0% found this document useful (0 votes)

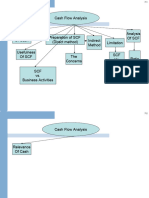

99 views36 pagesChapter 13 - Cfs - Lecture Notes

Uploaded by

Trung Võ ThànhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

99 views36 pagesChapter 13 - Cfs - Lecture Notes

Uploaded by

Trung Võ ThànhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 36