0% found this document useful (0 votes)

187 views2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)

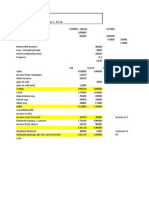

1. The document provides sample problems and solutions for accounting for long-term investments using the equity method.

2. It includes an example of allocating the fair value adjustment for an investment in a subsidiary and calculating income from the investment.

3. A second example demonstrates accounting for an investment where the acquiree's book value differs from fair value, including adjusting investment income.

Uploaded by

Rezky ApriliantiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

187 views2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)

1. The document provides sample problems and solutions for accounting for long-term investments using the equity method.

2. It includes an example of allocating the fair value adjustment for an investment in a subsidiary and calculating income from the investment.

3. A second example demonstrates accounting for an investment where the acquiree's book value differs from fair value, including adjusting investment income.

Uploaded by

Rezky ApriliantiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2