0% found this document useful (0 votes)

122 views4 pagesDCFguide Example

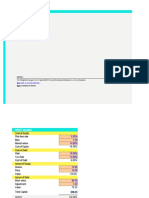

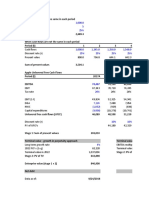

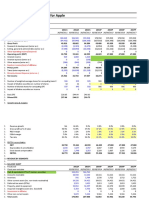

The document outlines cash flow calculations for a financial analysis, detailing both constant and variable cash flows with respective present values. It provides unlevered free cash flow projections for Apple from 2017 to 2022, including EBITDA, EBIT, and capital expenditures, along with their present values. Additionally, it calculates the enterprise value using two methods: growth in perpetuity and EBITDA multiple, resulting in different valuations.

Uploaded by

LawCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

122 views4 pagesDCFguide Example

The document outlines cash flow calculations for a financial analysis, detailing both constant and variable cash flows with respective present values. It provides unlevered free cash flow projections for Apple from 2017 to 2022, including EBITDA, EBIT, and capital expenditures, along with their present values. Additionally, it calculates the enterprise value using two methods: growth in perpetuity and EBITDA multiple, resulting in different valuations.

Uploaded by

LawCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 4