Financial Accounting & Analysis

Answer 1

A journal is described as a record that you keep of daily events or your ideas, or as a

periodical, that deals with a topic or business. A diary is an example of a journal because it

allows you to record your thoughts and events. Transactions are recorded in a subsidiary

book of accounts called a journal. A ledger is the main book of accounts used to organize

transactions entered in a journal. The minimum number of line items for a journal entry is

two, and the total amount recorded in the debit column must match the total amount entered

in the credit column.

These are the structural requirements of a journal entry. A journal entry is often printed, kept

in a binder of accounting transactions, and has supporting documentation attached. External

auditors' year-end review of a company's financial statements and related systems may

include access to this information.

The date, the amount to be credited and debited, a brief description of the transaction, and the

accounts involved are all included in each journal entry along with other information related

to a business transaction. Depending on the business, this may include a list of affected

subsidiaries, tax information, and other facts. In order for the general ledger and financial

reports based on this information to be accurate and complete, correct and complete input of

journal data is required.

Recurring journal entries can be automated and templated in today's accounting software,

reducing the possibility of errors. According to the double-entry accounting method, journal

entries are made in chronological order and include a credit and debit column. The values in

each column must be the same, even if debits and credits are connected to multiple accounts.

There are seven different categories of journals: general, sales, cash receipts and

disbursements, and purchases, repurchases, and cash receipts and disbursements.

An entry placed directly in the main journal is called a journal entry. To identify the accounts

and amounts affected by each transaction, a journal entry follows a standard structure. Each

journal entry must have at least one debit and one credit.

�Financial Accounting & Analysis

So, this is in a nutshell, the journal entries. Recording it is important because it serves the

purpose of properly and thoroughly documenting every business transaction, whether

physical or online. The most important books of entry are journal entries because they

organize your company's information and ensure that all other accounting processes are

accurate.

Answer 2

A financial statement known as a profit and loss (P&L) statement provides an overview of

revenues, expenditures, and expenses incurred during a given period of time, usually a fiscal

quarter or year. These documents reveal whether a business can make a profit by increasing

sales, cutting expenses, or doing both. P&L statements are often presented using the cash or

accrual method. P&L statements are used by investors and corporate management to assess a

company's financial condition. A financial statement known as a profit and loss (P&L)

statement provides an overview of revenues, expenditures, and expenses incurred during a

given period of time, usually a fiscal quarter or year. These documents reveal whether a

business can make a profit by increasing sales, cutting expenses, or doing both. P&L

statements are often presented using the cash or accrual method. P&L statements are used by

investors and corporate management to assess a company's financial condition. When total

costs and expenses are subtracted from total revenue and income, the result is a statement of

profit and loss, commonly known as an income statement or a statement of P and L. The

consistent categories of sales and expenses on the P&L statement. Categories include gross

margin, selling and administrative expenses (or operating expenses), net profit, and net sales.

The P&L statement helps to understand how money moves in (and out) of the company

because it provides revenues and expenses.

A financial statement known as a profit and loss (P&L) statement provides an overview of

revenues, expenditures, and expenses incurred during a specific period of time.

Along with the balance sheet and the cash flow statement, every publicly traded firm also

issues a P&L statement quarterly and annually. The P&L statement, balance sheet, and cash

flow statement when combined offer a thorough analysis of a company's entire financial

performance. The cash method or accrual method of accounting are both used to make

statements. Comparing P&L statements from multiple accounting periods is important

because any changes over time have more significance than the raw data.

The main categories found in the P&L include:

Revenue (sales/turnover): Revenue, determined by multiplying the average sales price by the

number of units sold, is the money generated through regular business activities. The top line

(or gross income) number is used to calculate net income by deducting expenses. Sales is

another name for income on the income statement. Because it appears at the top of the

income statement, income is sometimes called the top line. A profit figure represents the

profit a business makes before deducting any expenses. For example, a shoe retailer's profit is

the amount it receives from the sale of shoes before deducting any expenses.

Cost of goods sold (COGS): The total amount your company spends on expenses directly

related to the sale of goods is known as cost of goods sold. Depending on the nature of your

company, it may also include raw materials, packaging, direct labor involved in

manufacturing or selling the product, and items purchased for resale. The value of inventory

held at the end of the study period is subtracted from the value of inventory held at the

�Financial Accounting & Analysis

beginning, which is then added to the cost of any new inventory acquired during the study

period.

COGS = Beginning Inventory + Purchases – Ending Inventory.

Gross profit (revenue minus COGS): Gross profit is the amount of money saved by a

company after deducting all the costs of producing and offering its goods or services. A

company's income statement shows the gross profit, which is obtained by deducting the cost

of goods sold (COGS) from the revenue (sales). The income statement of a business will

contain these numbers. Sales profit or gross profit are other names for gross profit. Gross

profit measures how well a business uses its workers and resources to produce goods and

services. In contrast to net profit, which takes into account all costs of the entire company,

gross profit only accounts for the value of goods sold. Gross margin, which shows what

percentage of the revenue a company makes can be allocated to corporate operating expenses,

is a source of gross profit.

Expenses: In accounting, the money spent and the expenses incurred by a business in pursuit

of income are called expenses. The money and expenses incurred by a business to make a

profit are called expenses. Account expenses are expenses associated with running a

business; when combined, these costs generate income. Although they are similar in ordinary

conversation, there is a big difference between cost and bookkeeping cost. Cost is the amount

of money required to purchase any asset. The use and consumption of these assets are costs.

Although the purchase of a company car is an example of an expense, paying for fuel and

maintenance are expenses; however, not all costs are costs. All costs are listed in a company's

financial accounts. Businesses can calculate their gross profit by deducting expenses from

total sales.

Net income: The amount earned by an individual or corporation after expenses, allowances,

and taxes is called net income. Sales are subtracted from cost of goods sold, selling, general

and administrative expenses, operating expenses, depreciation, interest, taxes, and other

expenses to arrive at net income (NI), also known as that net earnings. Investors can use this

number to determine how much the company's revenue exceeds its expenses. This figure is a

measure of a company's profitability and may appear on the income statement.

Net Income = Total Revenue - Total Expenses.

Therefore, we can conclude that the profit and loss statement helps to understand the net

income of the company and helps the management team, especially the board of directors, to

make decisions. Business stakeholder groups find it extremely valuable because it shows the

Sales Revenue, all Business Expenses, and Profit or Loss of a Business for a Given Period of

Time. It provides a financial picture of how much money is earned or lost and allows you to

make accurate future projections for your company.

Answer 3a

The concept behind the term "balance sheet" is that assets always equal liabilities and

shareholders' equity. One of the three basic financial statements, the balance sheet is

important in accounting and financial modeling . The balance sheet shows the total assets of

the business as well as how those assets were financed—through debt or equity. It is also

known as a statement of financial position or a statement of net worth. The most complete

snapshot of a company's financial condition is provided by the balance sheet, commonly

known as the

Statement of Financial Position.

�Financial Accounting & Analysis

The basic formula Assets = Liabilities + Equity serves as the foundation of the balance sheet.

An organization's assets, liabilities, and shareholder's equity are listed on a balance sheet,

which is a financial statement. One of the three main financial statements used to evaluate a

company is the balance sheet. It offers a picture of the financial condition of a business (what

it owns and owes) as of the date of publication. An organization's assets, liabilities, and

shareholder's equity are listed on a balance sheet, which is a financial statement. One of the

three main financial statements used to evaluate a company is the balance sheet. It provides a

brief overview of a corporation's assets and liabilities as of the publication date. Assets on the

balance sheet are equal to the sum of liabilities and shareholders' equity. Financial ratios are

calculated using the balance sheets of fundamental analysts.

Therefore, we can conclude that, balance sheets are important because they help to evaluate

risk. This financial statement contains all the assets and liabilities for a corporation. A

business can determine in a timely manner if it has taken on too much debt, if the liquidity of

its assets is insufficient, or if it has enough cash on hand to cover immediate needs. . Balance

sheets are also used to attract and retain talent, as well as to obtain capital and a business

loan.

Answer 3b

The comparison of two or more financial data points is known as an accounting ratio, and it is

used to analyze the financial statements of businesses. Shareholders, creditors, and other

types of stakeholders effectively use it to understand the profitability, power, and financial

status of businesses. Accounting ratios are a variety of measurements used to assess the

productivity and profitability of an organization based on its financial reporting. This is an

important subset of financial ratios. They serve as a means of expressing the connection

between different accounting data points and form the basis of ratio analysis. The liquidity

ratio called the current ratio assesses the capacity of a company to settle short-term debts or

debts within a year. It explains to investors and analysts how a business can use its current

assets as much as possible to pay its debts and other payments. In general, an appropriate

current ratio is one that is comparable to industry norms or slightly higher. The probability of

distress or default may be increased by a current ratio that is lower than the industry norm. In

the same vein, if a company's current ratio is significantly higher than its peer group, it

suggests that management may not be deploying its best resources. Because it includes all

current assets and current liabilities, unlike other measures of liquidity, the current ratio is

called current. The working capital ratio is another name for the current ratio.

�Financial Accounting & Analysis

Current ratio = Current Assets/Current Liabilities

analysts analyze a company's current assets to its current liabilities to get the ratio. Cash,

accounts receivable, inventory, and other current assets (OCA) that are expected to be

liquidated or converted to cash in less than one year are all examples of current assets that are

included. on a company's balance sheet. Bills payable, wages, taxes due, short-term loans,

and the current portion of long-term debt are all examples of current liabilities. If the ratio is

less than 1, it means that the company has more obligations that must be paid in the next year

or less than it has in cash or other short-term assets that are expected to be converted into

cash in the next year. year or less. Although many conditions can negatively affect the current

ratio of a solid corporation, a current ratio of less than 1.00 can be scary. A corporation is

better equipped to meet its obligations when its current ratio is higher because it has a higher

ratio of short-term asset value to short-term liability value.

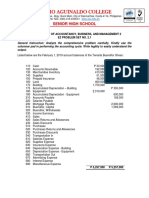

Calculation of current ratio of Z and X LLP

The

above calculations show that the current ratio of Z and X LLP is 2.53:1

Importance of current ratio: The current ratio helps in determining the liquidity setting of the

business. It shows the ability of the business to pay its current bills or pay with its current

assets.

A ratio of 2:1 is considered a very good ratio because it reveals that the company has doubled

its current assets compared to its current liabilities. However, any ratio between 1:1 and 2:1 is

considered important. If the ratio is lower than 1:1, it suggests low cash liquidity of the

business. If the ratio is very high, it indicates that the company still has existing assets and is

wasting an opportunity to use them to generate income.

Therefore, we can conclude that the company with the current ratio as 1.404 means that they

are able to meet their short term responsibilities. The capacity of the company increases as

the ratio increases. The ideal current ratio for a company is between 1.2 and 2, which

indicates that it has twice as many current assets than liabilities to service its debts .