0% found this document useful (0 votes)

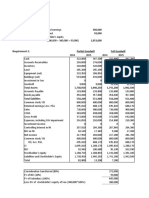

362 views20 pagesFinancial Statement Analysis Of: Asian Paints Limited

Asian Paints Limited is India's largest and the world's second largest paint company by market capitalization. It manufactures a wide range of paints for decorative and industrial use. Asian Paints has a market share of 60% in decorative paints and 20% in automotive coatings in India. Over the past 5 years, the company's revenue has grown at 5.97% annually and net income has grown at 12.46% annually. Asian Paints operates 11 manufacturing facilities in India and 18 internationally through its subsidiaries serving customers in 65 countries.

Uploaded by

PreetiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

362 views20 pagesFinancial Statement Analysis Of: Asian Paints Limited

Asian Paints Limited is India's largest and the world's second largest paint company by market capitalization. It manufactures a wide range of paints for decorative and industrial use. Asian Paints has a market share of 60% in decorative paints and 20% in automotive coatings in India. Over the past 5 years, the company's revenue has grown at 5.97% annually and net income has grown at 12.46% annually. Asian Paints operates 11 manufacturing facilities in India and 18 internationally through its subsidiaries serving customers in 65 countries.

Uploaded by

PreetiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 20