0% found this document useful (0 votes)

449 views8 pagesTopic II - Statement of Comprehensive Income

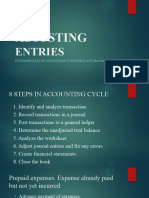

1. The document discusses the statement of comprehensive income (SCI), including its purpose of showing a company's financial performance over a period of time.

2. It explains the key elements of the SCI for both service and merchandising businesses. For service businesses, the single-step format is used, listing revenues and expenses separately. For merchandising, the multi-step format subtracts cost of goods sold from sales to calculate gross profit.

3. Examples are provided of SCIs for both a service company and merchandising company to illustrate the different presentation formats.

Uploaded by

Jianne Ricci GalitCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

449 views8 pagesTopic II - Statement of Comprehensive Income

1. The document discusses the statement of comprehensive income (SCI), including its purpose of showing a company's financial performance over a period of time.

2. It explains the key elements of the SCI for both service and merchandising businesses. For service businesses, the single-step format is used, listing revenues and expenses separately. For merchandising, the multi-step format subtracts cost of goods sold from sales to calculate gross profit.

3. Examples are provided of SCIs for both a service company and merchandising company to illustrate the different presentation formats.

Uploaded by

Jianne Ricci GalitCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 8