journal entries for issuing stock and paying dividends. Problem E11-1 involves journal entries for issuing common stock at par value and in excess of par value. Problem E11-2 records the issuance of preferred stock and repurchase of treasury stock. Problem E11-3 tracks the issuance of preferred stock over time. Problems P11-1A and P11-2A provide multiple stock transactions with calculations of stockholders' equity accounts.

Uploaded by

Linh TranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

117 views8 pagesHomework Chapter 11

The document contains homework problems involving journal entries for issuing stock and paying dividends. Problem E11-1 involves journal entries for issuing common stock at par value and in excess of par value. Problem E11-2 records the issuance of preferred stock and repurchase of treasury stock. Problem E11-3 tracks the issuance of preferred stock over time. Problems P11-1A and P11-2A provide multiple stock transactions with calculations of stockholders' equity accounts.

Uploaded by

Linh TranCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 8