Non Profit Organinzation Q & A

Uploaded by

Jas Singh DevganNon Profit Organinzation Q & A

Uploaded by

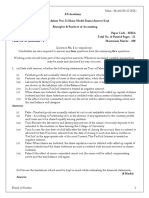

Jas Singh DevganDK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

studiestoday.com

DK Goel Solutions Class 12 Accountancy

Chapter 1 Financial Statements of Not for

Profit Organisations

54–68 minutes

Read DK Goel Solutions Class 12 Accountancy Chapter 1 Financial

Statements of Not for Profit Organisations below, These solutions have

been prepared based on the latest book for DK Goel Class 12 for current

academic year. These solutions for DK Goel Accountancy Class 12 help

commerce students understand the concepts of accountancy and build

strong base in accounts. Refer to the solutions provided below prepared

by CBSE NCERT teachers

Financial Statements of Not for Profit Organisations DK

Goel Class 12 Solutions

Class 12 Accountancy students should refer to the following DK Goel

Solutions for Class 12 Chapter Financial Statements of Not for Profit

Organisations in standard 12. This DK Goel Book for Grade 12

Accountancy will be very useful for exams and help you to score good

marks

DK Goel Class 12 Financial Statements of Not for Profit

Organisations

Short Answer Questions

Question 1. Give three essential features of Receipts and Payments

Account.

1 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 1. Features of Receipts and Payments Account:

1.) Capital and Revenue: It records all receipts and payments whether

they are of revenue nature or capital nature.

2.) Period: It records cash and bank transactions without distinguishing

among current, previous or succeeding (next) accounting periods.

3.) Opening and Closing Balance: Opening balance of this account

shows cash in hand and/or at bank in the beginning of the accounting

period and closing balance shows cash in hand and/or at bank at the end

of the accounting period.

Question 2. Give three essential features of Income and Expenditure

Account.

Solution 2. Features of Income and Expenditure Account:-

1.) Nature: It is a Nominal Account. Hence, it is debited with expenses

and losses and it is credited with income and gains.

2.) Opening and Closing Balance: It does not have an opening Balance.

Its Balance at the end is either surplus or deficit. It is transferred to Capital

Fund in the Balance Sheet.

3.) Adjustment: This account is prepared on accrual basis of accounting

and thus all adjustments relating to prepaid or outstanding expenses and

income, provision for depreciation or doubtful debts are made.

Question 3. Distinguish between Income and Expenditure Account

and Receipt and Payment Account on the basis of:

(1) Nature, (ii) Nature of items, (iii) Period

Solution 3.

2 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 4. How would a not-for-profit organisation deal with the

following items:

(i) Outstanding Subscriptions, (ii) Subscriptions Received in

advance, (iii) Tournament Fund.

Solution 4.

(i) Outstanding Subscription:- Outstanding Subscription Of that year is

recorded on debit side of Income and Expenditure A/c and also shown in

the Balance Sheet of Current year in the Assets Side.

(ii) Subscriptions Received in advance:- Subscriptions Received in

advance for the following year are shown on the liabilities side of the

Balance Sheet.

(iii) Tournament Fund:- Tournament Fund will be treated in the liability

side of Balance Sheet according to its Adjustments.

Question 5. List the items that you will exclude from the Income and

expenditure Account and in each case state briefly in a sentence or

two why you excluded that item?

Solution 5.

1. Opening and closing cash/bank balances have been excluded.

2. Payment for purchase of Government securities being capital

expenditure has been excluded.

3. Amount of subscriptions received for the year 2013-14 and 2014-15

3 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

have been excluded.

4. Life membership fee is an item of capital receipt and so excluded.

5. Donation for building is a receipt for a specific purpose and so

excluded.

Question 6. Explain the following terms:

(i) Capital Fund; (ii) Legacy (iii) Specific Donations.

Solution 6.

(i) Capital Fund:- Capital Fund does not carry any restriction with respect

to its use. In other words, managements can use the amounts in the fund

as it deems appropriate, but to carry out the purpose for which the

organisation exists.

(ii) Legacy:- Legacy is the amount received as donation by a Not-for-

Profit Organisation under Will of deceased person. The donor may or may

not specify conditions for its use. In case, no condition is specified, it is

accounted as ‘General Donation’. And if a condition is specified, it is

accounted as ‘Specific Donation’.

(iii) Specific Donation:- In case the donor specifies the purpose for

which the donation can be used, it is a Specific Donation. For example, a

donor donates Rs. 5,00,000 for a library. It means the donation received

can be used only for library, i.e. it is a specific donation. Specific donation

is capitalised and is shown on the liabilities side of the Balance Sheet.

Question 7. How will you deal with sale of old assets while

preparing the financial statements of a not-for-profit organisation?

Solution 7. Sale of an asset may result in gain, if sale value is more

than the book value; or loss, if sale value is less than the book value; or

neither profit nor loss, if sale value is equal to the book value. Book Value

of an asset as on the date of sale is determined after charging

depreciation up to the date of sale. Sale Value is credited to the Asset

Account while gain, if any, is credited or loss, if any is debited to the

4 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Income and Expenditure Account.

Question 8. How would a non-profit organisation record the

following items while preparing Income & Expenditure Account and

Balance Sheet

(i) Entrance Fees

(ii) Life Membership Fees

(iii) Legacy

(iv) General Donation

Solution 8.

(i) Entrance Fees:- Entrance Fee or Admission fee is the amount paid by

a person at the time of becoming a member of a Not-for-Profit

Organisation. Entrance Fee or Admission Fee is a revenue receipt and

therefore, is accounted as an income and credited to Income and

Expenditure Account.

(ii) Life Membership Fees:- Life Membership Fees is accounted as a

Capital Receipt and added to Capital Fund on the liabilities side of the

Balance Sheet. It is not accounted as income because a life member

makes one time payment and avails services all through his life.

(iii) Legacy:- Legacy is the amount received as donation by a Not-for-

Profit Organisation under Will of deceased person. The donor may or may

not specify conditions for its use. In case, no condition is specified, it is

accounted as ‘General Donation’. And if a condition is specified, it is

accounted as ‘Specific Donation’.

(iv) General Donation:- General Donation is the donation in which the

donor does not specify any condition for its use. The amount of general

donation is accounted as an income and credited to income and

expenditure account.

Question 9. How will you treat the following items while preparing

Income and expenditure A/c and Balance sheet of non-profit

5 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Organisation?

(i) Donation for Building (ii) Sale of Newspapers (iii) Investment

purchased.

Solution 9.

(i) Donation for Building:- Donation for Building means the donation

received can be used only for building it is a specific donation. Specific

donation is capitalised and is shown on the liabilities side of the Balance

Sheet.

(ii) Sale of Newspapers:- Amount paid for newspapers, magazines,

periodicals, etc. is debited to income and Expenditure Account, it being a

revenue expense. Thus, amount realised from sale of old newspapers,

magazines, periodicals, etc. is credited to Income and Expenditure

Account.

(iii) Investment Purchased:- Purchases of Investments are treated as

capital expenditures and shown on the assets side of the Balance Sheet.

Question 10. What amount will be credited to the Income and

Expenditure Account for the year ending 31st March, 2019 on the

basis of following information?

Subscriptions received during the year 2018-19 were 1,80,000.

Solution 10.

6 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 11. What amount will be credited to the Income and

Expenditure Account for the year ending 31st March, 2019 on the

basis of the following information :

Subscriptions received during the year 2018-19 were 2,00,000.

Solution 11.

Question 12. What amount will be credited to the Income and

Expenditure Account for the year ending 31st March, 2019 on the

basis of the following information :

Subscriptions received during the year 2018-19 were 5,00,000.

Solution 12.

7 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 13. Sports Club Ahmedabad had received in 2020-21 Rs.

80,000 as subscription. Further information is:

Solution 13. What amount should be credited to Income and

Expenditure Account as subscriptions?

Question 14. How much amount will be recorded in Income and

Expenditure Account if club has 400 members each paying an

annual subscription of 100. Outstanding Subscription on 31st March,

2019 were 2,000.

Solution 14.

8 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 15. How much amount will be recorded in Income and

Expenditure Account if club has 500 members each paying an

annual subscription of 200. On 31st March 2019, Advance

Subscription is 1,000 and Outstanding Subscription is Rs. 5,000.

Solution 15.

Question 16. How much amount will be recorded in Income and

Expenditure Account if there are 500 members, each paying an

annual subscription of 100; subscriptions received during the year

46,000; subscriptions received in advance at the beginning of the

year 1,200.

Solution 16.

Question 17. Salary paid by Rotary Club for the year ended 31st

March, 2019 amounted to 1,20,000. How much amount will be

recorded in 'Income and Expenditure Account' if unpaid salary was

5,000 and salary paid in advance was 1,000 on 31st March, 2019.

9 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 17.

Question 18. Salary paid by Lions Club for the year ended 31st

March, 2019 amounted to 1,80,000. How much amount will be

recorded in Income and Expenditure Account if outstanding salary

on 31st March, 2018 was 10,000 and Outstanding salary on 31st

March, 2019 was 6,000.

Solution 18.

Question 19. Salary paid by Jaipur Sports Club for the year ended

31st March, 2019 amounted to 2,00,000. How much amount will be

recorded in Income and Expenditure Account in the following case :

Solution 19.

10 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 20. In the year 2020-21, salaries paid in cash amounted to

Rs. 40,000. Ascertain the amount chargeable to Income and Exp. A/c

for the year ending on 31st March 2021 from the following additional

information:

Solution 20.

Question 21. Calculate what amount will be posted to Income and

Expenditure Account for the year ending 31st March, 2021:

Amount paid for stationery during the year Rs.10,000; stock of

stationery in hand at the beginning and end of the year RS.1,200 and

Rs.1,500 respectively.

11 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 21.

Question 22. How much amount will be shown in Income and

Expenditure Account in the following case :

Solution 22.

Question 23. How much amount will be shown in Income and

Expenditure Account in the following case:

Solution 23.

12 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 24. How much amount will be shown in Income and

Expenditure Account in the following case :

Solution 24.

Question 25. How much amount will be shown in Income and

Expenditure Account in the following case :

13 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 25.

Question 26. How much amount will be shown in Income and

Expenditure Account in the following case :

During 2018-19 payment made for Stationery was 40,000.

Solution 26.

14 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 27. Amount paid for sports materials during the year Rs.

20,000; stock of sports materials at the beginning and end of the

year Rs. 3,300 and Rs. 2,900 respectively, creditors for sports

materials at the beginning and end of the year Rs. 5,000 and Rs.

4,000 respectively. What amount will be recorded in Income &

Expenditure Account?

Solution 27.

Question 28. On the basis of following information, calculate the

amount of stationery to be shown in Income and Expenditure

Account for the year ended 31st March, 2019.

Solution 28.

Question 29. From the following information, calculate the amount

of stationery consumed by 'Shree Club' for the year ended 31st

March, 2018.

15 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

During the year creditors were paid Rs.3,00,000.

Solution 29.

Numerical Questions:-

Question 1. From the information given below, prepare Receipts and

Payments Account of Modern Club, Janakpuri for the year ending on

March 31, 2021:

Solution 1.

16 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Sale of an asset may result in gain, if sale value is more than the book

value; or loss, if sale value is less than the book value; or neither profit nor

loss, if sale value is equal to the book value. Book Value of an asset as on

the date of sale is determined after charging depreciation up to the date of

sale. Sale Value is credited to the Asset Account while gain, if any, is

credited or loss, if any is debited to the Income and Expenditure Account.

Question 2. From the following information, prepare Income and

Expenditure A/c for the year ending on 31st March, 2021 of an

Entertainment Club:

Solution 2.

17 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 3. How will you deal with the Entrance Fees while

preparing the final accounts for the year ended 31st March, 2017, in

each of the following alternative cases:

Case 1. During the year 2016-17, Entrance Fees received Rs.1,50,000.

Case 2. During the year 2016-17, Entrance Fees received Rs.1,50,000.

It is the policy of the club to treat the Entrance Fees as revenue

receipt.

Case 3. During the year 2016-17, Entrance Fees received Rs.

1,50,000. It is the policy of the club to treat the Entrance Fees as

capital receipt.

Case 4. During the year 2016-17, Entrance Fees received Rs.

1,50,000. According to the policy of the club 40% of the Entrance

Fees is to be capitalised.

Solution 3.

18 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Receipts and Payments Account is a summary of cash (including bank)

receipts and Payments during and accounting period, receipts and

payments being shown under appropriate heads of accounts.

Question 4. Show how will you deal with the following items in the

final accounts of Chetak Club, Jaipur as at 31st March, 2019:

Solution 4 .

19 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Receipts and Payments Account is a summary of cash (including bank)

receipts and Payments during and accounting period, receipts and

payments being shown under appropriate heads of accounts.

Question 5. Show how would you deal with the following items

while preparing the financial statements of a 'Not-for-Profit

organisation:

Solution 5.

Question 6 (new). How will the following information of Patna

Sports Club be presented in the Income and Expenditure Account

for the year ended 31st March, 2021 and its Balance Sheet as at that

20 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

date?

Solution 6 (new).

Question 6. How the following items for the year ended 31st March,

2018 will be presented in the financial statements of Aisko Club:

Solution 6.

21 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Receipts and Payments Account is a summary of cash (including bank)

receipts and Payments during and accounting period, receipts and

payments being shown under appropriate heads of accounts.

Question 7 (new). Show the following information in the Income and

Expenditure Account and the Balance Sheet of Madurai Sports Club

as at 31st March, 2021:

Solution 7 (new).

22 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 7. Show how will you deal with the following items while

preparing the fine accounts of a N.P.O. for the year ending 31st

March, 2020:

The construction work is in progress and has not yet completed.

Solution.

Question 8. As per Receipts and Payments Account for the year

ended on March 31, 2017, the subscriptions received were Rs.

6,00,000. Additional Information given is as follows:

1. Subscriptions outstanding on 1-4-2016 Rs. 60,000.

23 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2. Subscriptions outstanding on 31-3-2017 Rs. 40,000.

3. Subscriptions Received in Advance as on 1-4-2016 Rs. 32,000.

4. Subscriptions Received in Advance as on 31-3-2017 Rs. 38,000.

Ascertain the amount of income from subscriptions for the year

2016-17 and show how relevant items of subscriptions will appear in

opening and closing balance sheets.

Solution 8.

Question 9. The Chennai Sports Club received Rs. 6,50,000 by way

of subscriptions during the year ended on March 31, 2017.

24 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Show how the subscription will appear in Income and Expenditure

Account.

Solution 9.

Question 10. From the following information calculate the amount of

subscription to be credited to the Income and Expenditure Account

for the year 2016-17:

Solution 10.

25 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 11. From the following information related to a 'Health

Club', calculate the amount of subscriptions received during the year

ended 31st March, 2018.

Solution 11.

26 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 12. (A) From the following particulars, calculate amount

of subscriptions to be credited to the Income & Expenditure Account

for the year ended 31st March, 2019 and show the items in the

Balance Sheet as at that date.

Solution 12 (A).

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

27 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

accounting period.

Question 12. (B) In the year ended 31st March, 2019, subscriptions

received by Prince Club, Delhi were Rs. 2,50,000 including Rs. 15,000

for the year ended 31st March 2018 and Rs.13,000 for the year ended

31st March, 2020. At the end of the 31st March, 2019, subscriptions

outstanding for the year ended 31st March 2019 were Rs.25,000. The

subscriptions due but not received at the end of the previous, i.e.,

31st March, 2018 were Rs. 21,000, while subscriptions received in

advance on the same date were Rs. 16,500.

Show how the subscriptions will appear in Income and Expenditure

Account for the year ended 31st March, 2019 and in the Balance

Sheet as at that date.

Solution 12 (B)

Question 13. From the following information calculate the amount

of subscription outstanding as on 31st March, 2017:

A club has 200 members each paying an annual subscription of Rs.

1,000. The Receipts and Payments Account for the year showed a

sum of Rs. 2,05,000 received as subscriptions. The following

28 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

additional information is provided:

Rs.

Subscriptions Outstanding on 31st March 2016

30,000

Subscriptions received in advance on 31st March 2017

40,000

Subscriptions received in advanced on 31st March 2016

14,000

Solution 13 .

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 14. Subscriptions received during the year ended March

31,2017 by Hyderabad Art Club were as under:

Rs.

2015-16 5,000

2016-17 1,08,000

2017-18 3,000

29 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

______________

1,16,000

_______________

Additional Information :

Total number of members 240.

Annual Subscription fee Rs.500.

Subscriptions Outstanding on April 1, 2016 Rs. 9,000.

Show the amount of subscription in Income and Expenditure Account for

the year ended 31st March 2017 and in the Balance Sheet as at that date.

Solution 14.

Working Note:-

Total subscription received during the year 2016-17 Rs.

1,20,000

Less: Amount received during the year 2016-17 Rs.

1,08,000

Outstanding subscriptions for the year 2016-17 Rs. 12,000

Question 15. From the following extract of Receipts and Payments

Account and the additional information given below, compute the

amount of income from subscriptions and show as how they would

30 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

appear in the Income and Expenditure Account for the year ending

March 31, 2017 and the Balance Sheet as at that date:

Additional Information:

Rs.

1. Subscriptions outstanding March 31, 2016 10,000

2. Total Subscriptions outstanding March 31, 2017 25,000

3. Subscriptions received in advance as on March 31, 2016 4,000

Solution 15.

Question 16 (new). Calculate the amount of subscription to be

credited to Income and Expenditure Account for the year ended 31st

March 2020:

31 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 16.

Question 16. Following is the Receipts and Payments Account of

Star Club for the year ended 31st March, 2019:

Subscriptions outstanding on 31st March, 2018 were Rs. 4,500 and

on 31st March, 2019 were Rs.6,000. Rent outstanding at the

beginning of the year was Rs. 1000 and in the end was Rs. 1,500.

Furniture was purchased on 1st July, 2018.

On 1st April, 2018 the Club had Furniture valued Rs. 8000 and

Investments valued Rs. 15,000.

Prepare Income and Expenditure A/c for the year ended 31st March,

32 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2019 and a Balance Sheet as at that date, after depreciating furniture

by 10% p.a.

Solution 16.

Question 17. From the following Receipts and Payments account of

a Club, prepare Income & Expenditure Account for the year ended

31st March 2019 and a Balance Sheet as at that date:

33 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Subscriptions include Rs. 3,200 for the last year, rent include Rs. 900

paid for the last year. Subscriptions outstanding of the current year

are Rs. 4,500. Rent outstanding for the month of March, 2019 is

Rs.1,000 and a payment for stationery is also due for Rs. 250.

On 1-4-2018, Club had land valued Rs. 50,000 and furniture valued at

Rs.15,000.

Solution 17.

34 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 18. From the following Receipts and Payments Account of

Rolaxe Club, for the year ended 31st March, 2019, prepare Income

and Expenditure Account for the year ended 31st March, 2019.

Additional Information:-

(i) Depreciate furniture by 15% p.a.

(ii) There were 416 Life Members on 31.3.2018 the subscription

payable by each member, to be a life time member is Rs. 125.

(iii) Subscription outstanding on 31st March, 2018 6,000

Subscription outstanding on 31st March, 2019 7,000

35 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Subscription received in advance on 31st March, 2018 4,000

Subscription received in advance on 31st March, 2019 5,000

Solution 18.

Point of Knowledge:-

Life membership fees and entrance fees to be capitalised.

Question 19. Following is the Receipts and Payments Account of

Rajdhani Club for the year ended 31st March, 2015 :

Additional Information :

31-3-2014

31-3-2015

Rs. Rs.

36 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

(i) Outstanding Subscriptions 7,000

5,600

(ii) Subscriptions Received in advance 2,000

2,500

(iii) Salaries Outstanding 1,200

1,800

(iv) Furniture 10,000 —

(v) Sports Equipment 20,000 —

Depreciate furniture by 20% and Sports Equipment by 30%

You are required to prepare an Income and Expenditure Account for

the year ended 31st March, 2015 and a Balance Sheet as at that date.

Solution 19.

37 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 20. Following is the Receipt and Payment of Chennai Sports

Club for the year ended 31-3-2014:

Other Information:

On 31-3-2014 subscription outstanding was Rs. 4,000 and on 31-3-2013

38 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

subscription outstanding was Rs. 3,000. Salary outstanding on 31-3-2014

was Rs. 2,000.

On 1-4-2013 the club had building Rs. 80,000, furniture Rs. 20,000, 10%

investments Rs. 45,000 and sports equipment Rs. 25,000. Depreciation

charged on these items including purchases was 10%.

Prepare Income and Expenditure Account of the Club for the year ended

31-3-2014 and ascertain the Capital Fund on 31-3-2013. Also prepare a

Balance Sheet as at 31st March, 2014.

Solution 20.

39 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 21. Calculate the amount of medicines consumed to be

debited to Income & Expenditure Account for the year ended 31st

March, 2019:

Solution 21.

Question 22 (new) . Following is the Receipts and Payments

Account of Rajdhani Club for the year ended 31st March, 2021 :

40 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information : 31-3-2020 31-3-2021

Rs. Rs.

(i) Outstanding Subscriptions 7,000 5,600

(ii) Subscriptions Received in advance 2,000 2,500

(iii) Salaries Outstanding 1,200 1,800

(iv) Furniture 10,000 —

(v) Sports Equipment 20,000 —

Depreciate furniture by 20% and Sports Equipment by 30%

You are required to prepare an Income and Expenditure Account for the

year ended 31st March, 2021 and a Balance Sheet as at that date.

Solution (new).

41 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 22. On the basis of the information given below calculate

the amount of Sports Materials to be debited to the 'Income and

Expenditure Account' of Durga Sports Club for the year ended

42 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

31-3-2019:

Sports Materials purchased during the year ended 31-3-2019 were

Rs. 4,94,000.

Solution 22.

Working Note:-

Creditors for Sports Materials will be ignored because purchased of sports

materials given in the question.

Question 23 (new). Following is the Receipt and Payment of Chennai

Sports Club for the year ended 31-3-2021:

Other Information:

On 31-3-2021 subscription outstanding was Rs. 4,000 and on 31-3-2020

subscription outstanding was Rs. 3,000. Salary outstanding on 31-3-2021

was Rs. 2,000.

On 1-4-2020 the club had building Rs. 80,000, furniture Rs. 20,000, 10%

investments Rs. 45,000 and sports equipment Rs. 25,000. Depreciation

charged on these items including purchases was 10%.

43 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Prepare Income and Expenditure Account of the Club for the year ended

31-3-2014 and ascertain the Capital Fund on 31-3-2021. Also prepare a

Balance Sheet as at 31st March, 2014.

Solution 23 (new).

Question 23. Calculate what amount will be posted to Income &

Expenditure A/c for the year ending 31st March 2015 :

44 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 23.

Question 24. Calculate the amount that will appear against the item

Stationery Account, in the Income & Expenditure Account for the

year ended 31st March, 2019:

45 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

During 2018-19, the payment made to these creditors amounted to

Rs. 1,62,000. Stationery purchased in cash during the year was 25%

of the total purchase of Stationery.

Solution 24.

Question 25. How are the following items treated while preparing

the final accounts of a club for the year ended 31st March, 2019:

Solution 25.

46 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 26 (new). Calculate what amount will be posted to Income

& Expenditure A/c for the year ending 31st March 2021 :

Solution 26. (new)

47 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Payment made for purchase of stationery 42,000

Less: Opening Creditors 4,000

Advance paid as on 31st March, 2021 1,500 5,500

36,500

Add: Closing Creditors 8,000

Advance paid as on 31st March, 2020 6,000 14,000

Purchases of Stationery during the year 2020-21 50,500

Add: Stock in the beginning 7,000

57,500

Less: Closing Stock 3,000

Debit side of income and expenditure account 54,500

Question 26. The following is the Receipts and Payments Account

of Shri Mahbir Sports Club for the year ended 31st March, 2014 :

48 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information:

(i) Subscriptions Receivable is as follows:

On 31st March, 2013 Rs. 1,000

On 31st March, 2014 (for 2013-14) Rs. 2,500

(ii) Advance Subscriptions are as follows:

31st March, 2013 Rs. 600

31st March, 2014 Rs. 900

(iii) Stock of Medicines:

31st March, 2013 Rs. 480

31st March, 2014 Rs. 650

(iv) Staff Salary Payable :

31st March, 2013 Rs. 1,200

31st March, 2014 Rs. 1,400

(v) The total furniture on 1st April, 2013 was worth Rs. 20.000 and

book value of furniture sold was Rs. 5,000. Charge depreciation @

10% on closing balance of furniture.

Prepare an Income and Expenditure Account for the year ended 31st

March, 2014 and a Balance Sheet as at that date.

Solution 26.

49 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 27. Following is the Receipts and Payments Account of

50 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Maharaja Aggarsain Club, Bhiwani for the year ended 31st March,

2015 :

Other Information :

(i) Assets on 1-4-2014 were: Land and Building Rs. 1,50,000; Stock of

foodstuffs Rs. 2,200 and unused postage stamps 800.

(ii) Subscription due on 31-3-2014 was Rs. 2,400 and on 31-3-2015 (for

2014-15) was Rs. 3,500.

(iii) On 31st March, 2015 stock of foodstuffs was Rs. 3,800 and unused

postage stamps were of the value of Rs. 600.

(iv) The By-laws of the club provide that 60% of the Entrance fees and

20% of the surplus of any year are to be transferred to Reserve Fund.

Prepare an Income and Expenditure Account of the club for the year

ended 31st March, 2015 and a Balance Sheet as at that date.

Solution 27.

51 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 28. From the following Receipt and Payment Account

and additional information of Ashoka Club for the year ended

31-3-2017 prepare:

(i) Income and Expenditure Account of the Club for the year ended

31-3-2017 and

(ii) Prepare the Balance Sheet as at 31-3-2017.

52 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information:

(i) Subscriptions outstanding as on 31-3-2016 were Rs. 3,000 and on

31-3-2017 Rs. 6,000.

(ii) On 31-3-2016 salary outstanding was Rs. 900 and on 31-3-2017 salary

outstanding was Rs.1,200.

(iii) The Club owned furniture Rs. 30,000 and books Rs. 14,000 on

01-04-2016.

Solution 28.

53 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 29 (A) (new). From the following information, calculate the

amount to be charged to Income and Expenditure Account for

‘Sports Material Consumed’ for the year 2019-20.

There was zero stock at the end of financial year 2019-20.

Solution 29. (A) (new). Calculation of Sports Material Consumed to be

Debited to Income and Expenditure A/c:-

Points of Knowledge:-

Calculation of the Cost of Consumable Goods:-

54 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 29 (B) (new). How are the following items treated while

preparing the final accounts of a club for the year ended 31st March,

2019:

Solution 29 (B). Calculation of Sports Material Consumed to be

Debited to Income and Expenditure A/c:-

Assets side of the balance sheet stock of sports materials = Rs. 1,50,000

Liabilities side of the balance sheet creditors of sports materials = Rs.

60,000

Question 29 (new). From the following Receipt and Payment A/c of a

charitable dispensary, prepare Income and Expenditure A/c for the

year ended on 31st March, 2019:

55 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information:

(i) Subscription of Rs. 1,500 is still in arrear for the year ended 31st

March, 2018.

(ii) Subscription Outstanding as at 31st March, 2019 Rs. 41,500.

(iii) Stock of medicines on 31st March, 2018 was Rs. 6,000 and on 31st

March, 2019 was Rs.10,000.

(iv) One month rent is outstanding.

(v) Depreciation on Machinery to be charged @ 10% p.a.

Prepare Income & Expenditure Account for the year ended 31st March,

2019.

Solution 29.

Working Note:-

Outstanding Subscription = Rs. 41,500 – Rs. 1,500 = Rs. 40,000

56 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 30 (new). The following is the Receipts and Payments

Account of Shri Mahbir Sports Club for the year ended 31st March,

2021

Additional Information:

(i) Subscriptions Receivable is as follows:

On 31st March, 2020 Rs. 1,000

On 31st March, 2021 (for 2010-21) Rs. 2,500

(ii) Advance Subscriptions are as follows:

31st March, 2020 Rs. 600

31st March, 2021 Rs. 900

(iii) Stock of Medicines:

31st March, 2020 Rs. 480

31st March, 2021 Rs. 650

(iv) Staff Salary Payable :

31st March, 2020 Rs. 1,200

31st March, 2021 Rs. 1,400

(v) The total furniture on 1st April, 2020 was worth Rs. 20.000 and book

value of furniture sold was Rs. 5,000. Charge depreciation @ 10% on

closing balance of furniture.

Prepare an Income and Expenditure Account for the year ended 31st

March, 2021 and a Balance Sheet as at that date.

Solution 30 (new).

57 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 30. Following is the Receipts and Payments Account of

Citizen Club for the year ended 31st March, 2018 :

58 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Prepare Income and Expenditure Account for the year ending 31st March,

2018 and the Balance Sheet as at that date after considering the following

information :

(i) Subscription in arrears on 31st March, 2017 were Rs. 30,000 and on

31st March 2018 were Rs. 48,000.

(ii) Stock of stationery on 31st March, 2017 was Rs. 5,000 and on 31st

March, 2018 Rs. 14,000.

(iii) Insurance was paid on 1st January 2018 to run for one year.

Solution 30.

59 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 31 (new). Following is the Receipts and Payments Account

of Maharaja Aggarsain Club, Bhiwani for the year ended 31st March,

2021

Other Information :

(i) Assets on 1-4-2020 were: Land and Building Rs. 1,50,000; Stock of

foodstuffs Rs. 2,200 and unused postage stamps 800.

(ii) Subscription due on 31-3-2020 was Rs. 2,400 and on 31-3-2015 (for

2020-21) was Rs. 3,500.

(iii) On 31st March, 2021 stock of foodstuffs was Rs. 3,800 and unused

postage stamps were of the value of Rs. 600.

(iv) The By-laws of the club provide that 60% of the Entrance fees and

20% of the surplus of any year are to be transferred to Reserve Fund.

Prepare an Income and Expenditure Account of the club for the year

ended 31st March, 2021 and a Balance Sheet as at that date.

Solution 31 (new).

60 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 31. From the following information, show the salaries item in the

Income and Expenditure Account for the year ending 31st March, 2016

and in the Balance Sheet as at 31st March, 2015 and 31st March, 2016:

AN EXTRACT OF

61 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

RECEIPTS AND PAYMENTS ACCOUNT

for the year ending

31st March, 2016

Receipts Rs.

Payments Rs.

By

Salaries 1,60,000

Additional Information;

(i) Salaries outstanding on 31st March, 2015 Rs. 15,000

(ii) Salaries outstanding on 31st March, 2016 Rs. 25,000

(iii) Salaries paid in advance on 31st March, 2015 Rs. 12,000

(iv) Salaries paid in advance on 31st March, 2016 Rs. 10,000

Solution 31.

62 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 32. From the following particulars relating to Rama Krishna

Mission Charitable Hospital, prepare Income and Expenditure

account for the year ended 31st March, 2019 and a balance sheet as

at that date:

Solution 32.

63 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 33. From the following Receipts and Payments Account of

National Sports Club and from the given additional information,

show the salaries item in the Income and Expenditure Account for

64 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

the year ending 31st March, 2016 and the Balance sheet as at 31st

March, 2015 and 31st March, 2016.

Additional Information:

Rs.

(i) Salaries outstanding on 31st March,

2015 40,000

(ii) Salaries outstanding on 31st March,

2016 62,000

(iii) Salaries paid in advance on 31st March, 2015

18,000

Solution 33.

Point of Knowledge:-

65 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 34 (new). From the given Receipts and Payments Account

and additional information of friends Club for the year ended

31st March, 2019, prepare Income and Expenditure Account for the

year ending 31st March, 2019.

Additional Information:-

(i) On 1st April, 2018, the Club had the following balances of assets and

liabilities:

Furniture Rs. 1,00,000, Subscriptions in arrears Rs. 2,000 and

Outstanding Salary Rs. 6,000.

(ii) The club had 75 members each paying an annual subscription of Rs.

1,000.

(iii) Charge depreciation on furniture @ 10% p.a.

Solution 34 (new).

66 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Working Note:-

Calculation of depreciation on furniture:-

Question 34. Following is the Receipt and Payments Account of

Natraj Literary Society, Hyderabad for the year ended 31st March,

2016 :

Additional Information :

(1) There are 400 members each paying an annual subscription of Rs.

100.

(2) On 31st March, 2015, the trust owned Buildings Rs. 75,000; Furniture

Rs. 10,000; Books Rs. 6,000 and 12% Bonds Rs. 10,000.

(3) Salaries of Rs. 1,500 for March, 2016 were not paid until 7th April,

67 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2016.

(4) Journey income receivable Rs. 400.

(5) Charge depreciation @ 10% p.a. on Buildings and mowing machine

and 20% p.a. on the closing balance of furniture and books.

(6) It was decided to treat one-half of the amounts received on account of

donations as income.

Prepare Income and Expenditure Account for the year ending 31st March,

2016 and a Balance Sheet as at that date.

Solution 34.

68 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 35 (new). From the following Receipt and Payment A/c of a

charitable dispensary, Prepare Income and Expenditure A/c for the

year ended on 31st March, 2019:

Additional Information:

(i) Subscription of Rs. 1,500 is still in arrear for the year ended 31st March,

69 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2018.

(ii) Subscription Outstanding as at 31st March, 2019 Rs. 41,500.

(iii) Stock of medicines on 31st march, 2018 was Rs. 6,000 and on

31st March, 2019 was Rs. 10,000.

(iv) One month rent is outstanding.

(v) Depreciation on Machinery to be charged @ 10% p.a.

Prepare Income & Expenditure Account for the year ended 31st march,

2019.

Solution 35 (new).

Working Note:-

Calculation of depreciation:-

Machinery purchased on 01.oct.2018:-

Question 35. The following is the receipts and payment account of

the Rajasthan Society for the year ending 31st March, 2020:

70 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information :

(i) There are 600 members each paying a monthly subscription of Rs. 10;

Rs. 1800 being in arrear for 2018-19 at the beginning of the year.

(ii) A donation of Rs. 2,500 was wrongly included in subscriptions of the

current Year.

(iii) Entire Donation and 2/3 of Entrance fee are to be capitalised.

(iv) Insurance Premium was paid in advance for three months.

(v) Interest on Investments Rs. 300 though accrued was not actually

received.

(vi) A bill of medicine purchased during the year amounting to Rs. 200

was outstanding.

(vii) Gujarati cultural association owed Rs. 2,000 for the use of society

hall.

You are required to prepare an Income and Expenditure Account for the

year ended 31st March, 2020 and a Balance Sheet as at that date.

Solution 35.

71 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Working Note:-

Total subscriptions receivable during the year 16-17 (500 × 50)

25,000

Less: Amount received during the year 2016-17

20,500

72 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Outstanding subscriptions for the year 2016-17

4,500

Question 36. Given below is the Receipts and Payments Account of

‘Old Men Association Club' for the year ended on 31-3-2017:

Prepare Income and Expenditure Account for the year ended 31st March,

2017 and the Balance Sheet as at that date, after taking the following

information into account :

(a) There are 500 members each paying an annual subscription of Rs. 50,

and Rs. 500 is still in arrear for 2015-16.

(b) Rs. 1,000 for salaries is outstanding.

(c) Building stands in the books at Rs. 50,000 and it is required to write off

depreciation at 5% p.a.

(d) Interest on Investments is accrued for 5 months.

Solution 36.

73 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Working Note:-

Total subscriptions receivable during the year 16-17 (500 × 50)

25,000

Less: Amount received during the year 2016-17

20,500

Outstanding subscriptions for the year 2016-17

4,500

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

74 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 37. From the following Receipts and Payments A/c of

Dramatic & Sports Club Ambala, prepare an Income and Expenditure

A/c for the year ended 31st March, 2020 and a Balance Sheet as at

that date:

Information’s:

(a) The club has 600 members, each paying an annual subscription of Rs.

100. In 2018-19 ten members had paid their subscription for 2019-20 as

well.

(b) Balance of sports materials on 31 March, 2020 was Rs. 3,600.

(c) The Club had buildings amounting to Rs. 1,20,000 worth Rs. 1,80,000

on 1-4-2019.

Solution 37.

75 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 38. From the following information, show the salaries item

in the Income and Expenditure Account for the year ending 31st

March, 2021 and in the Balance Sheet as at 31st March, 2020 and

31st March, 2021:

76 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information;

(i) Salaries outstanding on 31st March, 2020 Rs. 15,000

(ii) Salaries outstanding on 31st March, 2021 Rs. 25,000

(iii) Salaries paid in advance on 31st March, 2020 Rs. 12,000

(iv) Salaries paid in advance on 31st March, 2021 Rs. 10,000

Solution 38 (new).

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 38. Following is the Receipts and Payments Account of

Chennai Sports Club:

77 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Prepare Income and Expenditure Account for the year ended 31st March,

2019 and a Balance Sheet as at that date after the following adjustments:

(i) Subscriptions received during the year included Rs.10,000 from a life

member and a Donation of Rs. 50,000 received for Building Fund.

(ii) Book value of Defence Bonds sold was Rs. 30,000; Rs.60,000 of

Defence Bonds were still in hand.

(iii) Municipal Taxes amounted to Rs. 20,000 per year is paid upto 30th

June.

(iv) Rent Rs. 5,000 is related to the year ended 31st March 2018 and Rs.

2,500 is still owing.

(v) It was decided to treat 40% of the amount received on account of

Legacies and Donations as income.

(vi) On 1st April 2018, the club owned furniture Rs. 1,10,000; Furniture is

valued at Rs.1,05,000 on 31st March, 2019.

Solution 38.

78 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 39 (new). From the following Receipts and Payments

Account of National Sports Club and from the given additional

information, show the salaries item in the Income and Expenditure

Account for the year ending 31st March, 2016 and the Balance sheet

as at 31st March, 2015 and 31st March, 2021.

79 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information: Rs.

(i) Salaries outstanding on 31st March, 2020 40,000

(ii) Salaries outstanding on 31st March, 2021 62,000

(iii) Salaries paid in advance on 31st March, 2020 18,000

Solution 39 (new).

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 39. Show how would you deal with the following items in

the final accounts of a Club:

80 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 39.

Question 40. Show how will you deal with the following items

while preparing the Balance Sheet of a Club as at 31st March, 2018:

Solution 40.

Working Note:-

Interest Accrued shown on the assets side Rs. 10,000.

81 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 41. Receipts and Payments Account of Shimla Sports

Club showed that Rs. 82,000 were received by way of subscriptions

for the year ended on March 31, 2016.

The additional information was as under:

Subscription Outstanding as on March 31, 2015 were Rs. 8,400

Subscription Outstanding as on March 31, 2016 were Rs. 9,200

Subscription received in advance as on March 31, 2015 were Rs. 3000.

Subscription received in advance as on March 31, 2016 were Rs. 5,000.

Show how the above information would appear in the final accounts for

the year ended on March 31, 2016.

Solution 41.

Question 42. Subscriptions received during the year ended March 31,

2016 by a Club were as under:

82 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2014-15 1,500

2015-16 44,000

2016-17 4,000

49,500

The club has 100 members each paying @ Rs. 500 as annual

subscription. Subscriptions outstanding as on March 31, 2015 were Rs.

2,500. Calculate the amount of subscriptions to be shown as income in

the Income and Expenditure Account for the year ended March 31, 2016

and show the relevant data in the Balance Sheet as at 31st March, 2015

and 2016.

Solution 42.

Working Note:-

Total Subscriptions receivable during the year 2015-16 (100 × Rs. 500)

Rs. 50,000

Less: Amount received during the year

83 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2015-16 Rs. 44,000

_________________

Outstanding Subscriptions for the year

2015-16 Rs. 6,000

________________

Question 43. From the following information of Gems Club,

prepare Income Expenditure Account for the year ended 31st March,

2018.

Additional Information:

Subscriptions received included Rs. 15,000 for 2018-19. The amount of

subscriptions outstanding on 31st March, 2018 were Rs. 20,000. Salaries

unpaid on 31st March 2018 were Rs.8,000 and Rent receivable was Rs.

2,000. Opening stock of printing and stationery was Rs. 12,000, whereas

closing stock was Rs. 15,000.

Solution 43.

84 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Receipts and Payments Accounts is Prepared on cash basis, i.e.

transactions and events which have been related to cash are shown in the

account. This is the summary of the cash transaction as in the cash book.

Question 44. The Young Association submits to you its Receipts

and payments Account for the year ending on 31st March, 2019. You

are required to prepare the Income and Expenditure Account for the

year and the Balance Sheet as at that date.

The Association also gives the following information :

(i) The Association holds 6% Government Securities amounting to Rs.

40,000 on 1st April, 2018

(ii) The Library Account (Books) stood at Rs. 20,000 on 1st April, 2018.

85 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

(iii) Half of the donations received is to be transferred to the Capital Fund.

(iv) Rent Rs. 300 is still payable.

Solution 44.

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

86 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 45. Calculate the amount of medicines to be debited in the

Income and Expenditure Account of a Hospital on the basis of the

following information :

April 1, 2016

April 1, 2017

Stock of Medicines 90,000

1,24,000

Creditors for Medicines

2,40,000 2,04,000

Amount paid for medicines during the year was Rs.6,79,000.

Solution 45.

Question 46 (new). Receipts and Payments Account of Shimla Sports

Club showed that Rs. 82,000 were received by way of subscriptions for

the year ended on March 31, 2021.

The additional information was as under:

Subscription Outstanding as on March 31, 2020 were Rs. 8,400

Subscription Outstanding as on March 31, 2021 were Rs. 9,200

Subscription received in advance as on March 31, 2020 were Rs. 3000.

Subscription received in advance as on March 31, 2021 were Rs. 5,000.

Show how the above information would appear in the final accounts for

the year ended on March 31, 2021.

Solution 46 (new).

87 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 46. From the following information calculate the amount of

medicines posted to Income and Expenditure Account of Sargam

Hospital for the year ending 31st March, 2018 :

Medicines purchased during the year ended 31st March, 2018 was Rs.

1,00,000

Also, present the relevant items in the Balance Sheet of Sargam Hospital

as at 31st March 2018.

Solution 46.

88 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 47 (new). From the following information, calculate the

amount of subscription to be credited in the Income and Expenditure

Account of Bharat Sports Club for the year ending 31.03.2018.

During the year, the club received Rs. 1,20,000 as subscription which

included Rs. 5,000 for the year ending 31st March, 2017.

Solution 46 (new). Calculation of Subscription credited to Income

and Expenditure A/c:-

Question 47. Prepare an Income and Expenditure Account for the

year ended 31st March 2016 and the Balance Sheet as at that date

from the following Receipts and payments Account of a Club and

from the information supplied :

Information’s:

89 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

(i) The club has 50 members, each paying annual subscription of Rs.

250.

Subscriptions outstanding on 1st April, 2015 were Rs. 3,000.

(ii) On 31st March, 2016, Salaries outstanding amounted to Rs. 1,000.

Salaries paid included Rs. 1,000 for the year 2014-15.

(iii) General Expenses include Insurance which is prepaid to the extent of

Rs. 100.

(iv) On 31st March, 2015, the club owned Land and Building valued at Rs.

1,00,000, Furniture Rs. 6,000 and Books Rs. 5,000.

(v) 40% of Entrance Fees is to be capitalised.

Solution 47.

90 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 48. From the following information, prepare Income and

Expenditure A/c for the year ending on 31st March, 2016 and a

Balance Sheet as at that date, of an Entertainment Club:

The Club had 500 members, each paying an annual subscription of Rs.

100, Rs. 4,500 were outstanding subscriptions at the end of previous year

and five members had paid their subscription for 2015-16 as well in the

previous year itself. On 31st March, 2016 outstanding salaries were

Rs.1,500 and prepaid salaries were Rs. 2,000. 50% of the Entrance fees

is revenue income and Donations and Life Membership fees are to be

91 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

capitalized Accrued interest at the end of the year was Rs. 1,200. At the

end of the year Stock of Sports Material was Rs. 5,000 and stock at the

refreshment room was Rs. 1,600.

Solution 48.

Question 49. Convert the following Receipts and Payment Account

of the Delhi Nursing Society for the year ended 31st March, 2017 into

the Income and Expenditure Account:

92 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

A donation of Rs.100 received for Building Fund was wrongly included in

the subscription Account. A bill of medicines purchased during the year

amount Rs.128 was outstanding.

Solution 49.

Point of Knowledge:-

Opening and Closing Balance: Opening balance of this account shows

cash in hand and/or at bank in the beginning of the accounting period and

closing balance shows cash in hand and/or at bank at the end of the

accounting period.

Question 50 (new). Namanjyot Society showed the following

position:

93 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information:-

(i) Computers were to be depreciated @60% p.a. and furniture @ 10%

p.a.

(ii) Membership subscription included Rs. 20,000 received in advance.

(iii) Electric charges outstanding Rs. 10,000.

Prepare Income and Expenditure Account for the year ended 31st March,

2018.

Question 50. Following is the Receipts and Payments Account of a

Club for the year ended 31st March, 2020:

Additional Information:

(1) Outstanding subscription for 2019-20 Rs. 80,000.

94 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

(ii) Outstanding salaries as on 1st April, 2019 were Rs.2,000 and as at

31st March, 2020 were Rs. 4,000.

(iii) Locker Rent rate is Rs. 2,000 per month.

(iv) Depreciation on sports equipment @10% p.a.

Prepare Income and Expenditure Account of the Club for the year ended

31st March, 2020.

Solution 50.

Point of Knowledge:-

Donations received or funds set aside for specific purposes are credited to

a separate Fund Account and are shown on the liabilities side of the

Balance Sheet. The incomes from or donations for these funds are

credited to respective Fund Account. On the other hand, expenses or

Payments out of these funds are debited. Accounting when done on this

basis is known as Fund Based Accounting.

Question 51. From the following information supplied by the

accountant of Lions Club for the year ended 31st March 2020,

prepare Income and Expenditure Account and Balance Sheet :

95 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Additional Information:

(a) The club has 400 members each paying an annual Subscription still

outstanding for 2018-19 are Rs.200

(b) Stock of stationary on 31.3.2019 Rs. 780 and on 31.3.2020 Rs.860

(c) On 1st April 2019 premises were Rs. 16,000. Depreciation on

premises and furniture to be charged @ 5% and 10% p.a. respectively.

Solution 51.

96 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 52 (new). How will the following items be treated while

preparing the financial statements of a not-for-profit organization for

the year ended 31st March, 2019?

As at 31st March, As at 31st March,

2018 2019

Creditors for 33,000 67,000

medicines

Stock of medicines 27,000 43,000

During 2018-19, the payment made to the creditors was Rs. 4,25,000.

Solution 52 (new).

97 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 52. From the following receipts and payment account of a

club and from the given additional information supplied, prepare

income expenditure account for the year ending 31st March 2016

and the balance sheet as at that date:

Additional information:

98 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

(1) The club has 50 members each paying an annual subscription of Rs

2,500. Subscriptions outstanding on 31st March 2015 were to the extent

of Rs. 30.000

(2) On 31st March 2016 salaries outstanding amounted to Rs.10,000.

Salaries paid in 2015-16 included Rs. 30,000 for the year 2014-15.

(3) On 1st April 2015, the club owned Building valued at Rs. 10,00,000,

Furniture worth Rs. 1,00,000 and books Rs. 1,00,000.

Solution 52.

99 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 53. Following is the Receipts and Payments Account of

Delhi Health Club for the year ended 31st December, 2018:

Additional Information:

(i) Donations for Building include 20% general donations.

(ii) During the year, the club had 600 members and each paying an annual

subscription of Rs. 200.

(iii) Outstanding salaries as at January 1, 2018 were Rs. 15,000 and as on

December 31, 2018 were Rs. 18,000. Prepare Income and Expenditure

Account of the club for the year ended 31st December, 2018.

Solution 53.

100 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 54. Prepare Income & Expenditure Account for the year

ended March 31, 2019 and a Balance Sheet as at that date from the

following information.

The following additional information is provided to you:

1. There are 1,800 members, each paying an annual subscription of Rs.

200, Rs.18,000 were in arrears for 2017- 18 as on April 1, 2018

2. On March 31, 2019 the rates were prepaid to June 2019; the charge

paid every year being Rs. 24,000.

3. There was an outstanding telephone bill for Rs.1,400 on March 31,

2019.

4. Outstanding sundry expenses as on March 31, 2018 totalled Rs. 2,800.

5. Stock of stationery as on March 31, 2018 was Rs. 2,000; on March 31,

101 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

2019, it was Rs. 3,600.

Solution 54.

102 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Question 55. From the following Receipts and Payments Account

and additional information, prepare Income and Expenditure

Account and Balance Sheet of Sears Club, Noida as at March 31,

2018.

Additional Information:

(i) The club has 200 members each paying an annual subscription of Rs.

1,000. Rs.60,000 were in arrears for last year and 25 members paid in

advance in the last year for the current year.

(ii) Stock of stationery on 1.4.2017 was Rs.3,000 and on 31.3.2018 was

Rs. 4.000.

103 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

Solution 55.

Working Note:-

Calculation of Subscription:-

Subscriptions (200 ×

1,000) 2,00,000

Add: Subscriptions for 2016-17 (60,000 – 40,000)

20,000

Less: Received Subscriptions during present year

94,000

Less: Received Subscriptions during the last year

25,000

______________

104 of 105 1/13/2023, 1:01 PM

DK Goel Solutions Class 12 Accountancy Chapter 1 Financial Statemen... about:reader?url=https%3A%2F%2Fwww.studiestoday.com%2Fdk-goe...

1,01,000

_____________

Point of Knowledge:-

Income and Expenditure Account is like profit and loss Account of an

enterprise. Since, Not for Profit Organisation are not established for the

purpose or earning profit, they do not prepare Profit and loss Account.

More Study Material

105 of 105 1/13/2023, 1:01 PM

You might also like