0% found this document useful (0 votes)

108 views36 pagesPrice Patterns

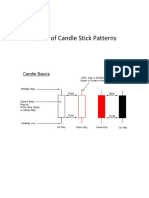

The document summarizes various common price patterns in financial markets that technical analysts use to identify potential reversals or continuations in trends, including wedges, flags, pennants, rectangles, double tops/bottoms, and head and shoulders patterns. These patterns are formed by connecting common price points like closing prices over time and are believed to reflect investor psychology, though their predictive power is debated. Continuation patterns suggest a temporary pause in a trend while reversal patterns signal a potential change in direction. Examples of each pattern type are depicted in charts.

Uploaded by

Руслан СалаватовCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

108 views36 pagesPrice Patterns

The document summarizes various common price patterns in financial markets that technical analysts use to identify potential reversals or continuations in trends, including wedges, flags, pennants, rectangles, double tops/bottoms, and head and shoulders patterns. These patterns are formed by connecting common price points like closing prices over time and are believed to reflect investor psychology, though their predictive power is debated. Continuation patterns suggest a temporary pause in a trend while reversal patterns signal a potential change in direction. Examples of each pattern type are depicted in charts.

Uploaded by

Руслан СалаватовCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 36