0% found this document useful (0 votes)

150 views5 pages(Career Point Infosystem IPO) : M.B.A. (Finance) 3

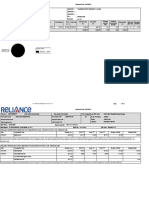

Career Point Infosystems is floating its initial public offering of Rs. 115 crores. The company provides tutorial services for competitive entrance exams across India. It operates 14 company-operated training centers and 18 franchisee centers. Some key details of the IPO include an issue price of Rs. 310 per share, a minimum order quantity of 20 shares, and purposes of using proceeds for campus development and acquisitions. The shares are proposed to be listed on the Bombay Stock Exchange and National Stock Exchange.

Uploaded by

Priyanka AgarwalCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

150 views5 pages(Career Point Infosystem IPO) : M.B.A. (Finance) 3

Career Point Infosystems is floating its initial public offering of Rs. 115 crores. The company provides tutorial services for competitive entrance exams across India. It operates 14 company-operated training centers and 18 franchisee centers. Some key details of the IPO include an issue price of Rs. 310 per share, a minimum order quantity of 20 shares, and purposes of using proceeds for campus development and acquisitions. The shares are proposed to be listed on the Bombay Stock Exchange and National Stock Exchange.

Uploaded by

Priyanka AgarwalCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 5