0% found this document useful (0 votes)

1K views1 pageAcknowledgement AY 22-23

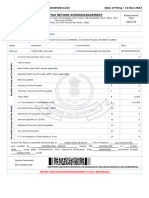

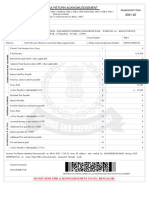

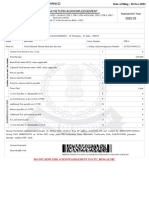

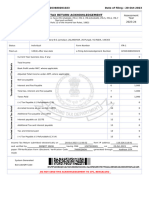

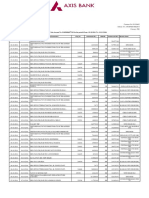

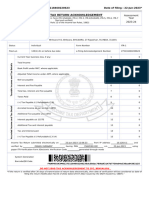

This document is an Indian Income Tax Return Acknowledgement for Chaitali Hiral Shah for the 2022-23 assessment year. It acknowledges the filing of her revised return using Form ITR-1. Her total income is Rs. 4,10,000 and she has no net tax payable or interest and fees owed. Her return was electronically filed and verified on July 30, 2022.

Uploaded by

Nirav RavalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views1 pageAcknowledgement AY 22-23

This document is an Indian Income Tax Return Acknowledgement for Chaitali Hiral Shah for the 2022-23 assessment year. It acknowledges the filing of her revised return using Form ITR-1. Her total income is Rs. 4,10,000 and she has no net tax payable or interest and fees owed. Her return was electronically filed and verified on July 30, 2022.

Uploaded by

Nirav RavalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1