0% found this document useful (0 votes)

72 views5 pagesWeb Aggregator Syllabus

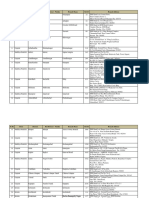

This document provides a syllabus for a course on web aggregators for life, health, and general insurance. It includes 25 chapters covering topics such as the history of insurance; customer service; grievance redressal mechanisms; regulatory aspects of web aggregators; legal principles of insurance contracts; life insurance products and applications; health insurance documentation, products, underwriting, and claims; general insurance principles; and personal and retail insurance. The syllabus provides an overview of the key concepts and issues that will be covered in the course.

Uploaded by

sam franklinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

72 views5 pagesWeb Aggregator Syllabus

This document provides a syllabus for a course on web aggregators for life, health, and general insurance. It includes 25 chapters covering topics such as the history of insurance; customer service; grievance redressal mechanisms; regulatory aspects of web aggregators; legal principles of insurance contracts; life insurance products and applications; health insurance documentation, products, underwriting, and claims; general insurance principles; and personal and retail insurance. The syllabus provides an overview of the key concepts and issues that will be covered in the course.

Uploaded by

sam franklinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 5