East West University

Department of Business Administration

Financial Analysis & Control (FIN 408)

Fall 2020

Term Final Total Marks: 25 Time: 80 minutes

Question No: 01 [Marks: 18]

BSRM is the leading steel manufacturing company and one of the prominent corporate houses in

Bangladesh. Over the years, BSRM steel products have been chosen solely for building major

National landmarks and infrastructures. To name a few, the Padma Bridge, Rooppur Neuclear

Power Plant, Hatirjheel Project, Zillur Rahman Flyover, Mayor Hanif Flyover and Shah Amanat

Bridge were built with BSRM.

BSRM Xtreme is a product that was introduced when there were no graded steel in Bangladesh. It

was a major change in the steel industry of Bangladesh. The core driver was the belief in evolution

in steel products, which resulted in bringing the first EMF tested rod, the first steel brand that

passed 5 million cyclic loading Fatigue testing in the U.K. and conformed to 10 global standards.

With the largest steel producing factory in the country and employing the best technology from

Europe, the company maintains volume with uncompromising quality. BSRM is dedicated to

providing the best solution for the construction industry.

(1) To finance a new project, the management of BSRM has decided to issue some bond in market

each with a face value of Tk 1,000 and maturity 4 years on January 01, 2021. The company will

issue either a 12% coupon interest bond or a zero coupon bond. The current market interest rate is

15%. Show the interest expense, ending balance and surplus/ deficit over the life time of the bond.

Also show the income statement, balance sheet and cash flow statement effect over the life time

of the bond. [8]

(2) After collecting fund by issuing bond, BSRM is going to invest the money for buying trademark

from an US based organization, in which method, the purchase price of the trademark should be

recorded? Why? [2]

(3) Last year, BSRM spend a good amount of money to prepare an advertisement. Now the

accountant is confused in which method the cost of advertisement to be recorded. Suggest which

method (capitalized or expensing) should be followed and why? [2]

(4) BSRM expects to collect in total Tk 20 lac by selling the bonds out of which Tk 8 lac will be

used to buy a new machine for its factory. The machine is expected to have an economic lifetime

of 5 years. The salvage value is expected to be Tk 80,000. Show the depreciation amount,

accumulated depreciation and net book value of the machine over the lifetime of the machine. [4]

�(5) In the previous case, if the machine’s lifetime is reduced to 4 years and salvage value is decided

to be Tk 60,000, what will be the first year’s depreciation amount under the Sum of Year Digit

method? [2]

Question No: 02 [Marks: 2]

During the initial period of an asset, what impact is found in the income statement of a company

for straight line depreciation method and accelerated depreciation method?

Question No: 03 [Marks: 3]

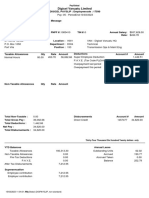

Following are the financial statement for Decta Company. The company started a construction

project in 2008, to support which, it took a loan at that time. The interest cost on the taken loan is

given below.

2008 2009 2010

Capitalized Interest 140,000 108,000 82,000

Recently, company’s CFO has been changed and the new CFO has decided to account the interest

cost as expense not as capital expense. So he has asked the account officer to make the changes in

the income statement.

The details of the income statement and cash flow statement of the company are given below.

Make correction in the accounts as per CFO’s requirement.

Income Statement

2008 2009 2010

EBIT Tk. 2,100,000 Tk. 5104,000 Tk. 5,750,000

Interest Expense 400,000 364,000 5,500,000

EBT 1,700,000 4740,000 2,50,000

Tax 510,000 1,422,000 75,000

Net Income 1,190,000 3,318,000 1,25,000

Question No: 04 [Marks: 2]

“Under expensing method the debt to total equity ratio is poor.” Why?