0% found this document useful (0 votes)

327 views5 pagesBudgeting Assignment - .Docx-3

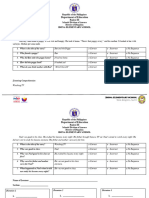

This document provides instructions for a student to create a monthly budget based on their desired career. It asks the student to research salary information for their chosen career (a cardiologist), calculate take-home pay, and use this to determine monthly income. It then guides the student to select housing and transportation expenses based on online research. Finally, it lists common monthly expenses and has the student create a budget in Excel that calculates whether they have a monthly surplus or deficit, both with and without a $1000 monthly savings contribution.

Uploaded by

Rania IhsanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

327 views5 pagesBudgeting Assignment - .Docx-3

This document provides instructions for a student to create a monthly budget based on their desired career. It asks the student to research salary information for their chosen career (a cardiologist), calculate take-home pay, and use this to determine monthly income. It then guides the student to select housing and transportation expenses based on online research. Finally, it lists common monthly expenses and has the student create a budget in Excel that calculates whether they have a monthly surplus or deficit, both with and without a $1000 monthly savings contribution.

Uploaded by

Rania IhsanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 5