0% found this document useful (0 votes)

837 views2 pages05 - Task - Performance - 1 Math

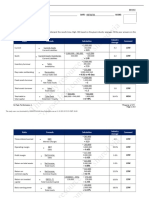

The document provides information to complete questions about stocks and bonds. For stocks, it asks for earnings per share, annual dividend per share, current price per share, current yield, and price-earnings ratio given various values. For bonds, it asks for redemption value, conversion period, coupon payments, and bond rate given values. The solutions provide the calculations to derive the missing values from the information given.

Uploaded by

aby marieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

837 views2 pages05 - Task - Performance - 1 Math

The document provides information to complete questions about stocks and bonds. For stocks, it asks for earnings per share, annual dividend per share, current price per share, current yield, and price-earnings ratio given various values. For bonds, it asks for redemption value, conversion period, coupon payments, and bond rate given values. The solutions provide the calculations to derive the missing values from the information given.

Uploaded by

aby marieCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

/ 2