0% found this document useful (0 votes)

141 views5 pagesWritten Assignment Unit2

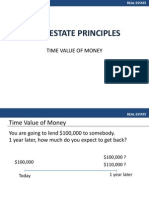

1) The document discusses calculating the net present value (NPV) of an investment project for a company called WePROMOTE owned by the author and their partner.

2) The author calculates the NPV two ways - using the partner's cash flow assumptions which results in a negative NPV, and using their own assumptions which results in a positive NPV.

3) A positive NPV means the project's return is higher than the discount rate, so the author recommends investing in the project based on their NPV calculation.

Uploaded by

modar KhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

141 views5 pagesWritten Assignment Unit2

1) The document discusses calculating the net present value (NPV) of an investment project for a company called WePROMOTE owned by the author and their partner.

2) The author calculates the NPV two ways - using the partner's cash flow assumptions which results in a negative NPV, and using their own assumptions which results in a positive NPV.

3) A positive NPV means the project's return is higher than the discount rate, so the author recommends investing in the project based on their NPV calculation.

Uploaded by

modar KhCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 5