0% found this document useful (0 votes)

250 views100 pagesModule 1

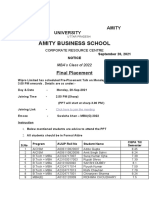

This document provides an overview of the Amity Business School's Financial Management course. The course covers topics such as financing decisions, investment decisions, dividend decisions, and valuation concepts across 5 modules. It introduces key concepts in financial management like time value of money, risk and return, capital budgeting, and capital structure. The goal of financial management is to maximize shareholder wealth. The document also provides a brief introduction to the Indian financial system and various methods of raising finance.

Uploaded by

aditi anandCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

250 views100 pagesModule 1

This document provides an overview of the Amity Business School's Financial Management course. The course covers topics such as financing decisions, investment decisions, dividend decisions, and valuation concepts across 5 modules. It introduces key concepts in financial management like time value of money, risk and return, capital budgeting, and capital structure. The goal of financial management is to maximize shareholder wealth. The document also provides a brief introduction to the Indian financial system and various methods of raising finance.

Uploaded by

aditi anandCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 100